Accelerated shift towards Electric vehicles

- Britain faces blackout due to electric vehicle revolution.

- Across Germany, auto manufacturers have advanced their complete EV adoption deadline to 2025/2030, despite spending a fortune on the existing internal combustion system.

- Japan automaker joining a growing chorus of major automakers in the US & Europe that are significantly accelerating their vehicle electrification efforts.

Nissan gets driving on highest gear

(Source: Extract from Bloomberg Live on Twitter)

- General Motors last month launched a new corporate-level ad campaign - its first in more than a decade - focused on the automaker's all-electric vehicle efforts, including 30 new models globally by 2025.

- President Biden recently set a target for 50% of all vehicle sales in the US to be fully electric, plugin hybrid, or fuel cell by 2030. Assuming ~1% annual growth in new car sales, total new car sales in the US would be ~19M by 2030 i.e., rise from ~600K currently to ~9.5M over next nine years.

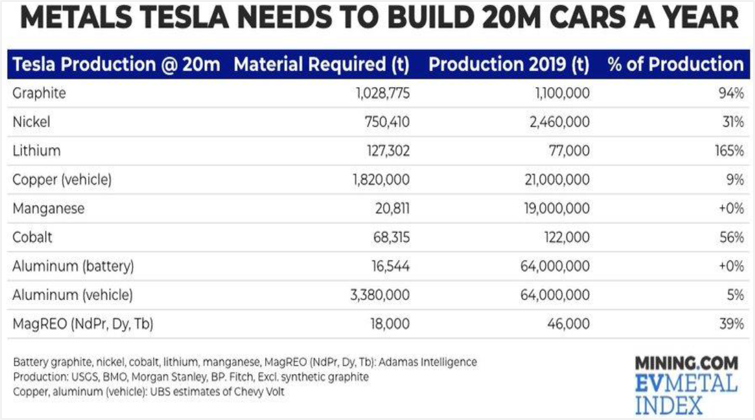

- This hockey stick growth in EV sales raises the obvious question of how the raw material inputs into EVs and the supporting infrastructure will be sourced.

Metals that could be beneficiaries with accelerated EV adoption

Other than exposure via certain listed commodity producers, there aren't any sophisticated investment options available domestically on the EV theme; unlike US listed markets which carry exposure via ETFs like Global X Lithium & Battery Tech, ISE Global Copper Index, Global X Autonomous & Electric Vehicles ETF etc.

What are the costs of transition to Net neutral (carbon release) by 2050..

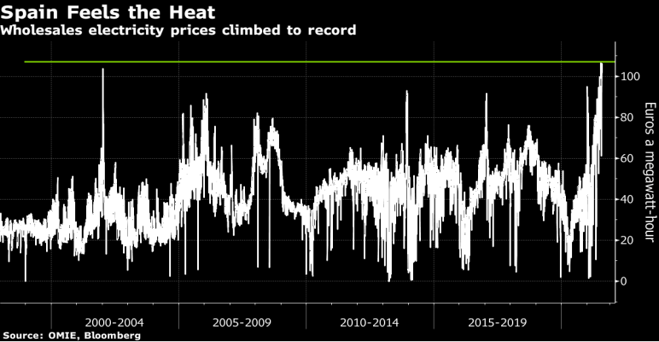

Prices hit record high in many countries even though its summer

- Energy prices are rising around the world as the global economy emerges from the pandemic, fueling concerns about inflation.

- Spain was already forced to cut energy taxes as power prices rose to a record, and the U.K. is expected to allow utilities to increase bills a second time this year.

- Hike in utility bills, frequently the biggest fixed cost after rent could push many small businesses over the edge.

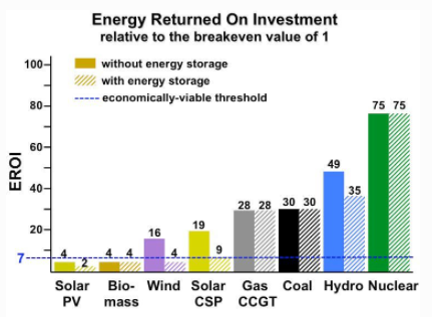

Fossil fuel has the highest return on investment

(Source :

https://www.forbes.com/sites/jamesconca/2015/02/11/eroi-a-tool-to-predict-the-best-energy-mix/?sh=59c062dba027 )

- Free market forces would lead to the use of the cheapest, most efficient option for energy, which have been and generally remain fossil fuels.

