Mutual funds offer a variety of easy and convenient solutions to meet specific investment needs and investment situations for the investor. Mutual Fund Systematic Transfer Plans or STP is one such investment solution. Using Systematic Transfer Plans, investors can transfer a fixed amount from one scheme to the other at a regular frequency in the same AMC. A variant of STP, known as Systematic Switch Plan, is also offered where investors can transfer a certain number of units from one scheme to another. STP is primarily used by investors to transfer from debt funds to equity or hybrid funds and vice versa depending upon what their investment objective is.

Types of Systematic Transfer Plan

There are two types of Systematic Transfer Plan (STPs):-

- Fixed STP in which investors can transfer a fixed amount at regular intervals from one scheme to another – Please check how a fixed STP works

- Capital Appreciation STP in which investors can take out the profit of a scheme and transfer it to another scheme – Please check how a capital appreciation STP works

Defence against Volatility

Systematic Transfer Plan is a very effective and convenient solution in providing protection for investor’s money in volatile markets. For example if an investor wants to invest in an equity fund but is worried that the market may fall in the next 6 months, he / she can invest in a low risk / no load liquid fund and transfer money at regular intervals (weekly, fortnightly, monthly etc.) to the equity fund. STP will ensure rupee cost averaging of purchase price along with liquid fund returns for the investor.

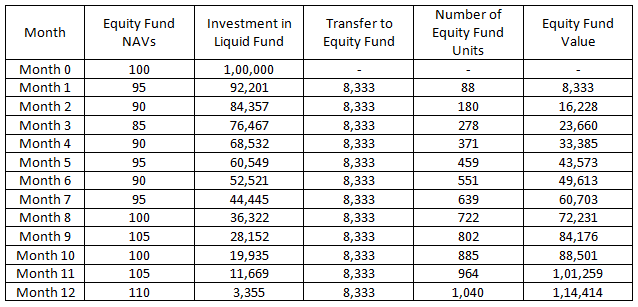

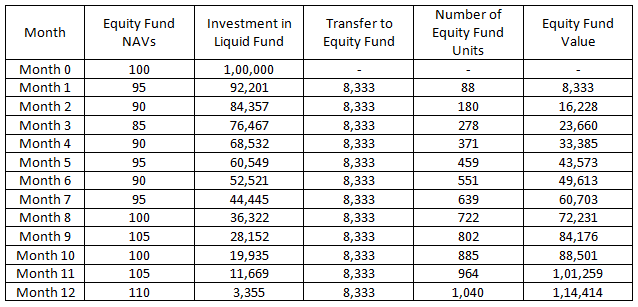

Let us understand with the help of an example. Suppose you want to invest Rs 1 lakh in an equity fund, but are worried that the market may be volatile in the next one year. You can invest the money in a liquid fund and use STP to transfer equal amounts to the equity fund every month. Let us assume that the liquid fund gives an annualized return of 7%. The table shows how the STP will work over the next 12 months (NAVs are purely illustrative).

You can see in the table above that the NAV at the time of investment was Rs 100 and the NAV at the end of the year was Rs 110. If you invested your money in the equity fund in lump sum, you would have purchased 1,000 units and the value of your investment at the end of the year would have Rs 110,000. However, using STP you were able to purchase additional 40 units (total 1,040) and the value of your equity investment was Rs 114,414. Further you also had a balance of Rs 3,355 in your liquid fund. Your total investment value at the end of the year was Rs 117,769. Using the STP, you were able to make an additional profit of Rs 7,769 through rupee cost averaging of the units and also through the extra returns given by the liquid fund during the tenure of the STP.

Typically STPs are used to transfer a fixed amount at a fixed frequency from overnight funds or liquid or ultra-short term funds to equity or hybrid funds. However, investors can opt for STPs to transfer between other schemes also depending on their risk taking appetite, investment needs and asset allocation. For example, investors who are nearing retirement or any other financial goal can use STPs to shift their investments from the existing schemes to safer schemes like debt or hybrid or monthly income plans. Investors need to ensure that both the scheme from which you are transferring (transferor scheme) and the scheme to which you are transferring (transferee scheme) belong to the same AMC.

Suggested reading: put your idle money to work by investing in liquid mutual funds

Systematic Transfer Plan needs financial discipline. You should not discontinue your STPs because of market fluctuations or volatility in the short term, because it may end up not meeting your long term investment return expectations. For example, if you have initiated a 12 months STP from a liquid fund to equity fund, you should not discontinue your STP just because the market was going up or coming down frequently. In fact volatility is good because you accumulate units in the transferee scheme at different points of the market and thus benefit from rupee cost averaging. If you discontinue your STP based on market movements either ways, you would be trying to time the market which always is a very difficult task. STP precludes the necessity of timing the market and helps you optimize the return on your investment by taking advantage of volatility.