No Decarbonization without Copper

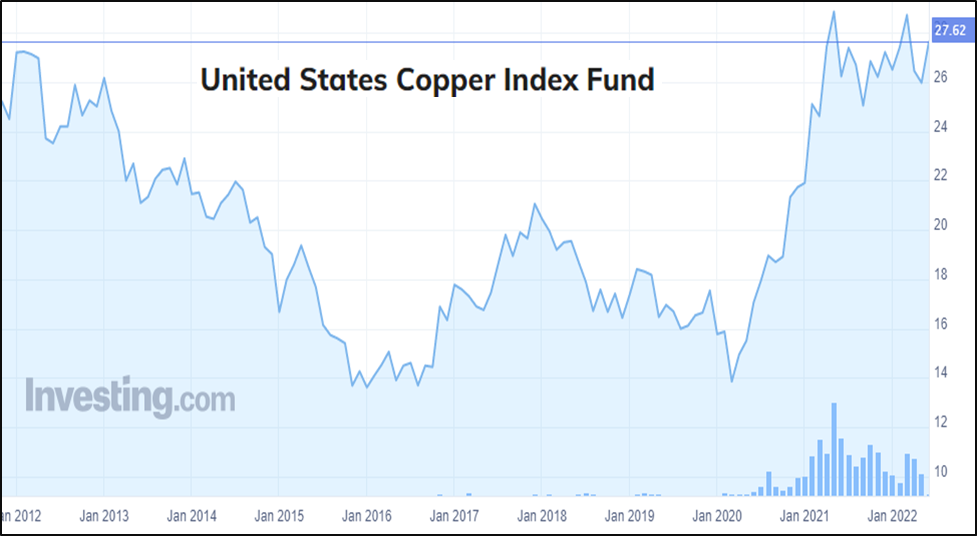

- Demand for copper presently is ~24 mn tones per year out of which non green demand (wiring) works to ~22.5mn tones & green demand (wind & solar) is about 1.5 mn tones. By the end of this decade, green demand for EV, charging infrastructure is expected to go upto 6-7mn tones moving from 5% of global demand to 20%.

- There isn’t shortage of copper in the earth’s crust but not much capital is flowing into those projects. Reasons – near death experience by miners in 2013/14 crash after over building in response to high prices of 2000s, ESG influence, high time lag in securing mining permits, shortage of skilled mining labour etc.

- Increases in demand for copper are expected to be very high unlike oil. It takes a really long time to get new production online. The existing production is expected to peak at the end of 2023/beginning of 2024 post which we see phase of open ended contraction of 1% from 2025 onwards. (Source: Bloomberg)

There are ETFs listed in US focused on Copper – COPX and CPER available for investment by Indian resident investors.

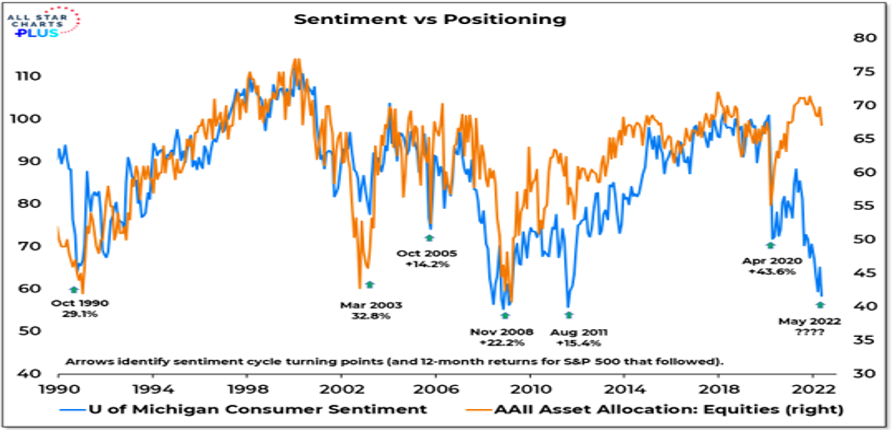

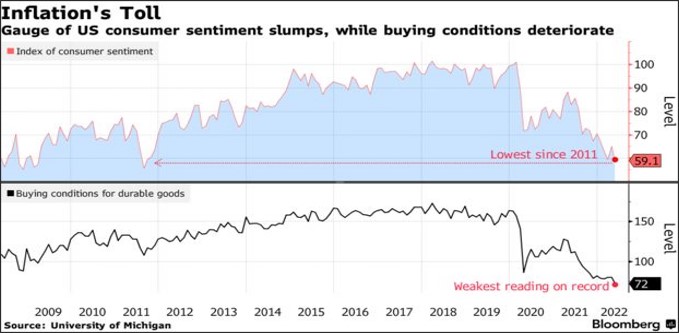

Consumer Sentiment – Weakest since GFC

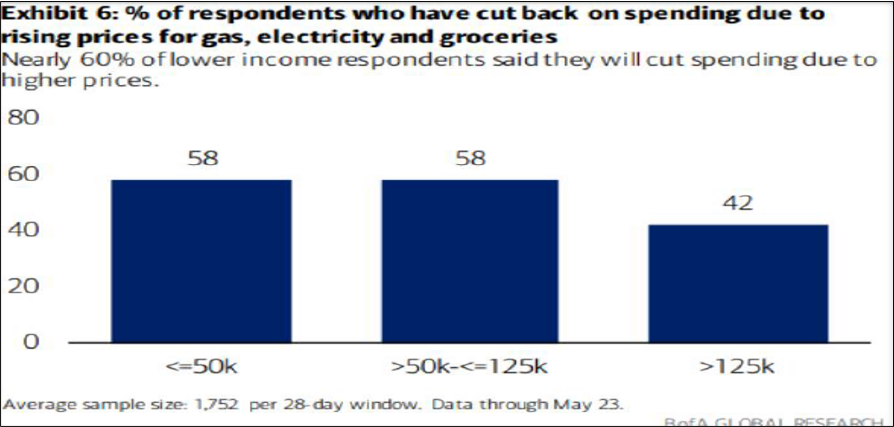

- US consumer sentiment declined in early May to the lowest since 2011 as inflation takes a toll on consumer discretionary incomes, consumers' purchases are starting to change. In order to cover the increased food costs,Americans cut back on clothing and furnishings.

- The two biggest export economies of the world – Germany and China are seeing their new export orders in the manufacturing PMI fall sharply indicating deteriorating global demand as we move towards recession.

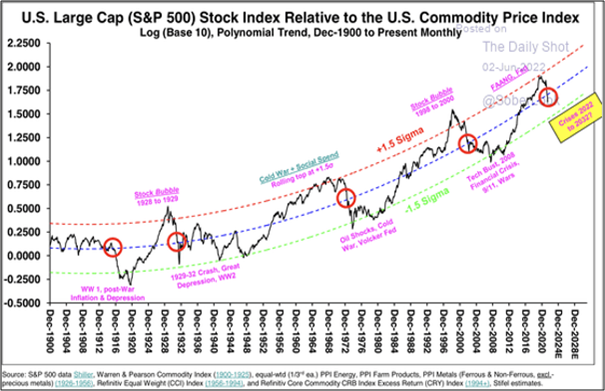

For much of the post-Great Financial Crisis (GFC) era, US equity prices have positively correlated with the overall systematic liquidity and Fed (US treasury) explicitly targeting higher stock prices to drive consumer spending, GDP and tax receipts.

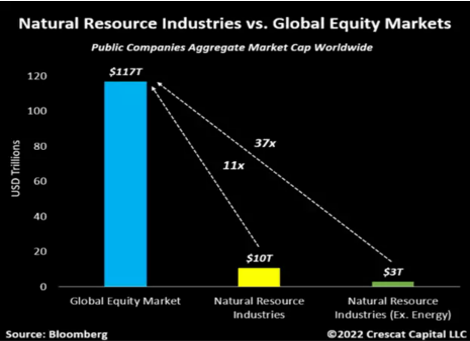

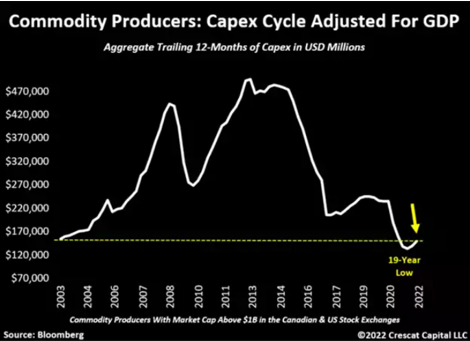

Its all about Capex cycle!

- The macro case for inflation being around at a higher rate for longer & contributing to a further bear market in financial assets is based first and foremost on structural commodity supply shortages today. There has been a multi-year declining investment

trend in capital expenditures of commodity producers necessary to boost output.

- This is in large part is the result of a policy error based on an aggressive green agenda that has lacked the foresight and coordination with industry for a viable clean energy transition.

- These industries have long lead times, so output cannot be ramped up without years of increased investment. As a result, the world now faces a commodity supply cliff and likely higher increase in energy and food prices.

There are ETFs listed in US focused on Commodity & allied investing – XME and XLE

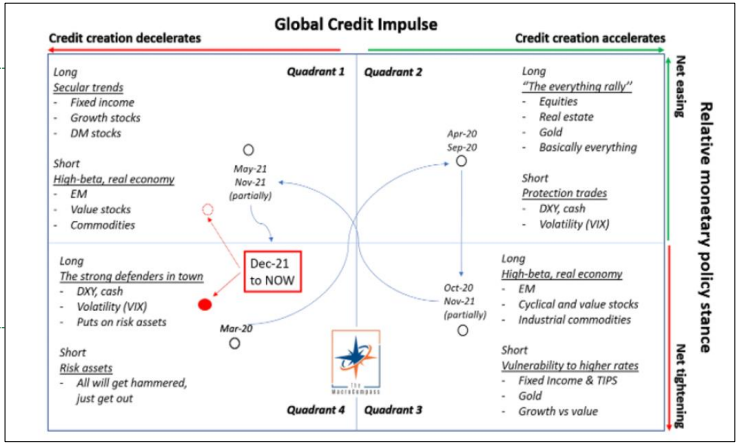

6-month Sharpe ratio of Risk Assets worst since 1991

In today’s macro environment where the economic growth impulse is decelerating and Central Banks are tightening monetary policy more aggressively than

expected, correlation amongst asset classes can swiftly change.

- At the end of 2021 we moved to Quadrant 4, which sees risk assets’ correlations converging to 1 as the long-standing negative correlation between bonds & stocks breaks as sharp tightening in monetary policy & hawkish forward guidance prevent bonds from rallying, despite a decelerating economic growth impulse.

A robust framework that helps you navigating different macro cycles and correlation regimes is hence important and ACTIVE Asset Allocation plays a key role in navigating through this framework.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation