World needs new growth engine that’s democratically sound, demographically fit and digitally savvy

Global Outlook

After 13 years of easy monetary conditions, the Fed finally made a “pivot” with aggressive tightening unlike seen in prior decades. It was a challenging year for asset allocators, as macro/market developments ended up being more extreme than anticipated. One of the most brutal global moves in the year was the double-digit losses facing fixed income investments - assets which are typically thought of as conservative, safe, defensive. Aside from the unwind in expensive equity valuations, there was the unwinding of a series of bubbles that blew in the wake of the pandemic stimulus - crypto, SPACS, private equity. Other than Cash and specific commodities; most other asset classes returned in ‘red’ this year.

The big question for 2023 is - Has battle on inflation won or the war on it has just begun?

China, second biggest economy is re-opening after having been on a lockdown for three years. Excess Chinese household savings along with record low mortgage rates could be one of the main drivers of pent-up consumption demand driven inflation in 2023.

It’s a new world, weaponization is no longer limited to planes and ships; but extends to dollar, gas, oil, metals, grains and chips. We are entering a period of ‘Globalization of localization’ as every country tries to secure supply chains by re-shoring, near shoring, friend shoring etc. As large-scale infrastructure investments take place to comply with ‘new world’ we could see commodities (scare) to average higher.

Who will attract global liquidity flows - Emerging markets or Developed markets?

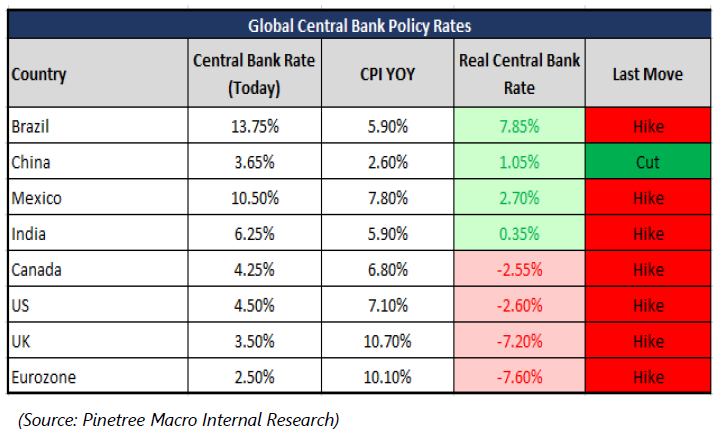

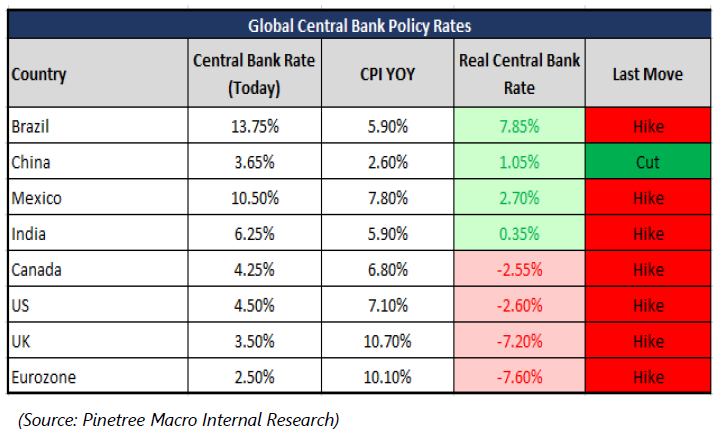

The simple answer to this is - One who maintains the value of currency. Monetary policy decisions by Global Central banks affect the overall systematic liquidity and thereby Asset class performance. Certain Emerging markets have raised rates to combat inflation or are running tighter monetary policy and with cooling of inflation. These countries are in a better position to keep rates stable/reduce interest rates.

In December’2022 India’s real rates turned positive, thanks to easing inflation numbers. Given the large gap between Inflation rates (current & expected) and Interest rates; most developed countries may still run negative real rate for a larger time frame.

