The electoral battle between Vice President Kamala Harris and former president Donald Trump has gone down to the wire. While there are allegations against Harris to have failed miserably as Vice President, Trump is already convicted of a felony, after his hush-money trial in New York. His best chances to stay out of jail is by winning the election. As suggested by opinion polls, Arizona, Nevada, Wisconsin, Michigan, Pennsylvania, North Carolina and Georgia would be the key swing states in reaching the 270-mark. However, if one has to go by the signals sent by cryptocurrency-based predictions market Polymarket, there's a clean sweep for Donald Trump. There are certain caveats too, such as the ability of just a small number of heavy bettors to successfully move that market; hence, signals could be skewed.

- Nevertheless, the broad consensus is that irrespective of whichever party wins, US sovereign debt to GDP ratio would be on the rise due to decline in labor share vis-a-vis corporate profitability that has already been happening over past decades because of populism taking over. Corporate profitability thrived at the expense of labor as a contribution to GDP. This essentially translates to lost income of private sector employees and on account of regressive transfer of debt to the corporates primarily led by China's entry in WTO in 2001 as well as Mexico's into NAFTA.

- Moreover, both parties follow socialist expenditure policies such that government social benefits as a share of household income has increased from a low of 6% in 1960 to 18% currently while on the other hand, effective corporate tax rate which peaked out at 43% in 1970 is currently at 11%. Hence, the surge in public sector debt to fill in the populist fiscal policy.

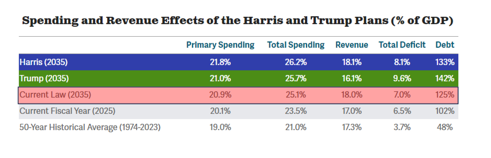

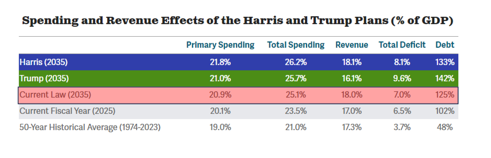

- The Committee for a Responsible Federal Budget (CFRB) has forecasted the impact of various proposals made by each candidate on the campaign trail and their impact on budget policy. Based on the analysis by CFRB, Kamala Harris' proposals would roughly accumulate an additional $3.5 trillion in US sovereign debt over the 10-year projection period relative to the baseline while it would be $7.5 trillion for Donald Trump. Even based on the current tax cuts and job cuts together with Trump tax cuts (expiring in 2025), US debt to GDP ratio is expected to accelerate to 125% in 10 years. Adding on Harris' policy proposals, US debt to GDP would accelerate to 133% in 10 years' time while for Trump it is expected to reach 142% in 10 years' time.

Source: CFRB

- More importantly, the situation is different today with war going around in different regions. While consensus views hold that the wars might come to end with Trump as President, empirical data however suggests that in the post-war era, Republican administrations have actually outpaced Democrat administrations in burdening the country with debt. For a full four-year period, public debt growth for Republicans would be ~36% vs 26% for Democrats. Having said that, we believe US under president Trump will become isolationist withdrawing its military from Rest of the world, reducing its defense spending leading to a void which will need to be filled.

- The outcome of the above, will probably be best reflected in treasury market. Besides, one needs to add to the fact that inflation hasn't abated to such comfortable levels, which warrants further rate cuts while dollar is losing its hegemony.

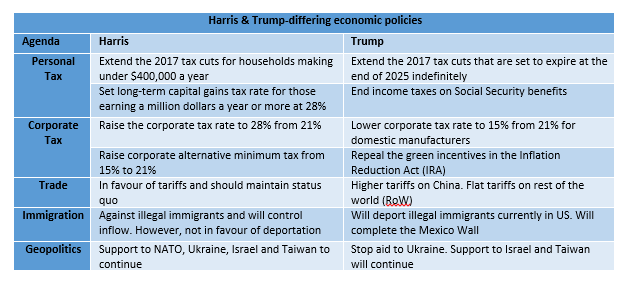

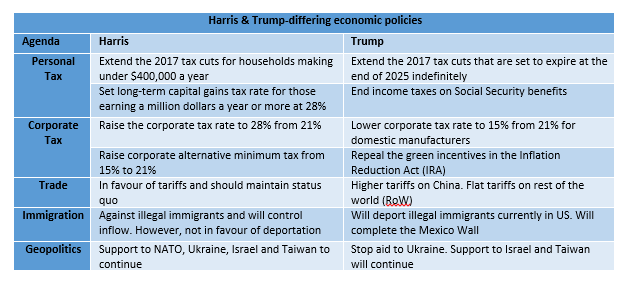

- Taxation: Harris' policies are all about protecting the interests of low and middle income groups while taxing wealthy Americans and corporate. Trump's policies hinges on tax cuts, extending tax sops and majorly incentivizing local manufacturing

- Tariffs: While both Trump and Harris agree on implementing tariffs to protect American interests, Harris intends to maintain status quo. Trump, however, being aggressive of the two, aims to implement tariffs of ~60% on China and 10-20% on Rest of the world

- Inflation: Trump's policies like tax cuts could lead to lower revenue and hence higher public debt while harsh tariffs could be inflationary as well.

- Geopolitics: Trump and Harris absolutely differ here. While Harris intends to continue supporting Ukraine, Trump has vowed to put an end to war by cutting off aid to Ukraine. Besides, he has friendly relations with Putin. Trump is also skeptical about the future of NATO. Both contestants, however, intend to confer support towards Israel.