With the stock market falling 30% from its all-time high, there is widespread panic among investors about equity as an asset class. Investor’s concerns about stocks and equity funds are understandable because there is a lot of uncertainty about the spread of Coronavirus and its impact on global / Indian economy. We think that the stock market will be very volatile in the coming weeks and outlook on recovery is uncertain till the disease is contained. With stocks and equity funds in free fall, investors are also worried about their other investments especially debt funds. Many investors may be sitting on cash due to uncertainty. In this article, we will try to address five main concerns / questions which investors are likely to have:-

1. Are debt funds safe now?

2. With uncertainty in equity, is it a good time to invest in debt funds?

3. Will there be a run on debt funds?

4. Is it better to invest in debt funds or keep money in the bank?

5. Which are the good debt funds to invest in now?

Let us address these questions one by one.

Are debt funds safe now?

All mutual funds are subject to market risks but debt mutual funds are much safer than equity funds for the following reasons:-

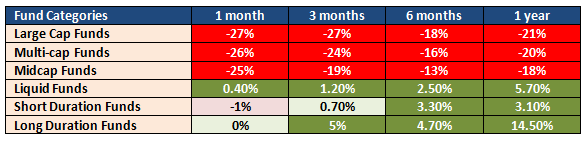

- Debt as an asset class is much safer than equity because the bond issuer is contractually bound to pay investors interest and return the principal amount, irrespective of prevailing economic situation. In equity, on the other hand, there is no such obligation. That is why equity investors are much more affected compared to debt investors in economic downturns and financial crisis (see the heat map of different fund categories below as on 18th March, 2020)

Check the return of long duration funds

Check the return of medium to long duration funds

Check the return of short duration funds

- There are two major risks in debt mutual funds – interest rate risk and credit risk. Interest rate risk is usually very low in economic downturns because low demand keeps inflation and therefore, interest rates low. In fact, in times of downturns the central banks try to bring down interest rate to spur demand and economic growth. Lower interest rates will result in higher debt fund returns – see returns of long duration funds over last 3 months to 1 year in the table above. The current interest scenario is favourable for debt funds.

- The other major risk in debt funds is credit risk. Credit risk gets exacerbated in times of economic downturns, but it is easier to understand and avoid than equity risk because credit rating companies rate debt papers on credit risk e.g. AAA, AA, A, BBB etc. You can avoid credit risk by investing in funds of high credit quality. Our financial advisors can help you select fund of high credit quality. In fact, in longer duration funds the bulk of the papers in the scheme portfolio are issued by the Government or Government owned bodies like NHAI, REC etc. which have no credit risks.

Is it a good time to invest in debt mutual funds?

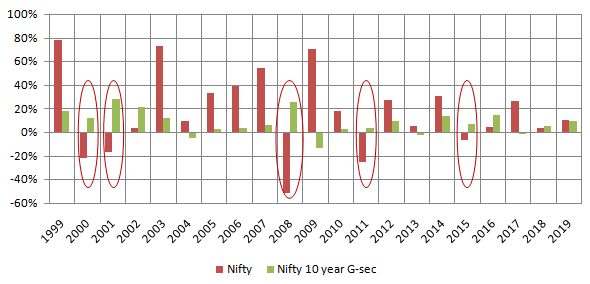

The chart below shows the annual returns of Nifty (proxy for equity) versus Nifty 10 year G-Sec Index (proxy for debt) over the last 20 years. Look at the years circled in red – these were the bear market years. You can see that Nifty 10 year G-sec Index gave good returns in those years ranging from 8% to as high as 20%+. History of equity and debt markets show that there is a negative correlation between equity and debt returns in bear markets. Based on historical evidence, we think it is a good time to invest in debt mutual funds.

Will there be a run on debt mutual funds?

If you are investing in a Gilt fund which invests only in Government Securities then there is no question of default. As mentioned earlier, longer duration funds and dynamic bond funds invest primarily in G-Secs. Further, there is low credit risk in funds which invest in banking and PSU debt papers. PSU debt papers are quasi sovereign (Government) and a big part of the papers issued by commercial banks are also quasi sovereign as many of these banks are PSU banks. Even with regards to commercial papers issued by private sector banks, the RBI will work to ensure sufficient liquidity in the banking system in financial crises like it had done in the past as well. As regards debt papers issued by companies, SEBI has put limits on concentration risk with respect to issuer and also sectors which AMCs have to comply with. So a scenario of defaults causing a big loss to investors is highly unlikely. The past data when we had a similar, if not bigger financial crises also tells us that such a thing never happened. You should apply your logic and not listen to rumours.

Is it better to invest in debt funds or keep money in the bank?

Interest rates have been coming down. Current FD rates of SBI and other major banks are below 6%. On a post-tax basis, the returns for investors in the highest tax bracket will be around 4%. The WPI inflation rate is around 3%. By keeping your money in the bank you will hardly be getting any returns on an inflation adjusted basis. Debt funds on the other hand can potentially give much higher returns. Further, for investment tenures of over 3 years, you can get the tax benefit of indexation of capital gains, which make debt funds much more tax efficient than bank FDs.

What are good debt funds to invest in now?

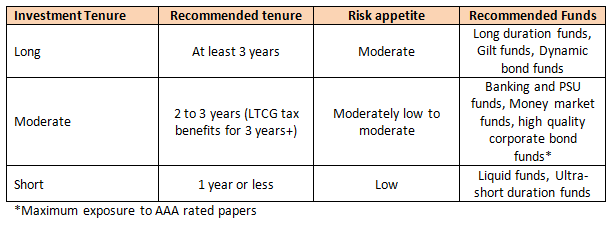

Debt funds offer investment solutions for a wide variety of investment needs even in the current economic situation. Investors should select the appropriate fund based on their specific investment need and risk appetite after consulting with our financial advisors. In our view, investors should take low credit risks in the current economic environment and the weaknesses in our financial system. Investors should avoid funds where papers rated below AA constitute more than 20% of the scheme portfolio.

In this article, we will give some broad guidelines based on investment tenures and risk appetite.

Suggested reading: In which debt mutual fund should you invest

Please note that this is just a general guidance. Your Eastern Financiers financial advisor will be able to give you more specific investment recommendations after understanding your specific requirements and concerns. Please contact your Eastern Financier’s Relationship Manager.