Liquidity moves to the jurisdiction it is treated the best and this could be a year for select Emerging markets.

In short, EMs have become DMs and DMs have become EMs.

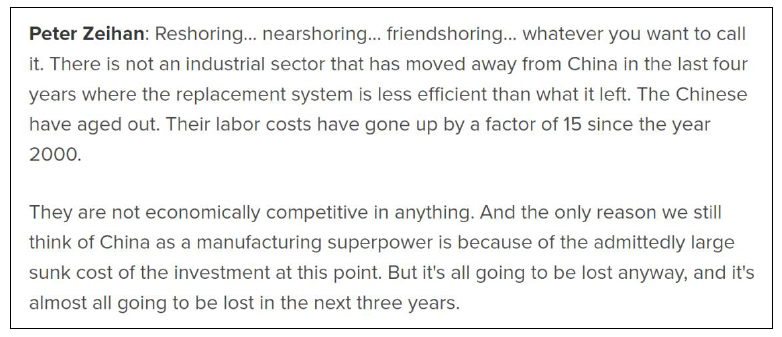

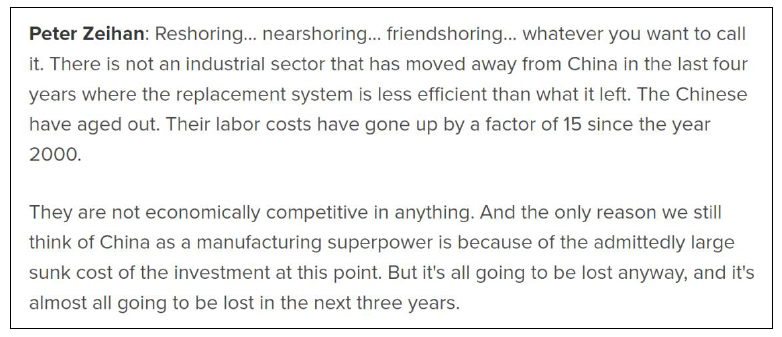

China + 1 strategy

China is peaking and losing out on its economic competitiveness. Industries that have moved out of China in past 4 years have seen relatively lower replacement costs. Chinese labour has aged out and their costs have gone up. The only reason China is thought of as a manufacturing superpower is because of the admittedly large sunk costs of the investment.

Countries like Vietnam, India, Brazil, Mexico could be beneficiary given demographic advantage and impending industrialization as China takes a back seat from begin tagged as “World’s factory”.

India PLI scheme + Manufacturing gaining momentum

In a turbulent world, India is an oasis of hope.

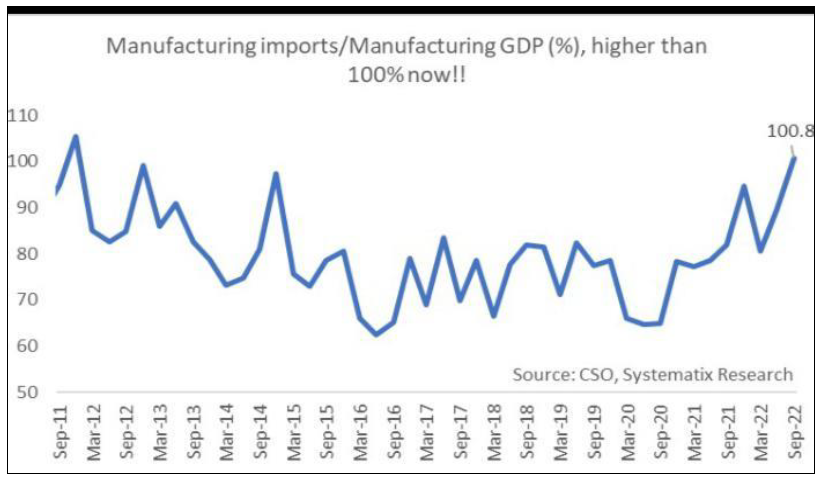

Back to basics i.e., industrialization and manufacturing exports taking over service, will be an important driver to India’s growth story next decade; buoyed by government’s robust policy thrust, initiatives like production-linked incentives (PLIs) and fresh investments that are pouring into the country’s core industrial sectors (13 sectors are mapped under PLI scheme with outlay of $47.8 bn and expected production increase of $500bn in next 5 years).

- India is among top four destinations for relocation of American companies. As per India commerce secretary “There is a global demand to move out of China, dependency is 80-90%. That's why many nations are eager to sign FTAs with India, they're an important part of our trade strategies”.

- Exports have seen tremendous growth over the last two years, with a compound annual growth rate (CAGR) of 15%, rebounding from 5-10% in the pre-pandemic years. As per a recent Morgan Stanley report, India will account for 22% of global growth in the current year.

- Proof of the pudding - Apple to manufacture Iphone14 from India, looking to diversify their manufacturing base beyond China for iPhone. In India mobile phone production has increased fivefold in the past five years and the country is on track to emerge as a global exporting hub of mobile phones.

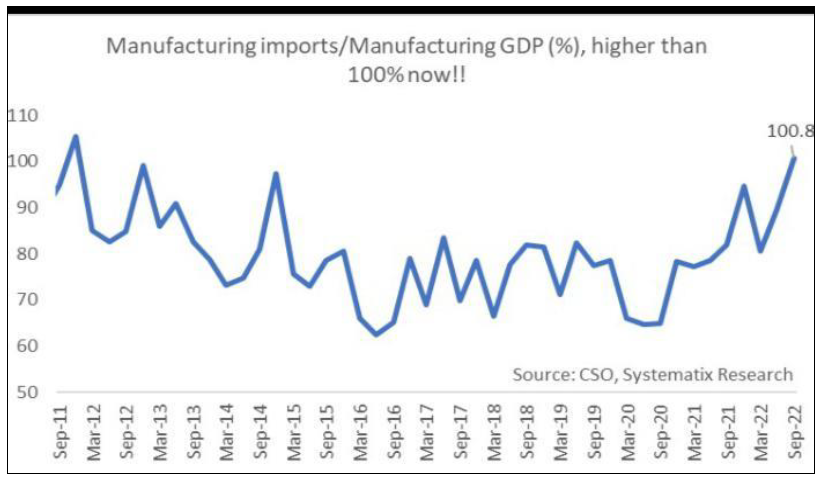

INR is presently the worst performing Asian currency and Indian Manufacturing imports have crossed 100% of the Manufacturing GDP as the country prepares to revamp and build up on production capacities. Next 2-3 years will be all about putting the building blocks in place to reduce manufacturing imports. This in the short term (till we build capacities) may put pressure on the current account deficits and thereby currency; however, as new India upscales the country could see reduction in imports which will give a boost to the GDP and bring long term stability to Indian Rupee.

2023 might just be the year for Fixed Income

The year 2022 has been nothing but eventful for bond markets. Risk of political events impact on inflation continues to stay and monetary policy may have to be flexible going forward to accommodate for uncertainty. Globally, declining corporate earnings may continue to weigh on Equity performance and that leads to a flight of capital towards bonds in almost all scenarios. Especially at such cheap levels.

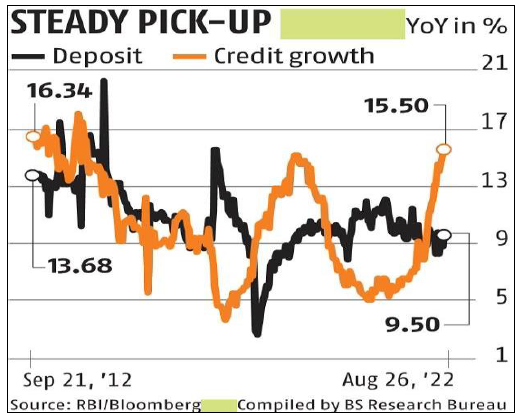

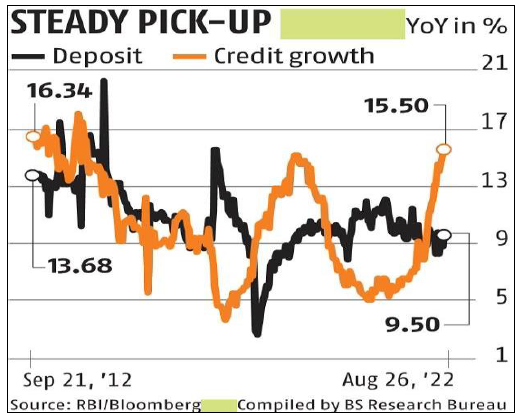

Domestically, RBI initiated rate hikes and commenced withdrawing accommodation instituted during the pandemic with overall market liquidity declining from ₹7.6 lakh crore in January 2022 to deficit levels in December 2022, complemented by robust credit growth and forex interventions.

Consequently, Bank deposit growth at 10% and credit growth at 15% YOY indicates expansion will continue to weigh on liquidity and keep credit demand high. Impact of this could be higher rates by financial institutions to attract deposits.

Both from accrual as well as from price gain perspective it could be an opportune time to build positions in Fixed Income via bonds and long dated Fixed Income mutual funds.

Oil

Last decade saw oil and gas discoveries sink to lowest level in 75 years. Supply constraints along with resurgence in demand may lead to higher energy prices. Saudi Arabia said global oil production could drop 30% by the end of the decade due to falling investment in Fossil fuels. Russia’s equation to the global supply balance will have a major say in shaping global oil trade. We think markets will be dealing with higher energy prices for this decade.

Domestically, India’s fast-rising Russian oil imports are being matched by its rising oil exports suggesting it may be reselling Russia’s oil to the West. In doing so, Indian companies have avoided the US dollar and are using Asian currencies (Dirhams/Renminbi) to pay for Russian oil imports to avoid being tied up in sanctions. Meanwhile, India and the UAE are also working on a rupee-dirham payment mechanism to bypass the U.S. dollar in bilateral trade, for oil and gas purchases from the UAE. While concerns around sudden rise in Oil price could weigh on India’s current account deficit numbers; however, bypassing USD for certain part of imports could add a layer of comfort if oil prices remains elevated.

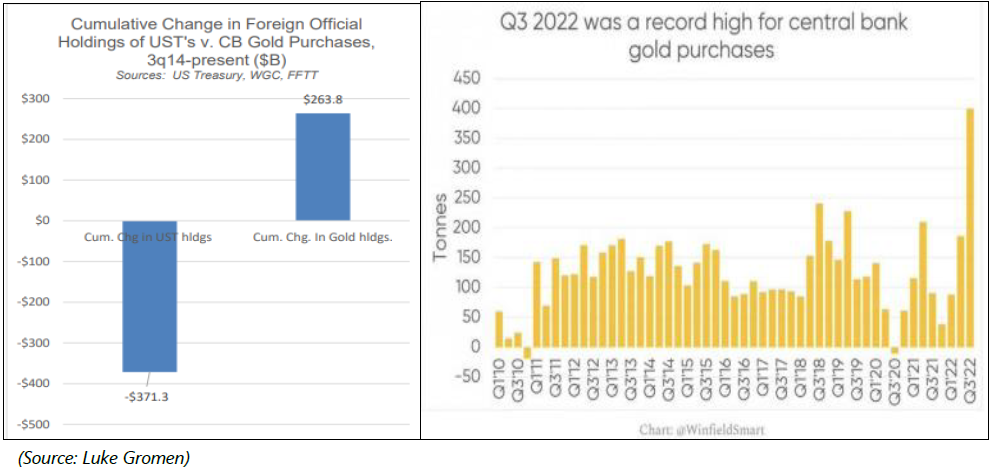

Gold

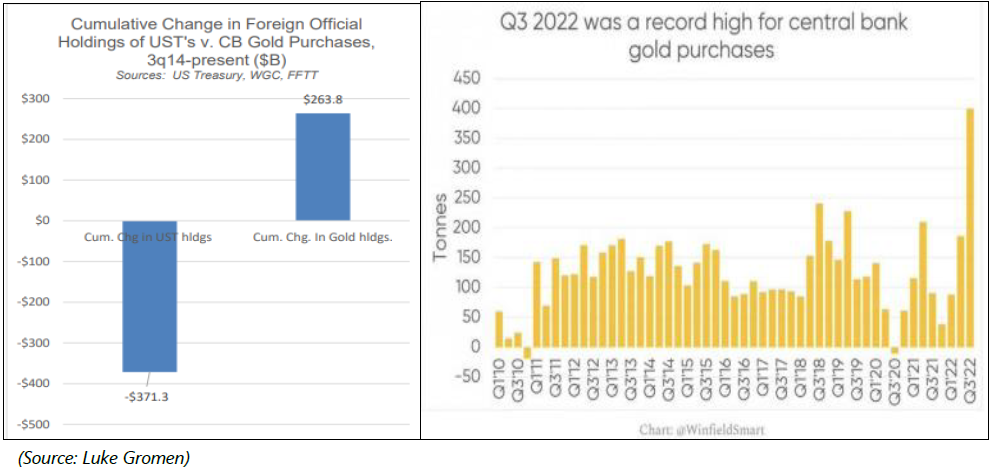

In a separate world Gold continues to shine, presently trading at a new all-time high in INR. Weaponizing the US dollar was the biggest blunder by the US administration. Because that taught the countries that are not as friendly and close to the US that they should not hold all their reserves in US dollars. This could be the start of decline in US dollar’s role as a major reserve currency. Precious metals are ready to take leadership in changing world where US hegemony is getting threatened.

Outlook

This decade will be about movement to Real assets & main street over Financial Assets - World is moving from low/no inflation of the past 40 years to inflationary era in this decade, as deglobalization takes hold, countries change their trading patterns to secure supply chains and going ahead with rebuilding their economies.

- Global liquidity situation will be interesting to watch. Will western world central bankers tighten in response to inflation fears and China continues ‘responsible Easing’ liquidity scenario?

- Cold war between East vs. West will change the globalized world and the manner in which trades took place in past 40 years. As countries look at sourcing from multiple partners and/or on-shoring; India’s diplomatic position in world politics stands as an advantage which could bear fruits in the next decade.

- 2010-2020 was all above asset light + growth model. We believe next decade is all about asset heavy companies i.e., essentially industries which are capex intensive and see operating leverage kick in as volume increases. We Prefer ”Asset owners” for this decade.

- India’s private capex cycle has been slow to gather pace, the outlook for coming quarters looks positive. With capacity utilization rising above 75 coupled with an improving demand scenario, we could expect the private investment cycle to accelerate.

- Having said that, India is not immune to challenges rising from global disruption, oil volatility, domestic political stability; however, at this juncture the country seems to be cleanest dirty shirt.

- Oil - While India is insulated for the time being because of Russia; but, any political/price changes here could have a much bigger impact on Current account deficit for a large oil importer like India.

Asset Allocation

- We continue to hold long term positive view on thematic ideas through Commodity heavy MFs, India Manufacturing focused MFs and IT fund. Ideal is to build allocation in a staggered manner via SIPs. To reiterate, the era of free money (led by low interest rate) gave rise to momentum investment strategy where passive or momentum driven investments flourished; but, as we move to a more volatile interest rate scenario, active asset allocation will take over passive/buy and hold investing. In short, “In 2023 money will be made outside the benchmark”

- Bond yields seem attractive and could potentially be a competition to Equity returns coming year.

- Gold positions can be built via Sovereign gold bonds with carry additional 2.5% annual coupon and capital gains for hold to maturity papers are tax free.