- IEA says - "Energy groups must stop new oil & gas projects to reach net zero by 2050"

- Shift to green energy would require central planning, as allowing free market forces to work would lead to the continued use of energy sources with the highest Energy Return on Invested Energy.

- Point to ponder is will producers pass the increased cost to consumers?

Given the in-efficiencies associated with Green Energy, world is dependent on fossil fuels to meet their energy requirements. Green Energy world is not ready - Rising oil prices (can reach triple digit values), low ROI for non-fossils and time consuming process to develop Nuclear (Uranium).

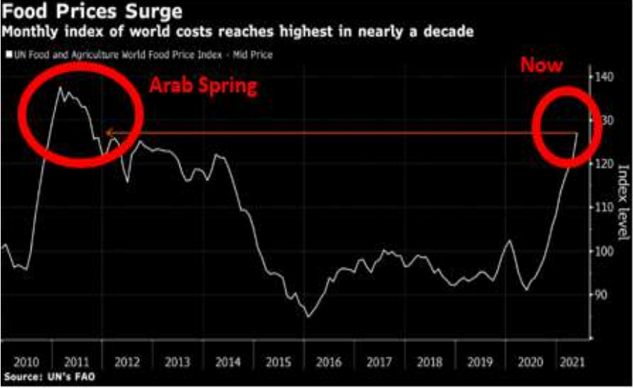

Is this "Food Crises" or poor State program planning...

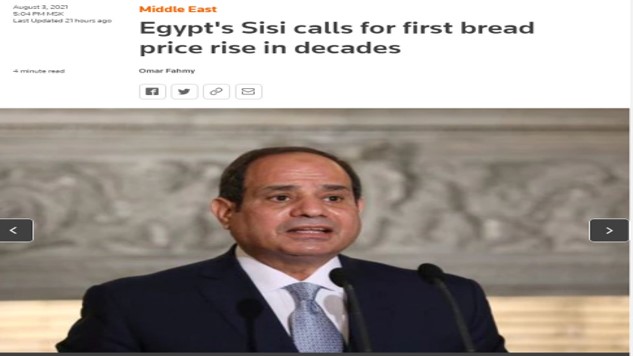

- Egyptian President announced planned increase in prices of state-subsidized bread. ~60 mn Egyptians get 5 loaves subsidized daily.

- This highest wheat importer country (12 mmt) ended into riots last time when they tried to increase price (1977).

- Possible reduction of an inefficient state program may lead to a reduction in imports; cause social unrest, which could bring back memories of Arab spring (Food Inflation).

- Developing countries will have to do something with their state programs and food imports as prices rise sharply.

- For a Country like Egypt (Turkey) with huge food import bill & declining currency income due to tourism, there could be trouble.

Food prices reach the Arab Spring highs

What happened during Arab Spring?

- The role of food crisis and its high prices in political unrest is historically accepted especially in poor countries as they have to rely upon some other countries for food.

- During 2007-08 the Arab countries like that of Yemen, Morocco, Tunis and Egypt had to suffer at the hands of public protests due to price increase in food grains.

- About two years prior to the Arab Spring the inflation rate reached to 25 - 30 % in the affected countries.

- Unemployment among the youth, especially females, was another most important cause behind the Arab Spring.

Egypt to increase bread prices 1st time since 1977

(Source : reuters.com - 2021-08-03)

India, courtesy good monsoon has not seen any steep price rise since last year in agricultural commodities other than edible oil & pulses (import commodities). Going ahead food inflation will be influenced on the upside due to factors like - international prices, monsoon progress, fuel cost rise & political factors.

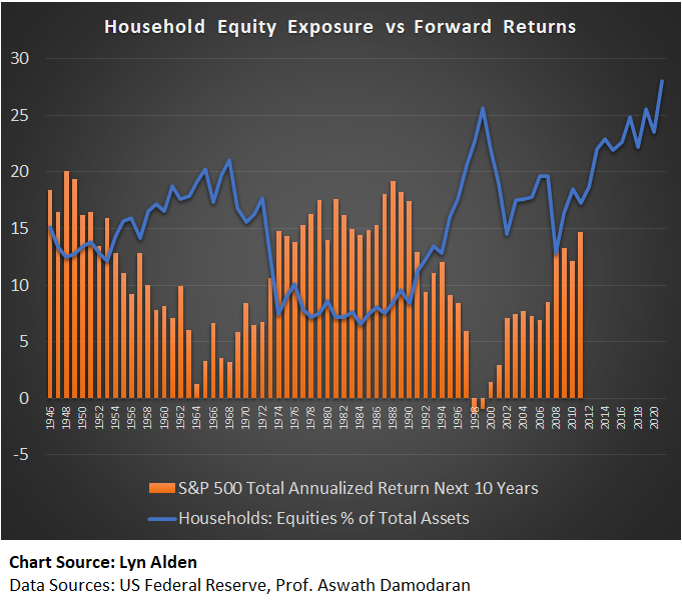

Is History repeating again or this is a new chapter (courtesy Fed)...

- Over these seven decades, periods of unusually high household equity exposure tended to have poor forward equity returns from those levels. This chart shows household allocation to stocks in blue and the forward annualized rate of return for the S&P 500 over the next ten years from that point, in orange.

- As we can see, there is a significant inverse correlation there. When stocks are cheap and households have low stock exposure, stocks tend to do very well from that point. From those low levels, there is more room for stock valuations to expand and for households to increase their allocation to stocks. However, when stocks are expensive and households already have high stock exposure, there is less room for them to expand in valuation and allocation.

- These types of valuation and allocation assessments don't tell us much about 1-year or 2-year forward returns, but they give us an idea of what sort of long-term returns we should expect.

- For example, markets were expensive in 1998, but that didn't stop them from getting even more expensive in 1999 and 2000, but then they did eventually run into trouble and provided poor long-term returns from those levels.

From this level, the broad market is unlikely to provide high inflation-adjusted returns over a 5-10 year period. We look at building cash positions in the portfolio over next 1-3 months to capture the volatility.

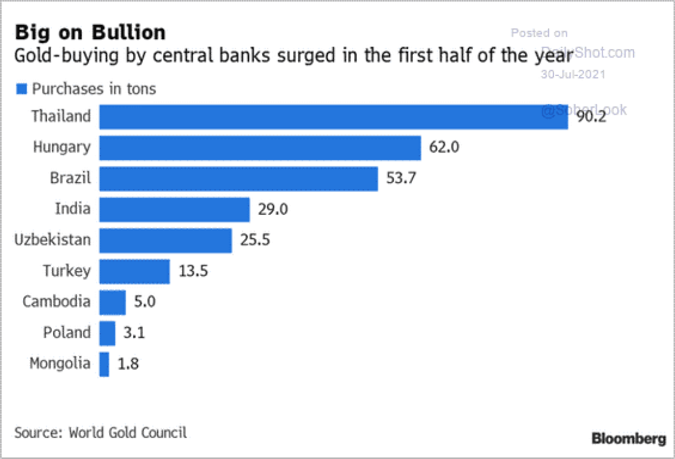

Watch what they do, not what they say - Gold & Negative Real rates

Decoupling of Bond Yields & Inflation lead to a much bigger problem - Negative Real Rates

- The textbook approach works on the assumption of a free-market economy; wherein, bond markets price in the current yields forward inflation expectations.

- Fed has artificially suppressed yields by growing their b/s 25% more than stated minimum level of QE of $120bn per month.

- We are going to discover that, as time progresses, bond yields are entirely decoupled from inflation. There is a long period of history, from 1939 to 1979, where they were largely decoupled.

- This week the 10y real rates have broken their past bottom of -1.1% in Aug'2020; perhaps to new cycle lows.

- Central Bank gold reserves rise 333.2 tons in 1H21, 39% higher than the 5-year average for the period.

- It appears that the global Central Banks are cushioning their reserves against (a) any expected economic slowdown due to Delta variant spread; which could lead to another round of stimulus package by Fed (b) deep negative real rates.

Real 10 year yield dropped to -14% during WW2

Gold buying by CBs 39% higher than 5 year average

Asset classes that have historically proved to hold purchasing power in an inflationary scenario - Precious Metals, Real Estate, Select Equities

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern") or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Credence or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation.