Deglobalization is Inflationary

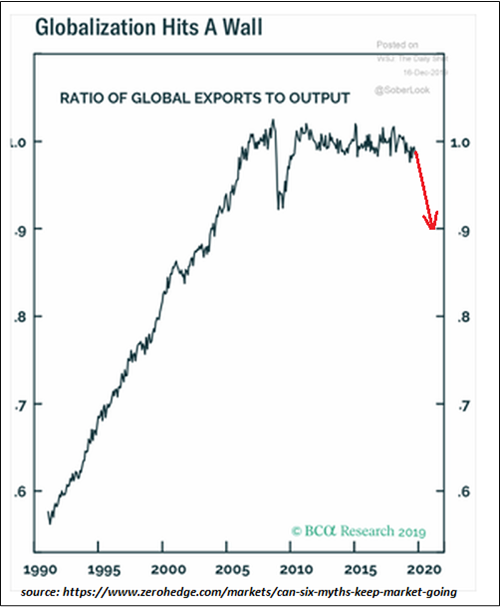

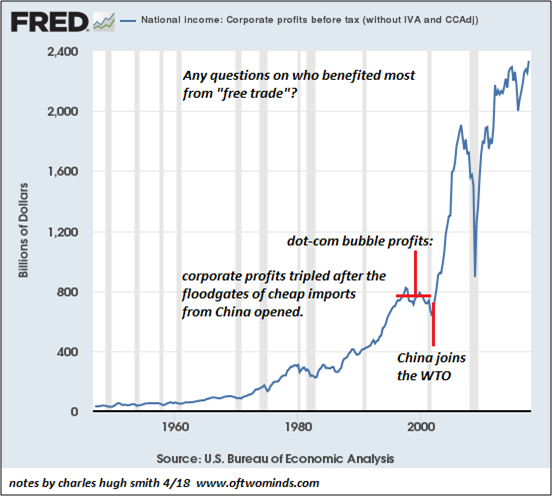

- Entire point of globalization is to 1) lower costs as a means of maximizing profits and 2) find markets for surplus domestic production. Both serve to export deflation as offshoring production keeps prices stable. Securing production from the threats of geopolitical blackmail, civil/economic disorder in the producing nations or broken supply chains requires moving essential supply chains back to the security of the domestic economy.

- Globalization enabled mobile capital to swoop in, buy up local assets, create new markets for credit and imported goodies and then sell at the top before all the external costs of globalization came due and the credit bubble burst.

Inflation isn't transitory or within the control of central banks. The forces at work are far beyond the reach of central bankers. Cost of credit matters, but so does the supply chain. This could lead to pricing arbitrage between commodities based on the demand supply metrics (ex – natural gas in US vs. Europe). The asset allocation of this decade will be far different from that of the past 40 years.

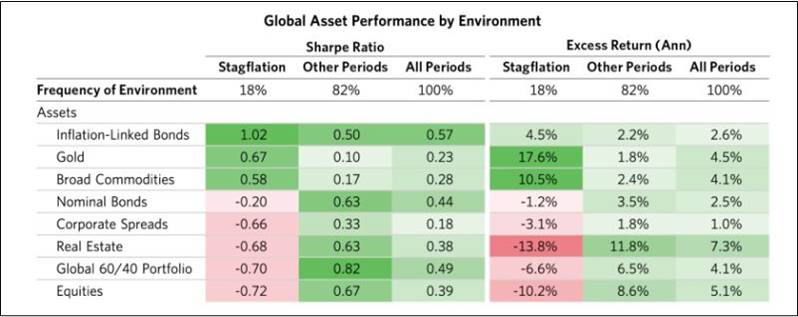

Transitioning to Stagflation!

- The table shows the historical returns of assets in stagflations compared to returns the rest of the time. Looking further forward, this stagflationary environment is ripe for instability and volatility over the coming decade as policy makers will be challenged to achieve their mandates with pressures on them coming from all sides.

- To make matters worse, policy makers seem to have an inadequate understanding of the forces at work, which raises the odds of continued policy errors.

- “If a stagflation is accompanied by a tightening that drives risk premiums and discount rates up, the impacts are far worse, though the rank ordering of effects across assets is similar. On the other hand, if the policy response favors stimulating to support growth, assets tend to do well for some period of time even in stagflations.” (Source: Bridgewater Associates)

There are Inflation themed ETF like TIPS; Gold themed ETF like GLD and Commodity themed ETFs like XME and RAAX available for investment by resident Indian investors.

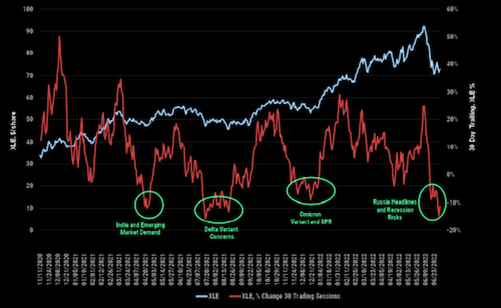

Is the Commodities bull market over?

- Last few weeks saw large outflows from commodity stocks, questioning the 'bull market' and 'supercycle' thesis building around this cyclical industry. But, volatility and risk are two different narratives, so asset classes like 'commodities' are known to be notoriously volatile, while 'traditional’ bonds may be not.

- But, from risk perspective in the present situation, commodities seem far less risky than bonds –

✓ We have a decade of underinvestment in the sector

✓ There is no clear supply coming on stream — from anywhere — and thanks to government overreach, additional or new capex is not taking place

✓ And then we also have an international war brewing (and geopolitical tensions are never bearish energy assets)

- Each of the previous three sell-offs during the energy bull market (we are now in one) created an excellent entry point for investors who understood the market. (Source: Capitalist Exploits)

There are Energy themed ETFs and ETNs like OIL, XLE, OIH; Material themed ETF like XLB and Metals themed ETFs like XME available for investment by resident Indian investors.

US – Housing & GDP correlation

- Outside the periods of high fiscal spending, US economic growth and housing are highly correlated. In % GDP terms, housing along with related services and ancillaries contributes to ~15-18% of the GDP with a multiplier effect across various discretionary and non-discretionary spends. Good part here is since summers of Covid 2020, new homes under construction has risen by 40%; highest level in 50 years.

- However, housing tends to be cyclical further accentuated by the slow nature of construction and over past 50 years a housing slowdown has led to rising unemployment, finally culminating into recession.

- US’s biggest homebuilder has reported increase in cancellations jump from 17% to 24% last quarter. Whats worrisome is 2/3rd of new construction is not completed yet and sales have been falling.

New homes under construction to Sales ratio is highest since 1974 & 2 year rate of change in new construction is 50% higher than anything seen in past 50 years. Every prior spike in this ratio was associated with recession, increasing the odds of US economic bust.

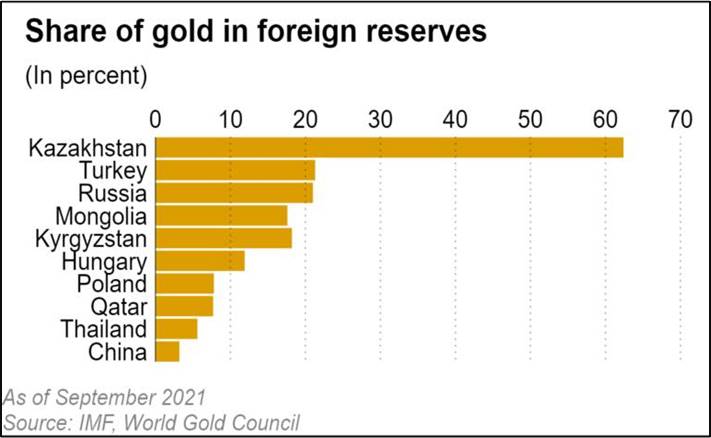

Russian alternative to LBMA

- Russian alternative to LBMA - MWS (Moscow World Standard) because LMBA is accused of systematically manipulating precious metals markets to depress prices. (Russia has fixed the price of gold in rubles at 5000₽/g i.e~ $2,447.17 /troy ounce vs. current LBMA fix of $1737.84)

- Prices will be fixed either in the national currencies of key member-countries or using new monetary units for international trade-for instance, the new BRICS currency proposed by Putin.

- Proposed member nations - Eurasian Economic Union, China, India, Venezuela, Peru & other South American countries, Africa (largely countries that control the resources for these metals). US + other hostile nations produce ~22% of world’s gold vs. 62% from Eurasian

Will the proposed standard lead to a new unparalleled price discovery for precious metals? You can now own precious metal ETFs like GLD, SLV, SIL, PPLT.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation