ICICI Prudential i-Protect Smart Plan is a term life insurance plan which provides high life insurance cover to the insured (policy-holders) at affordable costs. You should know that term insurance plans provide financial benefits (sum assured) to your dependents / nominees in the event of an unfortunate death; there are no survival or maturity benefits in a term plan. In that sense, term plans are pure insurance plans unlike endowment or unit linked plans which are insurance cum savings or investment plans.

The biggest advantage of term plans is that you can provide much more financial protection (insurance cover) to your family at much lower cost compared to other life insurance plans. The cost savings in term life policy premiums can be invested in pure investment products like mutual funds for your different financial goals.

Why ICICI Pru i-Protect Smart Plan?

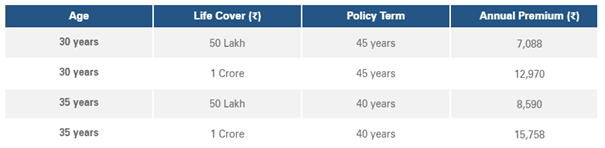

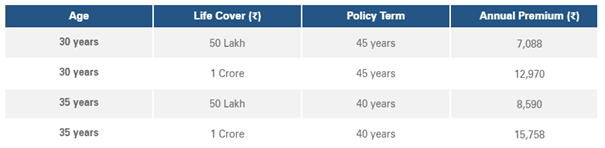

- Cost / Affordability: The cost of life insurance plans is often a hindrance to buying sufficient life insurance cover and / or making sufficient savings and investments for your financial goals. Insurance premiums after paying for your regular expenses like rent / home loan EMIs, electricity and other utility bills, school fees, food, transportation and other expenses. If the premium of your life insurance policy is high, then you will either settle for a lower cover which leaves you under-insured or have fewer saving for your investment goals which are equally important. The affordable premium of ICICI Pru i-Protect Smart Plan helps you manage your different financial priorities and provide adequate insurance cover.The table below shows indicative premiums for different cover amounts for a healthy non-smoking male.

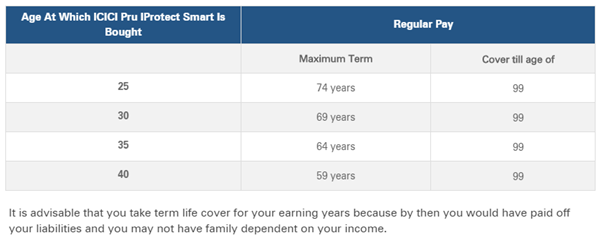

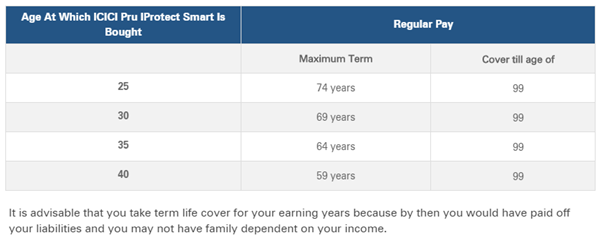

- Longer Cover Periods: The maximum maturity age of ICICI Pru i-Protect Smart Plan is 75 years. The policy options under i-Protect Smart Plan enables you to get whole life cover (till the age of 99). However, we in Eastern Financiers are of the opinion that your life insurance policy should cover your working years, when your family depends on your income. You do not need life insurance when you are not working and have paid off all your liabilities. The table below shows the maximum policy term for some ages.

- Life Cover for Terminal illness: Terminal illness is not just a very serious threat to your life, it can be extremely emotionally and financial distressful for your family. Please note that, Terminal Illness refers to the high likeliness of death within the next six months as diagnosed by medical practitioners that specialise in the same.ICICI Pru i-Protect Smart Plan covers serious terminal illnesses including AIDS. Your i-Protect Smart Plan policy will pay out 100% of the sum assured (insurance cover) in the event of an unfortunate terminal illnesses. The terminal illness cover in i-Protect Smart Plan will help your family with the financial resources to put up the last fight for your survival and provide financial protection before death.

- Pay-out options suited to your financial needs: There are four pay-out options, combinations of lump sum, monthly income and increasing monthly incomes depending on the financial needs of your dependents.

- Lump Sum: In this option, the sum assured (insurance cover) will be paid out in lump sum to your dependents in the event of an untimely death

- Income: In this option, 10% of the sum assured will be paid out every year in monthly instalments over the next 10 years. This option can help your family meet regular expenses like home loan EMIs etc., till your dependents (e.g. children) become financially independent

- Increasing Income: In this option, your dependents (e.g. wife, children etc.) receive monthly benefits (income), but the income received by your dependents increases at the rate of 10% p.a. on a simple interest basis.

- Lump sum + Income: With this option, the Life Cover will be paid in two parts as selected by you at policy inception. This option provides flexibility to select the pay-out depending on your family’s financial circumstances.

- Critical Illness Cover: Unfortunately many insurance buyers in India ignore critical illness as a financial risk when buying insurance covers. In our view, financial risks arising out of critical illness is as serious as death. You need critical illness cover for your family not only to pay for medical expenses for your treatment, but also to provide financial protection for loss of income in case you are unable to work for long periods due to illness. As such, in our view, you should always consider buying a critical illness cover along with your term insurance plan.ICICI Pru i-Protect Smart Plan pays out critical illness cover / sum assured purchased along with your term insurance policy in lump sum on the first diagnosis of the illness. An important feature of the critical illness cover of i-Protect Smart Plan is that hospital bills are not required to claim critical illness benefit. You only need to provide photo copy of your diagnosis report. The claim pay-out from your critical illness cover will provide your family more financial resources to manage their finances during the course of eventual hospitalizations and the expenses incurred thereof. ICICI Pru i-Protect Smart Plan pays on diagnosis of any of the 34 critical illnesses. To know more about the critical illness policy benefits including the illnesses covered, please contact your Eastern Financiers insurance advisor.

- Accidental benefit option: Road and train accidents happen all the time; sometimes this can lead to death. Sudden deaths arising out of accidents have emotionally devastating effects on your family, but life insurance plans can mitigate the financial effects of such distressful events. ICICI Pru i-Protect Smart Plan lets you add accidental cover of your choice during purchase or, even after purchase. For example - if you buy life cover of Rs 1 Crore with accident benefit of Rs 50 lakh, your dependent / nominee will get Rs 1.5 crore in case of death due to accident. Maximum accident cover available with this benefit is Rs 2 crore.

- Claims pay-out track record: While cost of life insurance and plan features are important decision factors, claims payout track record and customer experience related to claims should also be one of the most important factors in buying insurance policies. In the event of an unfortunate death, when your family is coping with severe difficulties, emotionally and otherwise, rejections or delay in paying insurance claims can cause distress. It is in the interest of your family, to ensure a hassle free, quick process of insurance claims settlement. ICICI Prudential Life Insurance is one of the largest and strongest brands in the industry and has a very high claims settlement ratio track record. The claims settlement ratio of ICICI Prudential Life Insurance in FY 2018-19 was 98.6%. Timely insurance claims payment will provide succour to your family in very difficult times.

- Income Tax Benefits: Under Section 80C of Income Tax Act 1961, you can claim deductions for the premiums of your life insurance policy from your gross taxable income. If you are in the 30% tax bracket and are paying Rs 15,000 of life insurance premium then your tax saving per year will be Rs 4,680. If you are in the Rs 50 lakhs plus income slabs, your tax savings will be even higher.If you opt for critical illness cover with your life insurance policy, then you can claim additional tax benefits u/s 80D of Income Tax Act (you should note that 80D benefits are over and above 80C) for incremental premium paid for the critical illness in your policy. You can claim up to Rs 25,000 of tax deductions for insurance premiums paid towards health insurance, including critical illnesses.

- Special benefits for women policy-holders: ICICI Pru i-Protect Smart Plan provides special benefits for women policy-holders. They enjoy lower premium rates. Women also have the option to cover critical illnesses like breast cancer and cervical cancer.

- Protecting the financial interests of your loved ones: The most important purpose of buying life insurance is to provide financial protection to your immediate family and dependents in the event of your untimely death. Unfortunately certain financial / legal circumstances can cause your creditors or your other relatives to wrongfully lay a claim on your insurance amount. You can protect your immediate family / dependent’s financial interest by buying the ICICI Pru i-Protect Smart Plan under Married Women’s Property (MWP) Act. You will have the peace of mind that the money will go to your wife and children.

Conclusion

In this post, we reviewed why the ICICI Pru i-Protect Smart Plan is an ideal term life insurance plan for providing you and your family adequate life insurance cover at an affordable price. The critical illness feature is an important add-on to your life insurance cover that you should consider when buying life insurance. You will also be able to save income tax by buying life insurance plan. We discussed several other features, which make ICICI Pru i-Protect Smart Plan ideal for your family’s financial protection. Please contact with your insurance advisors to know about this life insurance plan.