As per AMFI May data, Rs 7.7 lakh crores were invested in debt mutual funds in the month of May 2022, out which Rs 7.6 lakh crores were invested in just 5 (out of 15) fund categories – overnight, liquid, ultra-short duration, low duration and money market funds. The maximum duration of these five categories combined is 12 months. Investor’s fixed income preferences indicate that they are worried about rising yields. While these 5 fund categories may be suitable for conservative investors and investors with short investment tenures, long term fixed income investors with moderate risk appetites may consider longer duration funds because longer term yields are attractive now.

Long term yield versus short term yield versus Bank FDs

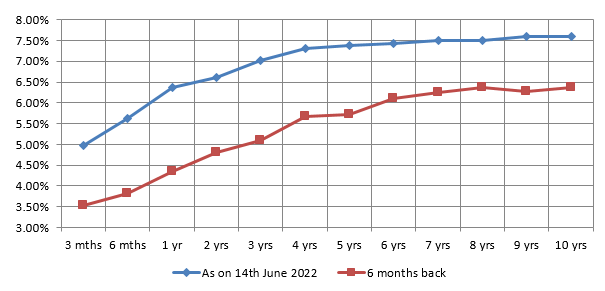

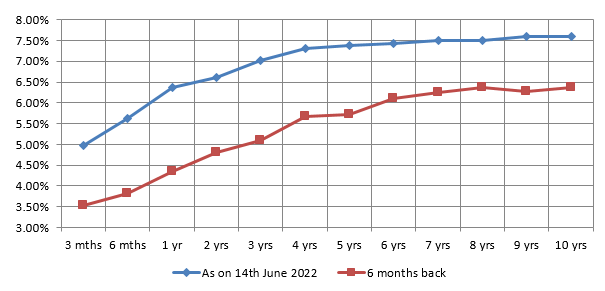

The chart below shows the G-Sec yield curve. While the yields have increased across all maturities along the curve, long term yields in the 8 to 10 year maturity range are 200 – 260 bps higher than short term (3 to 6 month) yields. If we compare yields in the 8 to 10 year maturities, these are much higher than interest rates of traditional fixed income investments. Fixed Deposit interest rates of 5 to 10 year term deposits of major public sector and private sector banks are in the range of 5.5 to 5.75%, while G-Sec yields in the 8 to 10 maturity range are 7.5 – 7.6%.

Source: worldgovernmentbonds.com

Furthermore, longer duration debt funds also invest in State Development Loans (SDLs), which are essentially bonds issued by State Governments. Like G-Secs, SDLs also have implicit sovereign guarantee because the State Government’s loan obligation (i.e. interest and principal payments) are part of the State Government’s budget. SDLs provide a few extra basis points of yields over G-Secs. As per Clearing Corporation of India Limited (CCIL) SDL index, the average SDL (as on 14th June 2022) is in the 7.8 – 7.9% range, which is 30 – 40 bps higher than corresponding G-Secs. In the current interest rate environment, long term fixed income investors can lock-in the higher yields by investing in longer duration funds with rolled down maturity strategy.

What is rolled down maturity?

The shape of yield curve is usually upward sloping i.e. bonds of longer maturity give higher yields than a bond of lower maturity. If you buy a long dated bond (long maturity) and hold it, then you lock-in higher yield even as the bond maturity rolls down (reduces).

Let us understand this with the help of an example. Let us assume a 10 year bond is available at 6.7% yield while 9 year bond is available at 6.5% yield. You invest in the 10 year bond. So after 1 year, your 10 year bond will effectively be a 9 year bond but with additional 0.2% yield. Since the duration of the bond reduces over time, the interest rate risk also reduces.

Active duration call versus rolled down maturity

Funds taking active duration calls, invest in bonds of different maturities depending on their interest rate outlook. If interest rates are going down, they will invest in longer duration bonds. If interest rates are going up, they will invest in shorter duration bonds. Dynamic bond funds usually take active duration calls. Funds with rolled down maturity strategies hold the bonds in their portfolio till maturity. Funds across several debt fund categories e.g. long duration, corporate bond, banking & PSU and even money market funds use rolled down maturity strategy. In the last one year, dynamic bond funds (which usually take active duration calls) have brought down their average maturities to around 3.5 years, while Nippon India Nivesh Lakshya Fund which rolls down maturity has an average maturity of 22 years.

Benefits of roll-down strategy

- No interest rate risk if bonds are held till maturity. You should have long investment tenures for these funds.

- Visibility of returns over long investment tenures. You will get the YTM if you remain invested till the bonds mature.

- Superior returns compared to traditional investments.

- These funds usually invest in sovereign (G-Sec, SDLs) or highly rated (AAA corporate, PSU and banking) instruments. So credit risk is usually low.

- Over 3 years plus investment tenures, debt funds enjoy benefits of long term capital gains taxation (including indexation benefits), whereas FD interest is taxed as per the income tax rate of the investor.

Next we will discuss about some debt funds with rolled down maturity strategy.

- Nippon India Nivesh Lakshya Fund: This is a long duration debt fund. Average maturity of the scheme is 22 years, while modified duration is around 10 years. The current yield to maturity (YTM) of the fund is 7.3%. The scheme invests mostly in G-Secs; so credit risk is low. However, investors must be prepared for volatility. Most importantly, you need to have long investment tenures for this scheme (ideally 5 – 7 years or longer).

- IDFC Corporate Bond Fund: This is a corporate bond fund using the rolled down maturity strategy. The scheme invests minimum 80% in AAA rated corporate bonds or non convertible debentures. Average maturity of the scheme is 1.84 years, while modified duration is around 1.63 years. The current yield to maturity (YTM) of the fund is 6.65%. However, investors must have moderate appetite for volatility in the short term. Most importantly, you need to have long investment tenures for this scheme (ideally 5 – 7 years or longer).

- Tata Nifty SDL Plus AAA PSU Bond Dec 2027 60:40 Index Fund: This is a target maturity index fund, which means that the scheme will mature on a specific date (December 2027) and you will get the accrued interest and principal on maturity. The fund invests in Nifty SDL plus AAA PSU Bond Dec 2027 60:40 Index, which comprises of SDLs and AAA, rated PSU bonds maturing on or before December 2027. 60% of the scheme portfolio in SDLs and 40% in AAA rated PSU bonds. As mentioned earlier, SDLs have implicit sovereign status since they are issued by State Governments while PSUs also enjoy quasi sovereign status since they are owned by the Government. Like the previous two funds, this fund also uses rolled down maturity strategy by holding the bonds till maturity. The current yield to maturity (YTM) of the fund is 7.35%. You should have moderate appetite for volatility and be prepared to remain invested till the end of 2027 in this scheme.

- DSP Savings Fund: This is a money market fund. The scheme invests in money market instruments (e.g. T-Bills, CPs, CDs etc) maturing in 12 months or less. The current yield to maturity (YTM) of the fund is 5.1%. This fund also rolls down maturity. The credit quality of the portfolio is high; the average credit rating is AAA/A1. Though the interest rate risk is low for this fund, but you should be prepared for some volatility. You should have minimum 1 year investment tenure for this fund. You can invest in this fund for longer tenure also and get potentially higher returns, since the fund may be able to re-invest proceeds of the maturing instruments at higher yields.

- Aditya Birla Sun Life Nifty SDL plus AAA PSU Bond Sep 2026 60:40 Index Fund: This is another target maturity index fund maturing in September 2026. The fund invests in Nifty SDL plus AAA PSU Bond Sep 2026 60:40 Index, which comprises of SDLs and AAA, rated PSU bonds maturing on or before December 2027. 60% of the scheme portfolio in SDLs and 40% in AAA rated PSU bonds. Like the previous funds, this fund also uses rolled down maturity strategy by holding the bonds till maturity. The current yield to maturity (YTM) of the fund is 6.92%. You should have moderate appetite for volatility and be prepared to remain invested till September 2026 in this scheme.

Taxation benefits

While FD interest and interest paid by several Government Small Savings Schemes is taxed as per the investor’s income tax rate, long term capital gains (investment holding period of 3 years or longer) in debt mutual funds are taxed at 20% after allowing for indexation benefits.

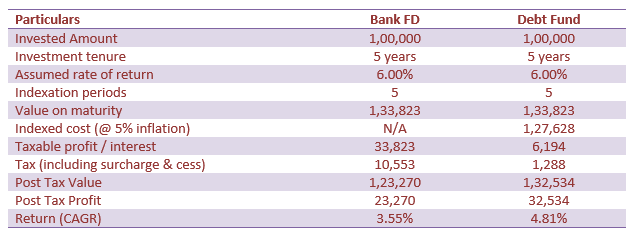

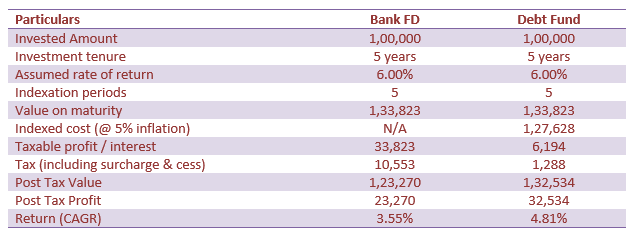

The table below provides illustration of indexation benefits in long term capital gains taxation. In this illustration we have assumed one investor has invested Rs 1 lakh in Bank FD at 6% p.a. interest rate for 5 years, while another investor has invested the same amount in a debt fund giving 6% annualized return (same as the FD interest rate) for the same tenure. In this illustration we have assumed that both the investors are in the 30% tax bracket.

For indexation purposes, we have assumed 5% inflation rate. For ITR filing purposes, you will have to refer to Cost Inflation Index (CII) table provided by the Government to index your acquisition cost (cost of purchase). You will have to multiply your cost of acquisition by the ratio of CII in the year of redemption to CII in the year of purchase. You can find the CII table on the website of Income Tax Department, Government of India.

Let us now see the returns of the two investors in the table below. You can see that both the taxable amount and the effective tax rate of the debt fund investment are lower. Hence the post tax returns of the debt fund investor are significantly higher because of long term capital gains tax benefits.

Conclusion

There are quite a few debt funds which use rolled down maturity strategy. We have chosen to showcase a few funds to cover different type of investment needs, risk appetites and tenures ranging from 1 year to 5 years or longer. There are other debt funds using maturity roll down that may be similar to the funds discussed in this article or may be suitable for different investment needs.

Yields have been rising for the last 12 months and are now across several maturities. Investors can lock-in these yields by investing in debt funds with rolled down maturities.

Please contact with your Eastern Financier’s financial advisors if you want to know more about these funds or other funds with rolled down maturity strategy. Alternatively, you can also contact us at support@easternfin.com