Asset allocation is spreading your investments over different asset classes e.g. equity, fixed income, gold, real estate etc. The main purpose of asset allocation is to balance risk and returns. If you are over-invested in one particular asset class, you may end up either taking too much risk or accept too little returns. Through asset allocation you take optimal risks to get the right returns needed for reaching your financial goals.

Benefits of asset allocation

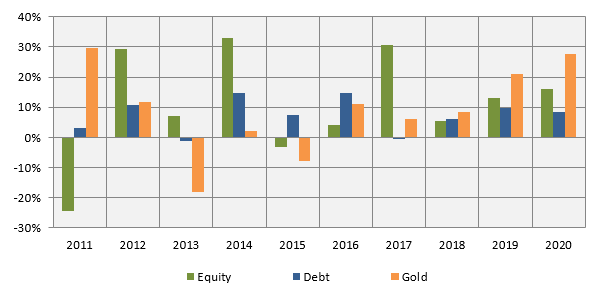

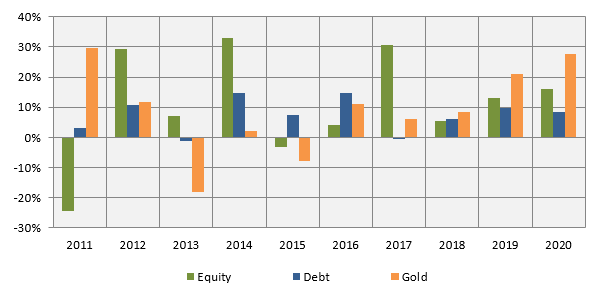

- There is low correlation between returns of different asset classes in different market conditions (see the chart below).

- Asset allocation will reduce portfolio risk since asset classes like debt is much less volatile than equity. Gold, on the other hand, is often counter-cyclical to equity (see the chart above); gold can serve as a hedge against equity risk. Asset allocation will diversify portfolio risk and will bring stability to your portfolio.

- One asset class cannot outperform in all market conditions; this is the essence of investment cycles. However, investors often seem to forget this and make investment decisions based on emotions. Asset allocation will keep you disciplined in your investments. Once you have an asset allocation plan, you should stick to it, irrespective of market movements.

- Asset rebalancing is an important part of asset allocation. You should rebalance your portfolio from time to time to bring it back to your target asset allocation. Asset rebalancing also implies buying low and selling high. By rebalancing your asset allocation on a regular basis you can reduce downside risk and improve risk adjusted returns.

- Your asset allocation will change over time with changes to your risk profile and as you approach different life-stage goals. As you progress through life your asset allocation should reflect reducing risk profile.

Why is asset allocation important now?

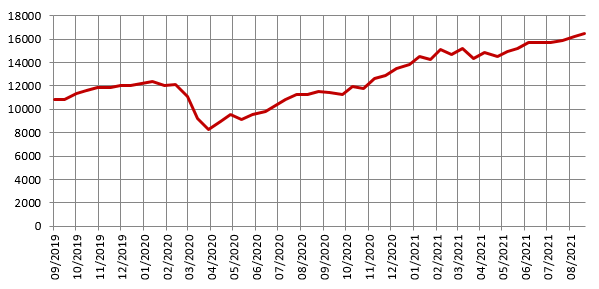

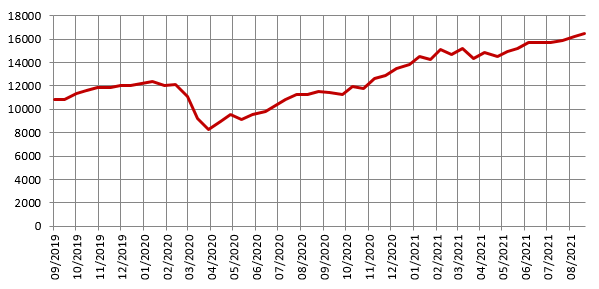

The stock market had a great bull run after the market crash in the first COVID wave (see the chart below). The Nifty 50 is not only at its all-time high, it is more than 50% higher than where it was just 2 years back (CAGR of 23%). The rally took place when our economy was slowing down. The main driver of the rally was the global liquidity situation due to extraordinarily accommodative monetary policy of the US Federal Reserve e.g. keeping interest rates near zero and buying bonds from the market. Investors should always pay attention to asset allocation in strong bull markets particularly ones fuelled by extraordinary liquidity.

Asset allocation is important because the equity allocation of your portfolio will help you ride the market upside and the debt allocation will protect your portfolio from a potential pullback. The US Federal Reserve is continuing its accommodative monetary policy and the equities are expected to go up further. However, experts are of the opinion that, the Fed may taper its bond buying program and / or raise interest rates next year. We may see a pullback in the market then. Further, Nifty is already trading near its all-time valuations, 25 – 26 PE multiple. When market trades at such high valuations pullbacks can result in deep corrections. It is difficult to predict what will happen after 6 – 9 months, but prudent investors should take cognizance of risk factors and be prepared for risks. Asset allocation will help in risk diversification. Since the market is at its all-time, this is a good time to take a look at your asset allocation and rebalance if required.

What should be your asset allocation?

Rebalancing your portfolio does not mean switching completely from one asset class to another. By rebalancing, you should maintain a prudent mix of different asset classes e.g. equity, debt and gold. Your ideal asset allocation will depend on the following factors:-

- Your age

- Your risk appetite

- Your assets and liabilities

- Your short term, medium term and long term financial goals

Your Eastern Financiers financial advisor can help you plan your asset allocation according to the above asset allocation and advise how you can execute your asset allocation plan.