Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI, multi asset allocation funds must invest minimum 10% each in at least 3 asset classes. Apart from the two most popular asset classes, equity and fixed income or debt, multi asset allocation funds must invest in other asset classes like gold, real estate investment trusts (REITs), infrastructure investment trusts (InvITs) etc. The fund manager decides the proportional allocation to each asset class based on the market conditions with the objective of balancing risks and returns.

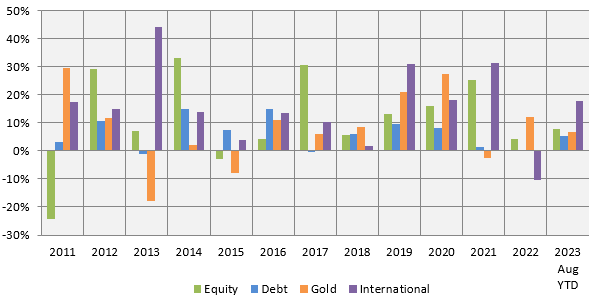

Role of different asset classes in you asset allocation

- Equity: The primary objective of equity as an asset class in capital appreciation over long investment tenures i.e. wealth creation.

- Debt: The main investment objective for debt is income. Debt as an asset class is relatively less volatile and therefore can provide stability to your portfolio in market downturns.

- Gold: Gold, as an asset class, is seen as a store of economic value and also has great cultural significance in India. Historical data shows that gold can be hedge against inflation in the long term. Gold is usually counter-cyclical to equity and can provide diversification to your asset allocation

- REITs: Real Estate Investment Trusts or REITs are investment vehicles which invest in real estate properties. REITs can give you regular income as dividends from rental income as well as capital appreciation over long investment horizons.

- InvITs: Infrastructure Investment Trusts or InvITs are investment vehicles which invest in revenue generating infrastructure projects e.g. commercial assets across Roads, Power, Railways, Warehouses, Airports, Data centres, Telecom towers, etc. The main investment objective of InvITs is long term income and can be suitable investment options for retirees.

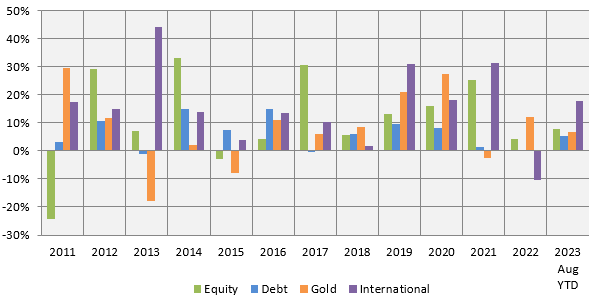

Winners rotate across asset classes

Notes: Equity is represented by Nifty 50 TRI, Debt by Nifty 10 year Benchmark G-Sec, Gold by MCX Gold Prices and International by S&P 500 in INR.

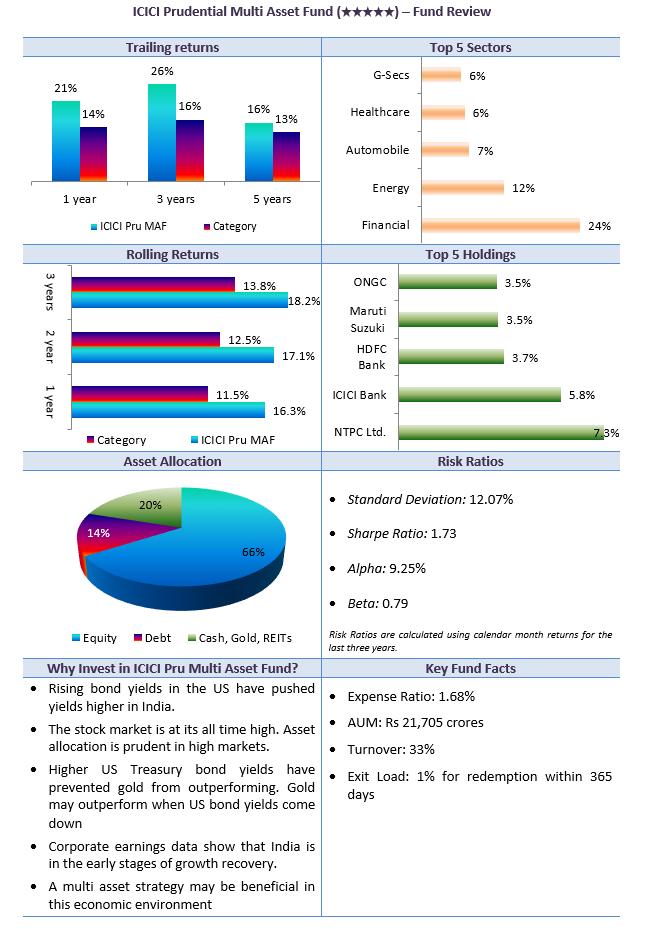

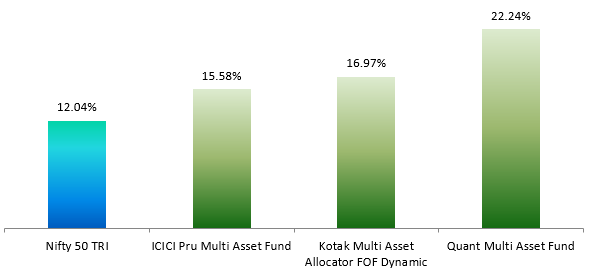

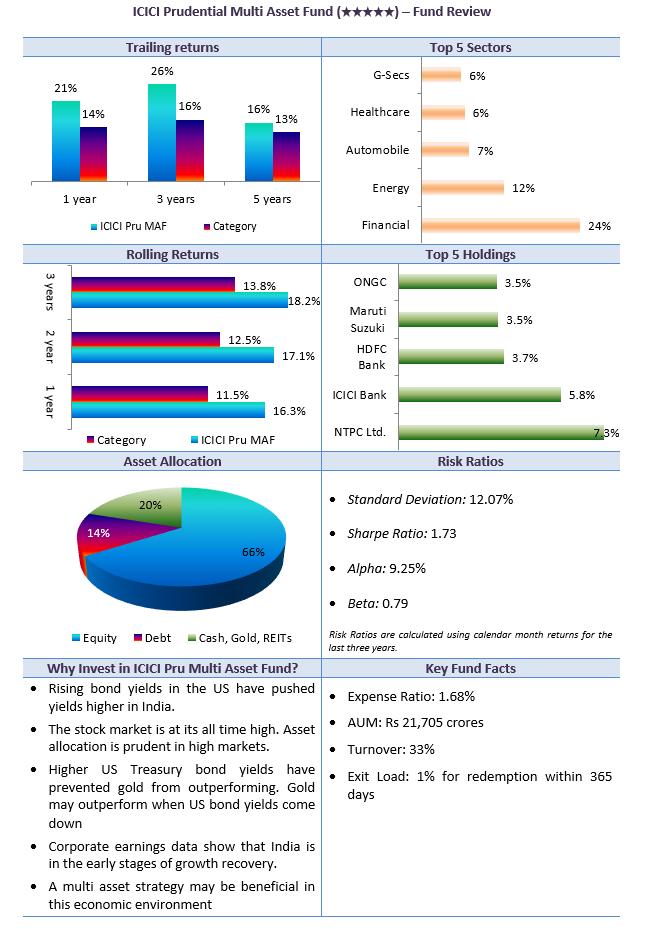

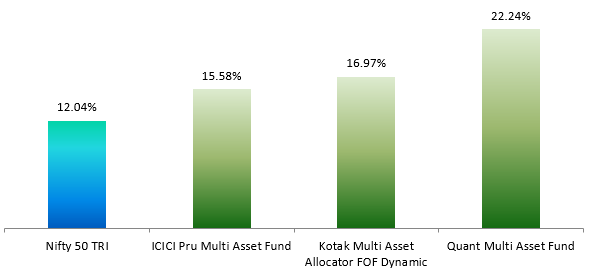

Top Performing Multi Asset Funds have outperformed Nifty 50 TRI in the last 5 years

We have compared performance of top performing multi asset funds with Nifty 50 TRI over the last 5 years since SEBI introduced this product category. Top performing Multi Asset Allocation funds were able to outperform Nifty by a significant margin during this period despite much lower risks.

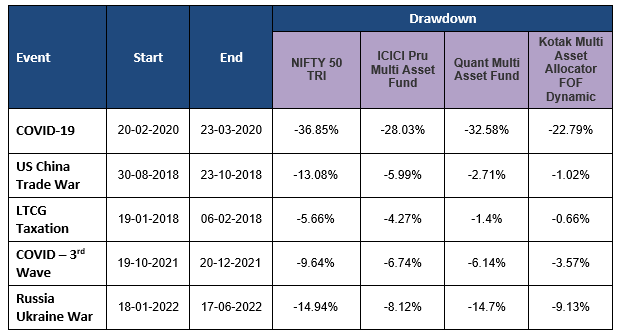

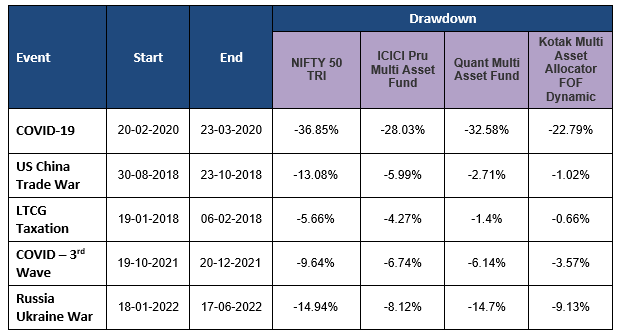

Smaller Drawdowns

The table below shows the biggest drawdowns in the last 5 years or so, ever since the multi asset category came into being. You can see that top performing multi asset funds had much smaller drawdowns compared to Nifty.

This shows that multi asset funds can deliver superior risk adjusted returns for investors.