In the last one year, when Nifty Small Cap (250 TRI) Index gave only 7.69% and small cap mutual funds as a category gave only 12.34% return, Kotak Small Cap beaten both, the category average return as well as Nifty Small Cap 250 TRI by delivering 23.2% returns! The excellent performance by Kotak Small Cap Fund in very difficult market conditions (last one year) and its outstanding long term performance, 14.7% CAGR over the last 10 years, make the scheme, in our opinion, one of the best small cap mutual funds.

If we look at the performance of small cap funds over last 5 and 10 years (see our research tool, Top Performing Mutual Funds (Trailing returns) - Equity: Small Cap), you will see that Kotak Small Cap Fund is always among the top 5 best performing small cap mutual fund schemes in the last 1,3,5 and 10 years period.

We give a lot of importance to consistency in a fund’s long term performance track record. Our Top Ranking Mutual Fund Performers identifies most consistent performers based on different rolling returns performance parameters relative to their peers. It is not surprising that Kotak Small Cap Fund is among the list of only 7 most consistent small cap funds out of the 21 funds in the small cap category that found place in this list.

Scheme Overview

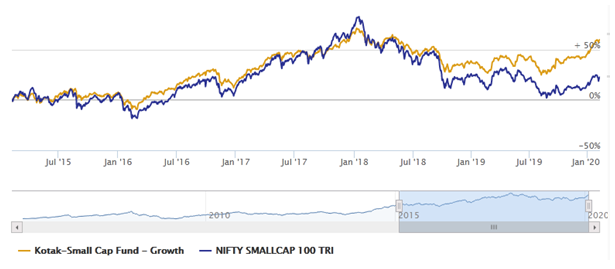

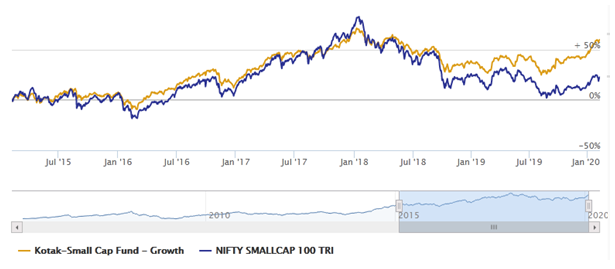

The scheme was launched about 15 years back (February 2005) and has around Rs 1,359 Crores of AUM. The expense ratio of the scheme is 2.15%. The scheme benchmark is NIFTY Small Cap 100 TRI. As per SEBI mandate, small cap funds must invest at least 65% of their assets in small cap stocks. SEBI classifies stocks which are below the top 250 stocks by market capitalization as small cap stocks. The chart below shows the NAV movement of Kotak Small Cap Fund over the last 5 years.

Source: EF Research

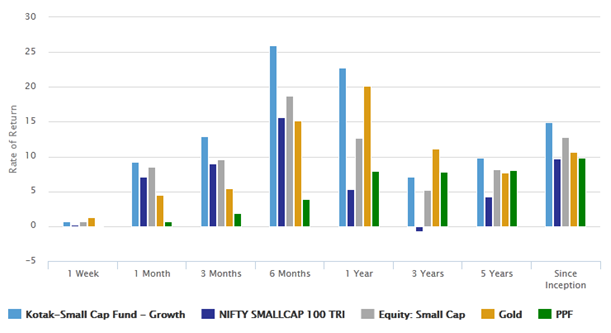

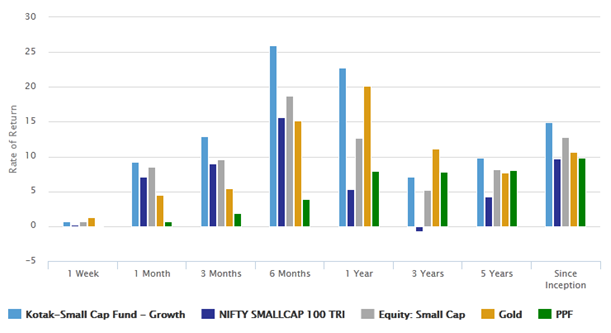

The chart below shows that Kotak Small Cap Fund was able to outperform both its benchmark, NIFTY Small Cap 100 TRI,and its peers (Small cap funds category average) and also the Gold and PPF returns in almost all the different market conditions, e.g. bull market, bear market, range-bound market and limited correction market.

Source: EF Research

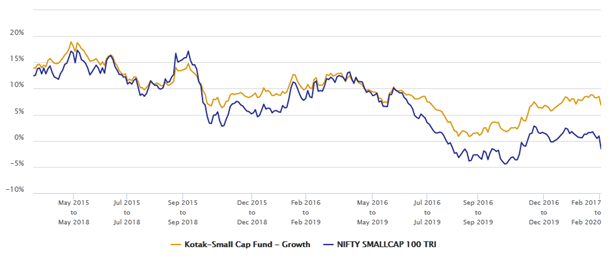

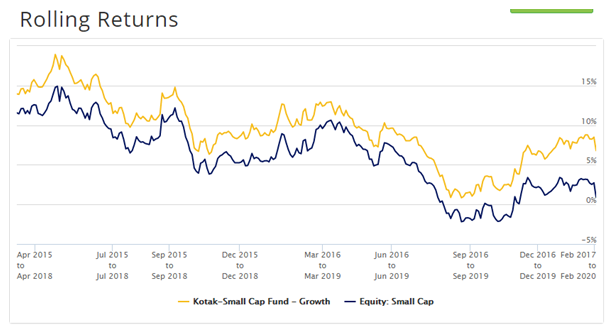

Rolling returns versus Benchmark

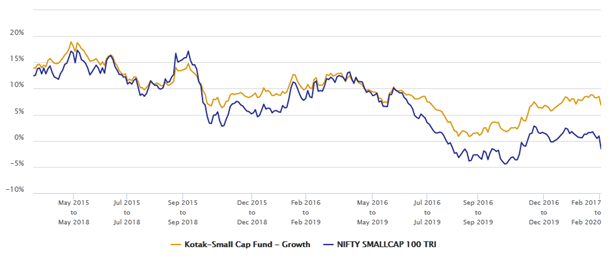

The chart below shows the 3 year rolling returns of Kotak Small Cap Fund versus its benchmark index over the last 5 years. You can see that the scheme has consistently outperformed the benchmark index most of the times, across different periods and market conditions, and delivered alphas to investors.

The scheme delivered returns between 8-12% CAGR 42% of the times and more than 12% CAGR 3-year returns 17% of the times in the last 5 years (minimum 3 year return was around 9.93%).

Source: EF Rolling Returns versus benchmark calculator

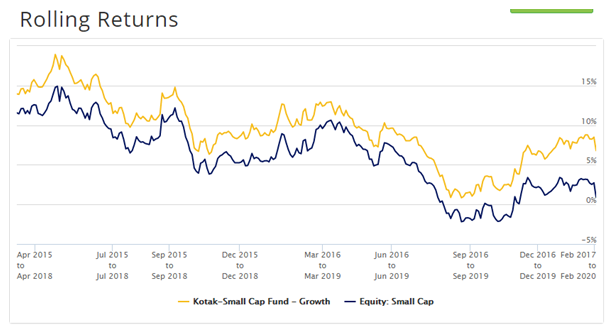

Rolling returns versus Category

Let us now compare the rolling returns of Kotak Small Cap Fund versus the small cap funds category average. The chart below shows the 3 year rolling returns of Kotak Small Cap Fund versus the average3 year rolling returns of the small cap funds category. The scheme outperformed the category average in terms of 3 year returns, 100% of the times in the last 5 years.

Source: EF Rolling Returns versus category calculator

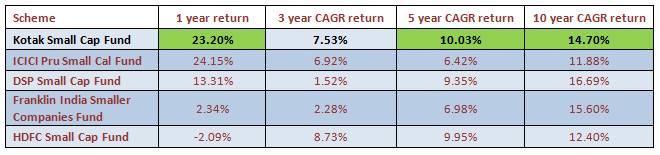

Peer Comparison

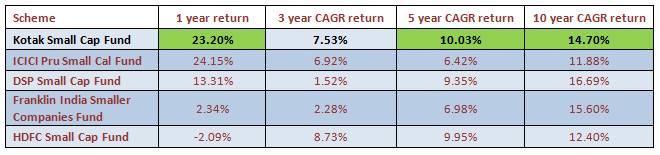

The table below shows the performance comparison of Kotak Small Cap Fund versus some of its peers (as on 7thFeb 2020). All the 5 schemes shown in the table below are among the Top performing schemes in the Small Cap Fund Category based on 10 year returns (Regular plans). You can see that Kotak Small Cap Fund outperformed most of its peers in terms of short term (1 year) and also in terms of long term (3, 5 and 10 year periods) returns.

Source: EF Research

Wealth creation in last 10 years – Lump Sum

The chart below shows the growth of Rs 1 lakh lump sum investment in Kotak Small Cap Fund (Growth Option, Regular Plan) over the last 10 years. Your Rs 1 lakh investment would have grown to Rs 3.67 lakhs, capital appreciation of Rs 2.67 lakhs in 5 years. The fund gave 14% annualized returns during the period.

Source: EF Research

Wealth creation in last 10 years – SIPs

The chart below shows the returns of Rs 5,000 monthly SIP in Kotak Small Cap Fund (Growth Option, Regular Plan) over the last 10 years. With a cumulative investment of Rs 6 lakhs you could have a created a corpus of more than Rs 12.71 lakhs by investing through monthly SIPs. The annualized SIP return (XIRR) in the last 10 years was over 14.5%.

Source: EF Research

Conclusion

Small cap stocks were trading at a considerable valuation premium to large cap stocks in 2017, but after the correction of 2018 small cap stocks are now trading at discount to large caps. Investment experts think that these are attractive levels to invest in small cap mutual funds. Several fund managers are launching Small Cap Fund NFOs (New Fund Offers) as they are seeing good investment opportunities in the small cap space with considerable upside in the long term.

We think that SIP is the ideal mode for investing in small cap funds, but the deep correction in small cap stocks have also created opportunity to tactically invest in lump sum.If you have lump sum funds but are worried about volatility, you can invest in Kotak Small Cap Fund through STP from Kotak Liquid Fund over the next 3 – 6 months. Investors should have high risk appetite and at least 5 year investment horizon for this scheme. You should consult with your Eastern Financiers RM if Kotak Small Cap Fund is suitable for your investment needs.