CBDCs – Ripe for major disruption or still long way to go!!

- China quietly working on its own CBDCs (e-version of yuan) since 2014, could challenge the undisputed global reserve currency status for USD. This year, the PBOC launched a test of it’s CBDC in more than 30 major cities to iron out any bugs

- While China is at an advanced stage, policymakers in US have only committed to exploring the possibility of launching their own digital currency. It’s difficult to say with certainty if & when a U.S. CBDC could be launched, but it’s difficult to imagine world’s largest economy & global reserve currency on CBDC sidelines.

- Real game changer though would be when the digital currency standards will be evolved enough to carry out cross border transactions. No remittance bank, no corresponding bank, no need for SWIFT system. One of the farfetched offshoots of such a change can be that the US Dollar loses its preeminence as the reserve currency of the world.

- One of the major benefits which the dollar system provides is the easy and well tested payment and settlement system. In case two countries come to a central bank supported digital platform, this dependence can go away. Hence, the cross border payment space is ripe for major disruption.

- CBDC - It is a legal tender issued by the central bank in digital form. It is the same as the fiat currency & exchangeable 1 to 1 with it. So it is like a digital cash note.

CBDCs mean one thing – control. Governments that deploy CBDCs will present them initially as a convenient “digital complement” to physical currency. The physical currency will be phased out overtime and stop being replenished so paper currency will ultimately wear out.

Insider trades at Fed – Will this affect reappointment of the Chair!!

- Powell's odds in betting markets have fallen following sharp criticism of his performance by progressive Democrats & a trading scandal among Federal Reserve officials. Just a month ago, the chances of Powell staying at the helm of the Fed afterhis term expires in February 2022 were bright.

- Online betting website PredictIt now gives Powell a 76% chance of being confirmed by the U.S. Senate, while the odds that Federal Reserve Governor Lael Brainard will be nominated have increased to 18% from a low of 6% in September (Source: reuters.com)

- Brainard, who was nominated to the Fed board by former President Barack Obama in 2014, is widely seen as more dovish than Powell in part because of her push to retain super-easy monetary policy until there is more progress on job recovery.

Should Brainard be chosen as the next Fed chair, the Fed could extend its dovish policies and push back the central bank's timeline for raising interest rates beyond 2022, but that could result in a series of rapid rate increases down the line if high inflation persists and the Fed is behind the curve….

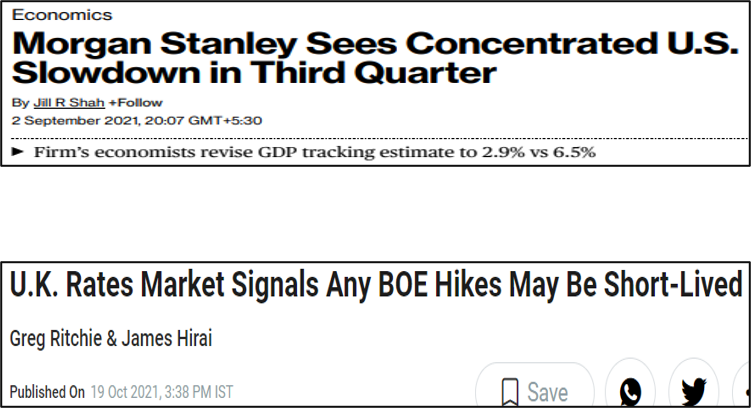

Are Central bankers too late in Tightening…

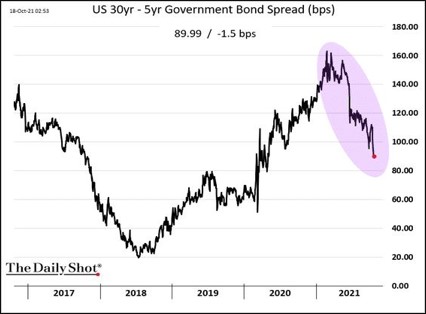

- Market participants often associate flattening of the yield curve with tightening in financial conditions. Historically, when the Fed raised the Fed Funds rate, the 5-year to 30-year yield differential has narrowed dramatically, sometimes falling below zero.

- Central Bankers will need to acknowledge the higher-than-expected rate of inflation and it is lasting longer than they previously envisioned.

- There are going to be even more price pressures in October with the flow-through from commodity prices into consumer prices and then potentially for supply-chain disruptions to actually show up more.

- This puts central bankers in a bind as they debate which risk they should prioritize. Targeting inflation with tighter monetary policy adds to the pressure on economies; but, trying to boost demand through continued monetary easing may ignite prices further.

- Meanwhile, bear flattening could signal upcoming Stagflation as rising inflation puts pressure on short end of the curve & slowing growth dampens the possibility of tightening.

Bear Flattening the curve – Markets lead CBs in tightening

- Yield curves flatten in one of two ways: a bull flattener, where long-term interest rates fall quicker than short-term rates; and bear flatteners, where short-term rates rise more than long-term rates.

Bull flatteners tend to be a positive signal for equities, the US dollar & Growth versus Value. Conversely, bear flatteners are bad for equities, better for Value and good for gold.

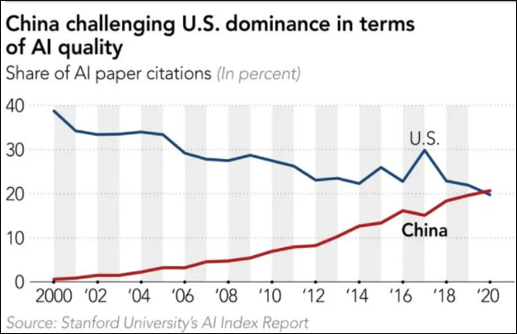

Shift of Focus for Yuan – from Cheap labor/Capital to AI/Tech dominance

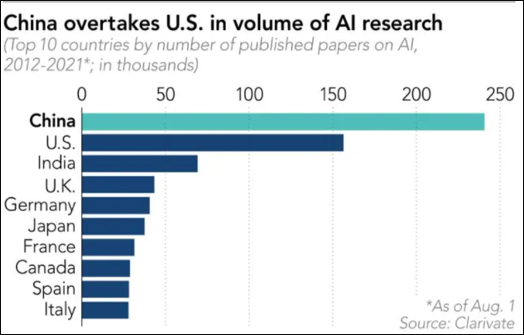

- China is overtaking the U.S. in artificial intelligence research, setting off alarm bells as the world's two largest economies jockey for AI supremacy. By 2030, ~8 bn devices in China will be connected via the IoT used in a range of industries affecting nation's competitiveness and security.

- China views AI as a way to make up for labor shortages in anticipation of a shrinking population. Erstwhile, FDI typically flowed from advanced to developing countries due to technology and wage gaps, which got mobilized by opening up the coastal cities & SEZs, targeting export-oriented manufacturing etc.

- China’s FDI strategy changed after Global Financial Crisis (GFC) due to slowdown, weak demand and lackluster export-led growth, evolving from rising labor and capital costs.

- The fact that the U.S. is shutting out Chinese companies out of the country when it comes to the use of personal data that determines the performance of AI is evidence of this. If the U.S. and China continue to develop their own AI, a global clash over competing standards may be inevitable.

- Irrespective of who wins this race, there is utmost certainty that the economies are moving from ‘capital & labor’ dominance to ‘Tech/AI’ dominance.

With companies transitioning to digital platforms/leveraging technologies such as cloud & AI, the global cybersecurity market has grown exponentially & is only expected to increase in coming years. There are cybersecurity ETFs in US with focus on innovative companies combatting global cyber threats available for investment by Indian investors.

“Power” Politics

- If you live in continental Europe, the natural gas that heats your home this October is costing at least five times more than it did a year ago. Reasons : China’s attempt to clean up its air & Russian president Vladimir Putin’s power politics (Europe imports 90% of its gas much of it from Russia).

- The transition to cleaner energy such as wind and solar has had the effect of pushing up demand for gas — often viewed by the industry as a medium-term “bridging fuel” between the eras of hydrocarbons and renewables.

- Europe’s is an energy crisis with Russia now controlling their energy future. The deal here being inevitable go-ahead to begin operating Nord Stream 2 pipeline from Russia to Germany, an act that will conclude 1 year long struggle between the US & Russia in Putin’s favor.

- Running under the Baltic Sea, it will double Moscow's gas exports to Germany and circumvent Ukraine, which relies on existing pipelines for income.

Just like the swift takeover of Afghanistan by Taliban, American diplomacy will soon discover that the reality on ground supersedes empty rhetoric with Europe turning to East.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation