Economic and market context

Last year (2022) was a very difficult year for debt funds. Rising inflation forced central banks around the world, especially the US Federal Reserve (Fed) to raise interest rates. Russia’s invasion of Ukraine and economic sanctions on Russia led to a surge in commodity prices, exacerbating the inflation situation. The Fed hiked interest rates 7 times in 2022, with an aggregate increase of 400 bps taking interest rates to 4.25% - 4.5% in 2022. The Fed followed up with another 25 bps rate hike in February 2022, taking interest rates to 4.5% - 4.75%. The Reserve Bank of India hiked interest rates by an aggregate of 250 bps in 2022, taking the repo rate to 6.25% in 2022. Like the Fed, the RBI followed up with a further rate hike of 25 bps taking the repo rate to 6.5%. In the last one year the 10 year Government Bond yield has gone up from 6.85% to 7.45%. Bond prices have an inverse relationship with interest rates; if interest rates increase bond prices fall and vice versa.

Interest rate and debt market outlook

The bond markets usually discount rate hikes in bond prices and yields in anticipation of interest rate changes. In other words, the market has already discounted further rate hikes by the central banks in bond prices and yields. Based on bond market research of global investment firms, the market may already have discounted US interest rates of up to 5.25% - 5.5% in bond prices; i.e. current bond yields in the US have already factored in further 75 bps hike in interest rates. Can US interest rates go higher than what the market is anticipating i.e. 5.25% - 5.5%? In the uncertain economic environment that we are seeing now, we cannot be sure, but global investment banks like Goldman Sachs, Bank of America etc, are predicting a recession in the US later in the year. If the US economy goes into recession, then the Fed will be forced to change its hawkish stance. Taking these scenarios into account, unless there are serious geo-political risks, we can conclude that interest rates are near their peak. As such, we think that this is a very opportune time to invest in debt funds.

Yields are very attractive

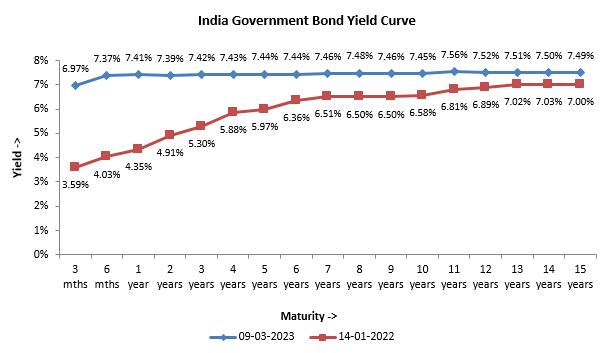

The chart below shows the yields of Government Securities (G-Secs) of different maturities. You can see that yields of G-Secs of 1 year maturity or longer are very attractive. The 1 years G-Sec yield is around 7.4%, the 3 to 5 year yield is also around 7.4%, while the 10 year yield is around 7.45%. From a yield perspective, you can see that there are very attractive investment opportunities all along the yield curve. These yields are significantly higher than traditional fixed income (e.g. Bank FDs, Post Office Small Savings Schemes etc) interest rates in similar tenures. The 1 year FD interest rates in major public and private sector banks is around 6.75%, while the 3 to 5 year rates are around 7%, and rates on deposits of over 5 years to 10 years is around 7% or less.

Source: worldgovernmentbonds.com, as on 08.03.2023

You can potentially get 40 - 50 bps higher annualized returns from G-Secs just due to higher yields, not taking into account potential capital appreciation (we will discuss this later). Debt funds can give even higher returns because in addition to G-Secs, they also invest in State Development Loans (SDLs) and debt or money market instruments of private issues. The spread between G-Secs and SDLs was 30 bps in 2022 (source: Moneycontrol). SDLs are State Government Bonds and have virtually no credit risk because the interest and principal payments of SDLs are guaranteed by the RBI. The spread between G-Secs and AAA rated corporate bonds of 1 to 5 year tenures are in the range of 40 to 86 bps (source: CRISIL). There are very attractive investment opportunities for investors for different investment tenures and risk appetite.

You may also like to read rolled down maturity debt funds

What does the shape of yield curve tell us?

The shape of a normal yield curve is usually upward sloping. If you compare the slope of the yield curve 1 year back to the current yield curve, you will see that the yield curve has flattened considerably, in fact the yield curve in the 1 to 10 year range is almost flat (just 8 - 10 bps difference in yields). This indicates that we are near or already at an inflexion point, as far as interest rate trajectory is concerned, in other words, interest rates may have peaked or near their peak. If the shape of the yield curve inverts, i.e. become downward sloping (instead of upward sloping), then it indicates potential recession and the central bank will then have to cut interest rates. Once interest rates come down, investors will gain from capital appreciation or Net Asset Value (NAV) rise. Longer duration funds will give higher returns than shorter duration funds, when interest rates fall.

How should you invest?

You should take 2 points into consideration in debt fund selection: -

- Your investment tenure

- Your risk appetite

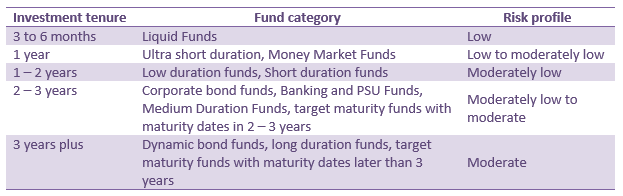

Which category to look at for different investment tenures?

Credit risk

Debt fund investors should always consider credit risks and make informed investment decisions. Lower the credit rating of a debt or money market instrument, higher is the yield given by the instrument. Credit risk funds have been the best performing debt fund category in the last one year. However, we should caution investors that credit risks increase in economic slowdown. The global economy has been slowing down due to high inflation and the monetary policy decisions of central banks. Though Indian GDP growth has been strong, India cannot be immune from a global slowdown. The IMF has predicted that the India’s GDP growth will slow down from 6.8% in 2022 to 6.1% in 2023, before picking up again in 2024.

Our view in Eastern Financiers is that in times of economic slowdown, investors should be mindful of credit risks and invest in high credit quality funds. Our financial advisors can help you select the right debt scheme that is suitable for your investment needs. Please contact your Eastern Financier’s financial advisor or call us at 033 - 40006800 to discuss your fixed income investment needs.