India takes over China – on Demographics

India expected to overtake China as the most populous country in 2023 with Indian demographics better than Chinese.

Chinese labour have aged out and their costs have got up since 2000s. Now imagine if some part of the manufacturing had to shift to India over this decade, the kind of boom it could create.

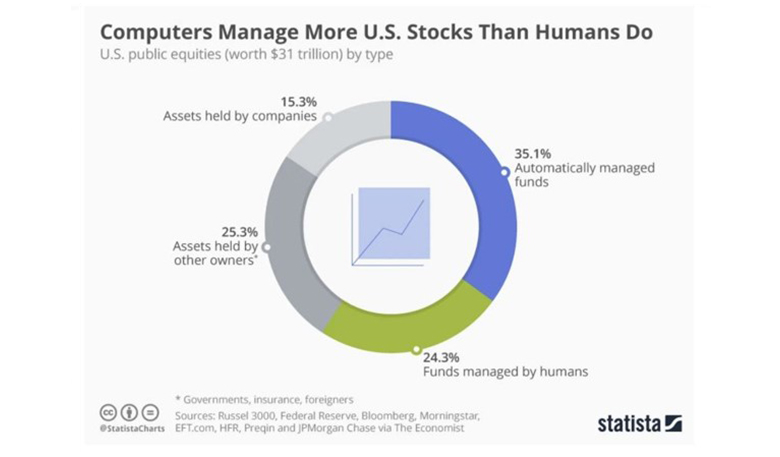

AUM: Algos > Humans

Apparently computers got more AUM than humans... These Algos are designed to trigger when markets run into anomalies...

Well Intriguing development anyway, with most likely intriguing impact on market structure/function if at all 2023 had periods of anomalies/volatility which auto trigger these Algos.

(Source: Statista)

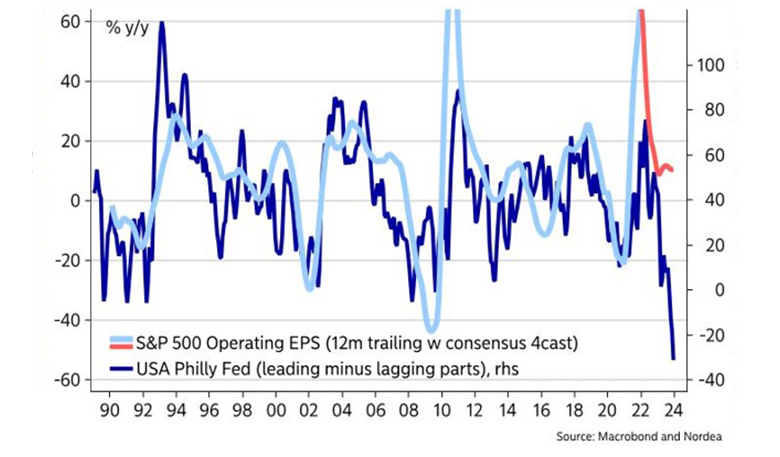

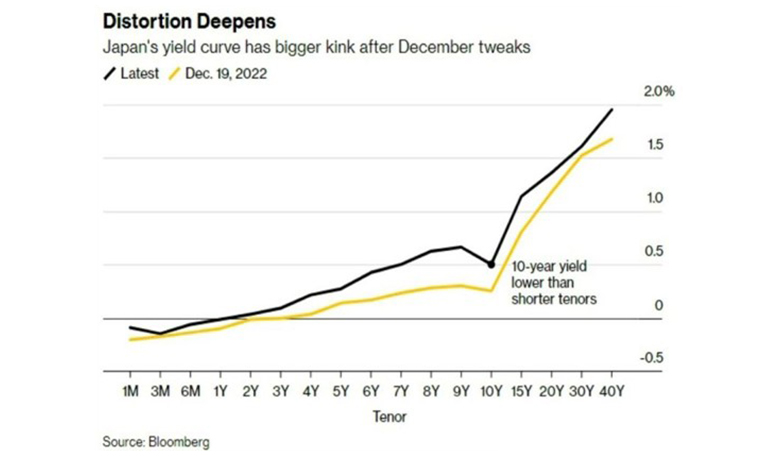

BOJ – Most important part of the liquidity puzzle

Estimates suggest that thus far this month the BoJ has spent JPY 18tn in its defense of the YCC which is now double their increased monthly limit which they set at their December meeting and we are barely past the half way point of January.

Troubling times for the Bank who sooner rather than later will have to abandon the policy. Liquidity in the market is shocking, the repo market in Japan is barely functioning and shorter dated JGBs are yielding higher than the “artificial 10y”. Not a good look all round and one which is unsustainable

What if this is just the ‘start’ of Wage Inflation?

Beyond CPI numbers, big mac index tracks real inflation by comparing purchasing power parity between two nations or between two time periods.

So, if this indicator proves correct, wage inflation is here to stay. To add on there are ageing demographics, obesity issues, labor strikes which add to the wage pressure.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation