The theory of 'Free Trade' was propounded by Adam Smith, the Scottish philosopher and economist often referred to as the "Father of Economics", in his famous book "The Wealth of Nations" in 1776. There he championed the use of minimal government intervention in the functioning of an economy, especially in international trade. The theory argued that by granting everyone, (here we would assume every country) the freedom to produce and exchange goods as they liked, preferred or chose and then trade free of any hindrances by opening the markets up to domestic and foreign competition, people's natural self-interest would promote greater prosperity than could stringent government regulations [1].

Let's just try to simplify this a bit for the purpose of understanding what free trade is. We assume that the countries produce goods according to the resources they have - whatever goods they want – which they believe they can produce best with the available resources. Here we must recognize the fact that just like individuals can't produce everything they need with all the resources they have and would have to trade what they have in excess for what they don't, countries also do the same. No country is completely self-reliant and will have to resort to trade sooner or later.

What Adam Smith advocated was that we should remove any barriers to such trade and the result would be greater economic prosperity of the nations participating in international trade. He believed that people would trade better and in a manner that will satisfy their own self-interest if government regulations were not in place.

It sounds so SIMPLE right? – we manufacture what we want and we sell what we don't use and we buy what we don't produce. But is it at all that simple? Let's dig a bit deeper. Adam Smith's theory of international trade, centers around the concept of absolute advantage. He argued that nations should specialize in producing goods where they have an absolute advantage (meaning they can produce them more efficiently than other nations) and then trade with other nations who specialize in different goods. This specialization and trade, according to Smith, leads to increased overall wealth and prosperity for all nations involved.

Then what happens to those countries that do not have any absolute advantage? Will they only buy from other nations and never sell? Won't that put them at a disadvantage all the time? Won't that hamper their industrial growth? Will they always spend in the international market and never earn? Sounds a bit impractical and non-sustainable because if a country was to only buy and not sell anything how will they survive? Where will they earn from? They will eventually run out of money to buy from others. Even if they acquire debt to finance such one-sided trade, where will they get the money to service the loan and repay it?

Also, the theory assumes that transport costs and taxes are nil. Another aspect that is impractical and irrelevant to modern world. How can I ship from here to there at zero cost – leave everything else, the transporter will at least have to recover the fuel cost, else it will go out of business. What could then be the possible way forward?

Here in enters the concept of Comparative Advantage – which says countries produce products and sell the ones where they have the most advantages or the least disadvantages and then trade the excess for whatever they need and don't have. Always remember that our resources are limited and several of the resources have alternative uses. So, countries (it is expected) will choose wisely to make the best possible use of their resources to produce the goods and services they best can, given their resources and technological prowess. They factor in the transportation cost, the Government levies taxes where thought necessary for various reasons (most important amongst them is providing advantage to indigenous products and offering protection to the home-grown industries and of course to reduce purchase from foreigners when the trade balance remains consistently unfavourable).

Now let's zoom in on India. We trade with several countries of the world. Major exports of India, includes petroleum products, gems and jewellery, textiles and garments, medicines, organic and inorganic chemicals, machinery and equipment, iron and steel, cars, dairy products, and tea. Our biggest import is oil. Other top imports include gold, electronic goods, edible oils, machinery, organic and inorganic chemicals, precious and semi-precious stones, coal, coke, and briquettes, transport equipment, and various forms of machinery. We produce them at home too but they are not sufficient to fulfil our country's aggregate demand. We need to make up for the shortfall through imports. Hence, we see some overlapping product categories. These goods represent a significant portion of India's overall import value and hence spent.

We earn from exports and we spend on imports. So, tariffs increase the spent-on imports and reduce our earnings from exports, resulting on higher drain from our coffers. Where the expenses outrun the earnings, we end up paying more than we earn and the merchandise trade balance turns unfavorable or negative. But trade is unavoidable. So what countries do is enter Free Trade Agreements (FTA) depending on mutual relations – economic and political. An FTA is a treaty between two or more countries that aims to reduce or eliminate tariffs and other trade barriers, like import quotas, to facilitate trade between member nations. Such as treaty offers advantages, favors, privileges or immunities granted to each-other by contracting countries. This is supposed to prove to be beneficial to the contracting parties while those outside the contract face a higher tariff or non-tariff barrier. FTA offers immunity to goods and services originating in the member countries. The contracting parties cannot erect higher or more restrictive tariff or non-tariff barriers with non-members as well [2].

The India-UK FTA that was entered last week, is expected to lower tariffs on 99% of Indian exports while making it easier for British firms to export whisky, cars and other products to India, besides boosting the overall trade basket [3]. The trade pact is expected to provide greater market access for an extensive range of Indian products and services in the UK and is aimed at doubling the bilateral trade in goods and services to US$ 120 billion by 2030 from present US$ 60 billion [4].

Let's look at the following news as an example

The FTA is expected to provide significant boost to Indian textile and apparel exports to the UK and Indian apparel makers expect to see $1 billion gains. Zero-duty access will dent Bangladesh's competitive edge in the UK market.

The expected reduction of duties on textiles and garments exported to the UK is 8-12%. Indian exporters are likely to gain a 12% edge over Chinese competitors, with the possibility of doubling India's exports to the UK to $1.5 billion within a couple of years.

Figure 1: UK-India FTA - Goods Covered

So many industries are to benefit from the agreement. India has gained market access in all industrial goods at 'Zero duty' on entry into force. It covers sectors such as leather, footwear, textile and clothing, gems and jewellery, base metals, furniture, sports goods, transport/auto components, chemicals, wood/paper, mechanical/electrical machinery, minerals. Currently, these sectors face duty in the range of 4-16% in the UK [4].

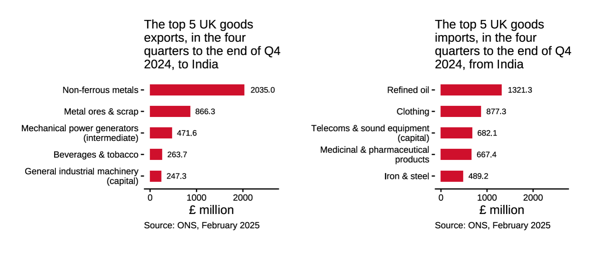

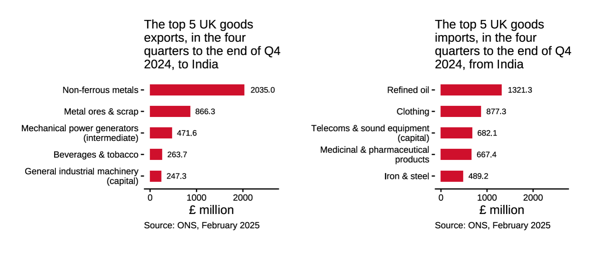

Figure 2: UK-India Trade

Source: World Economic Forum [5]

Labor mobility will increase with its implementation due to the increase in transparency and decrease in hurdles in visa procedure.

For UK the following benefits will confer

- Tariffs on whisky and gin reduced from 150% to 75%, and to 40% over a decade.

- Automotive tariffs cut from over 100% to 10%, with quotas for conventional and electric vehicles.

But what are the prices we pay for the India-U.K. FTA???

The agriculture sector is worried as farmers fear price in key products such as spices and tea will crash - similar to past experiences with FTAs involving Sri Lanka and ASEAN. For instance, rubber prices crashed post-ASEAN FTA from ₹230/kg in 2011 to ₹170/kg in 2025.

The biggest concerns are unequal competition, small land holdings leading to small farm sizes raise the cost of production as such farms are generally unfit for mechanization (necessary for cost reduction), and WTO's outdated methodology (base price set at 1980s) for subsidy calculations that put Indian farmers at a disadvantage and reduce their ability to compete.

MSMEs also show concern as they worry about being undermined by foreign competition in terms of public procurement and key sectors. According to experts, foreign firms have the potential to weaken India's policy tools for building local capacity in sectors such as defence, health, and renewables. Experts worry about unfair competition and that U.K. companies will get better access to Indian government contracts, potentially displacing small domestic suppliers who are in no position to compete with their foreign counterparts due to reasons such as fund crunch and hence technological and other disadvantages.

The country is likely to be at risk of import dependency, particularly in sensitive and strategic sectors. However, India has not accepted the demand of the UK for inclusion of a 'data exclusivity' provision in the free trade agreement which will safeguard the generic drug segment [6].

And finally, the concern regarding U.K.'s Carbon Border Adjustment Mechanism (CBAM) that may impose carbon pricing on imports, impacting India's aluminium and steel exports. Though CBAM is a European initiative, India has signalled possible retaliatory carbon taxes, adding to trade uncertainties [7].

Looks like even after the potential benefits, Free Trade is not free after all…

References

[1] A. Hayes, "Adam Smith and "The Wealth of Nations" | Investopedia," 17 Oct 2024. [Online]. Available: https://www.investopedia.com/updates/adam-smith-wealth-of-nations/. [Accessed 08 May 2025].

[2] Dept. Of Commerce, GoI, "Indian Trade Portal : Free Trade Agreements - FAQ," 2014. [Online]. Available: https://www.indiantradeportal.in/vs.jsp?lang=0&id=0,55,288. [Accessed 12 May 2025].

[3] PTI, "India-UK FTA a positive step; car prices unlikely to change | Business Standard," 11 May 2025. [Online]. Available: https://www.business-standard.com/economy/news/india-uk-fta-a-positive-step-car-prices-unlikely-to-change-bmw-mercedes-125051100111_1.html. [Accessed 12 May 2025].

[4] PTI, "Explainer: India-UK free trade agreement -- all you need to know | Economic Times," 10 May 2025. [Online]. Available: https://economictimes.indiatimes.com/news/economy/foreign-trade/explainer-india-uk-free-trade-agreement-all-you-need-to-know/articleshow/121056999.cms?from=mdr. [Accessed 12 May 2025].

[5] World Economic Forum, "The UK and India just signed a 'historic' free trade deal. Here's what to know," 09 May 2025. [Online]. Available: https://www.weforum.org/stories/2025/05/uk-india-free-trade-deal/. [Accessed 12 May 2025].

[6] PTI, "India has not accepted 'data exclusivity' demand by UK to protect generic drug firms | Economic Times," 12 May 2025. [Online]. Available: https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/india-uk-free-trade-agreement-india-has-not-accepted-uk-data-exclusivity-demand-in-fta-to-protect-generic-drug-firms/articleshow/121107749.cms?from=mdr. [Accessed 12 May 2025].

[7] Vajiram & Ravi, Institute for IAS Examination,"https://vajiramandravi.com/upsc-daily-current-affairs/mains-articles/fta/," 11 May 2025. [Online]. Available: "https://vajiramandravi.com/upsc-daily-current-affairs/mains-articles/fta/". [Accessed 12 May 2025].