Markets have experienced a sharp decline from their peak levels reached in September 2024. The Nifty 50 has dropped by 14%, the Nifty Midcap 150 by 19%, and the Nifty Small Cap by 23%. Additionally, the Nifty PE ratio has fallen from a peak of 21.3 times one-year forward earnings in September 2024 to the current level of 19 times.

However, it is crucial to remind investors that making investment decisions based on emotions can do more harm than good. Let’s explore why stopping your SIP is not a wise move.

1. Market Corrections Are Normal

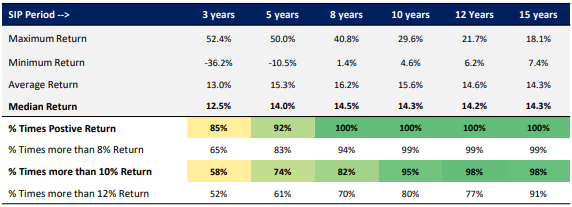

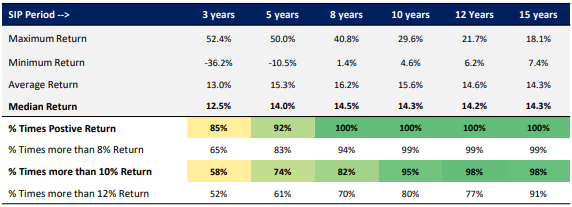

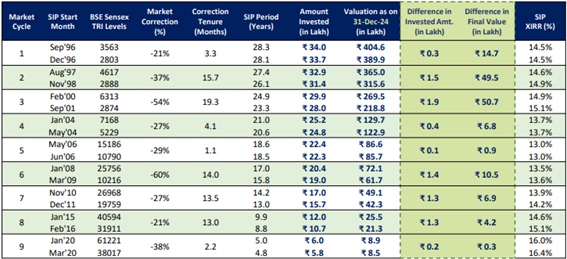

Equity markets are inherently volatile, experiencing fluctuations that can sometimes test investor patience. However, history has shown that markets have always recovered in the long run. Exiting investments during downturns locks in losses, while staying invested allows investors to ride the recovery wave.

This demonstrates how market ups and downs tend to even out over time, reinforcing the importance of long-term investing.

Source: Whiteoak Capital Mutual Fund

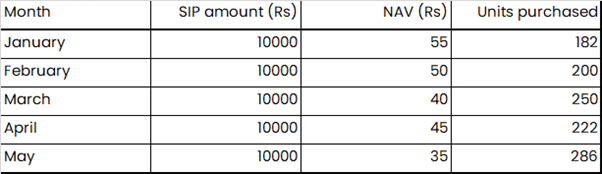

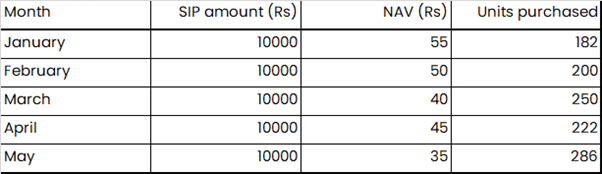

2. SIPs Help You Benefit from Market Lows

One of the key advantages of SIPs is rupee cost averaging, where investments are spread across market cycles. This strategy ensures that investors buy units at varying price points, effectively reducing the average cost of acquisition—especially during market downturns.

3. Time in the Market Is More Important Than Timing It

Attempting to predict market movements is nearly impossible. Investors who try to time the market often miss out on significant returns.

Data shows that if an investor had missed just the 20 best-performing days in the last decade, their overall returns would have been reduced by a staggering 80%. On the other hand, those who stayed invested throughout the same period achieved stable, double-digit returns (12.2%) and built a substantial corpus over time.

By discontinuing SIPs, investors miss out on the power of compounding, which could slow down financial growth and lead to a lower corpus in the long run.

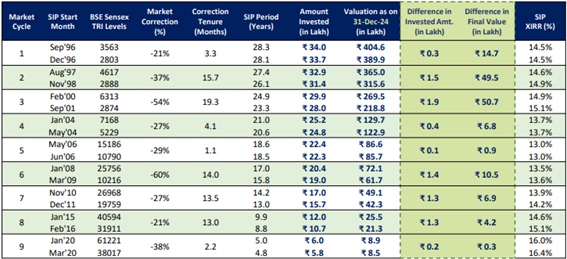

If one stays invested for the long term, it is always rewarding, as seen in the recovery from the last 2-3 bear markets.

Source: Whiteoak Capital Mutual Fund

Conclusion

Market downturns can be unsettling, but they are a natural part of investing. Stopping your SIP due to short-term volatility can hinder wealth creation and derail long-term financial goals. Instead, staying committed to your SIP ensures that you capitalize on market recoveries, benefit from rupee cost averaging, and harness the power of compounding to build a strong financial future.

Stay invested, stay patient, and let time work in your favour.

Source: Economic Times, Value Research, Whiteoak Capital Mutual Fund