Dynamic bond funds are ideal investment options for investors with sufficiently long investment tenors, who want to get good returns irrespective of interest rate situations prevailing in the interim. These funds have a flexible duration strategy and invest across durations; when yields bottom out, these funds switch to a long duration strategy and when yields are high, they switch from a long duration to a short duration strategy - hence the name dynamic bond fund. ICICI Prudential All Season Bond Fund is one of the best performing dynamic bond funds.

Consistent Performance of ICICI Prudential All Season Bond Fund

The true performance test of a top performing dynamic bond fund is not whether the fund has given the highest returns in the last one or two years; a dynamic bond fund can outperform others in a particular period by adopting a conservative or aggressive duration strategy relative to interest rate scenario prevailing in the particular period. The true test of a dynamic bond fund’s performance is consistency of performance in all interest rate scenarios.

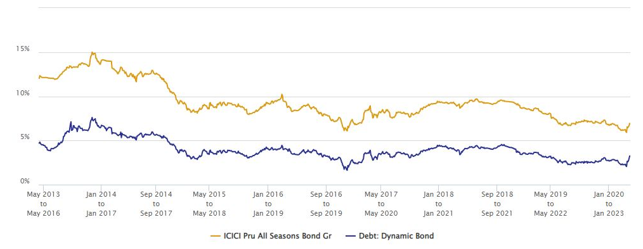

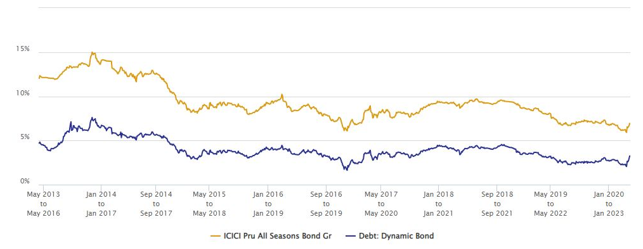

The chart below shows ICICI Prudential All Season Bond Fund’s performance versus the dynamic bond fund category over the last 10 years. You can see that the fund ranked in the top quartiles 9 times out of 10 in the last 10 years. In 6 of those the fund was a top quartile fund, while in 3 other years the fund was ranked in the upper middle quartile.

Duration Strategy

ICICI Prudential All Seasons Bond Fund modified duration is maintained in a range of 1-10 years based on an in-house model. The scheme takes duration calls based on an in-house Current Account (CA) Model and absolute G-Sec yield levels. The Current Account Model is based on three parameters:-

- Current Account Deficit

- Fiscal Deficit

- Credit Growth

Whenever the Current Account index level moves higher, the scheme increases duration and when the CA index is negative, the scheme decreases duration.

Rolling Returns

The chart below shows the 3 year rolling returns of ICICI Prudential All Seasons Bond Fund versus the dynamic bond fund category over the last 10 years. We are showing 3 year rolling returns because we always recommend minimum 3 year investment tenures for dynamic bond funds i.e. covering multiple interest rate cycles. You can see that the fund consistently outperformed the category average. The fund gave 8%+ CAGR returns in 76% of the instances over 3 year investment tenure in the last 10 years.

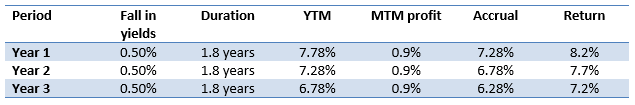

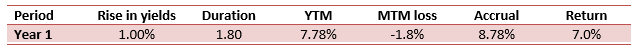

Illustrative returns in different interest rate scenarios

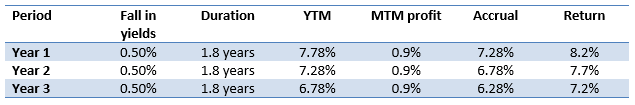

The yield to maturity (YTM) of ICICI Prudential All Seasons Bond Fund is 7.78% and the modified duration of the fund is 1.8 years. We in Eastern Financiers think we are approaching the end of the interest rate cycle. The bond markets have already discounted future interest rate hikes of 75 bps in bond prices. So probability of yields going up much from current levels is relatively low. Though central banks may keep interest rates high for some time to bring inflation down to the target range, at some point of time, the central banks will have to cut interest rates because of economic slowdown or recession. There are clear signs of a coming recession in the developed markets and slowdown in emerging markets like India. The table below shows illustrative returns assuming YTM of 7.78% and duration of 1.8 years.

In the above illustration we have assumed that duration remains unchanged for the sake of simplicity. However, dynamic bond funds actively manage duration based on the fund manager’s interest rate outlook. If interest rates are on downward trajectory the fund manager will increase the duration to get higher marked to market (MTM) profits.

Let us assume scenario where yields go further up by 1%. This is an extreme scenario because yields have already shot up by 60 - 140 bps across different bond maturities over the last 1 year or so. Purely for illustrative purposes, we have shown how a 1% rise in yields will impact the return of the above dynamic bond fund in the table below. You can see that the risk / return trade-off is very favorable for the fund

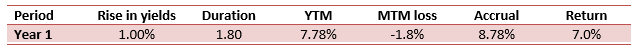

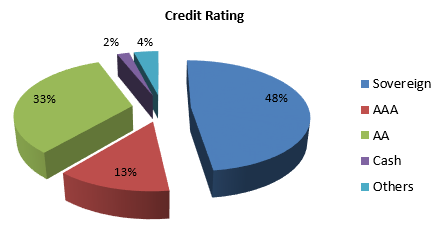

Credit quality

The credit quality of ICICI Prudential All Seasons Bond Fund is very high. Nearly 95% of the portfolio is in Sovereign (G-Sec), AAA and AA papers.

Why invest in ICICI Prudential All Seasons Bond Fund now?

- For the last 1 year, central banks all over the world, have been hiking interest rates to control high inflation. The RBI hiked repo rate by 2.5% in the last 1 year from 4% to 6.5%. The market expects RBI to hike repo rate to 6.75% in April 2023, which will be the highest repo rate in the last 7 years.

- Yields have rise across all maturities in the yield curve. The yield of the 3 year Government bond rose by 140 bps in the last one year from 5.7% to 7.15%, while the yield of the 10 year bond rose by 50 bps from 6.8% to 7.31%. There are attractive investment opportunities across all maturities in the yield curve.

- The yield curve has also flattened considerably over the past 6 months; the difference between the 3 year and 10 year bond yield is only 15 bps as on 1st April 2023; 1 year back the difference in yields of the 3 and 10 year bond was 110 bps. Flattening yield curve indicates possible reversal of interest rate trajectory.

- ICICI Prudential All Seasons Bond Fund has the ability to generate reasonable returns in all kinds of market scenarios. As yields are expected to show mean reversion in the future (fall in yields), the scheme can flexibly increase duration and generate higher marked to market profits i.e. capital appreciation for investors

- The credit quality of the fund is very high.

Please contact your Eastern Financier’s financial advisor to know more about ICICI Prudential All Seasons Bond Fund and discuss if it is suitable for your investment needs.