The Indian equity market has consolidated at higher levels after bottoming out at around 15,300 on the Nifty in June 2022. Our economy is on the recovery path and global commodity prices are showing signs of cooling off. US inflation data in July was lower than June, after rising for 25 consecutive months. The market took the US July inflation data as a signal that inflation is cooling, raising hopes that we are reaching the end of the interest rate tightening cycle in the US. However, concerns about the US economy seem to be an overhang on the market at higher levels; over the past few days, we saw profit booking at around 18,000 levels on the Nifty.

Concerns of recession in the US

For the last 12 months US inflation rate has been above 5%, well above the US Federal Reserve’s long term target inflation rate of 2%. US inflation reached a 40 year high of 9.1% in June. The Fed has hiked interest rates by 2.25% so far. In his speech last Friday, Fed Governor Jerome Powell indicated that “some economic pain is on the horizon”. What does the Fed Governor mean by “economic pain” because the US GDP contracted by 1.6% in Q1 and by 0.6% in Q2. Two consecutive quarters of economic contraction indicates recession, but the US labour markets have remained strong; 528,000 new jobs were added in July despite economic slowdown. Average hourly wages increased 0.5% in July after gaining 0.4% in June (source: Reuters). Some analysts are interpreting Governor Powell’s “economic pain” comment as increase in unemployment in the US. The Fed Governors comment has been an overhang on the market for the last few days. US markets have corrected and we have seen profit booking in the Nifty at around 18,000 levels.

Scenarios of recession in the US

Historical data shows that recession in the US has impact on the Indian market, irrespective of how our economy performed. The question is what kind of recession will we see in the US? Earlier in this year, three scenarios were being discussed with regards to the US economy at the end of the interest rate cycle.

- Soft landing (no recession)

- Mild recession

- Severe recession

While the scenario of soft landing should not be ruled out because both US labour market and consumer spending still continues to be strong, let us consider the other two scenarios. Will we see a mild recession or a severe recession? The consensus view in Wall Street is that US will experience a mild recession in 2023. The view is that after hiking rates well into the first quarter of 2023, the Fed will start cutting interest rates towards the end of that year.

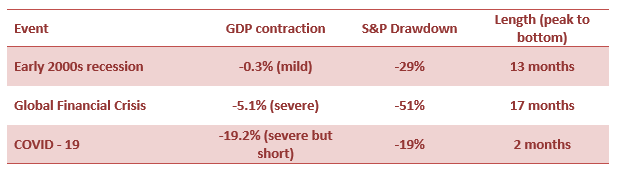

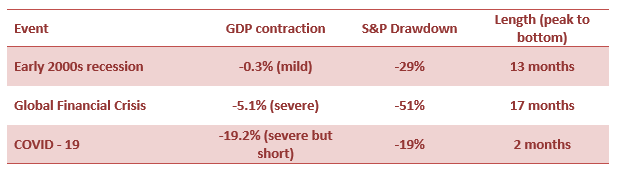

S&P 500 drawdown

Let us now look at the biggest drawdowns in S&P 500 over the last 20 years (as on 1st Sep 2022). You can see that despite the severity of the recession, the drawdown in the market is fairly short though the correction may be quite deep. The worst recession in the last 80 years was the Global Financial crisis of 2008, but the fall from peak to bottom took 17 months. The other two drawdowns last for 13 months and just 2 months.

We think that the length of drawdowns in future recessions will be short because the central banks and Governments quickly take steps to provide liquidity in financial markets along with fiscal stimulus to prevent large scale unemployment. We saw this in 2008 and even more aggressively during COVID-19. The market responds to the actions taken by central banks / Governments and bounce back from bottoms. Therefore, investors should be patient during bear markets because they do not last very long.

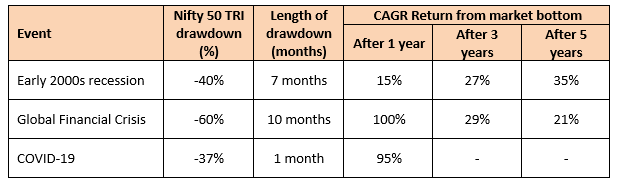

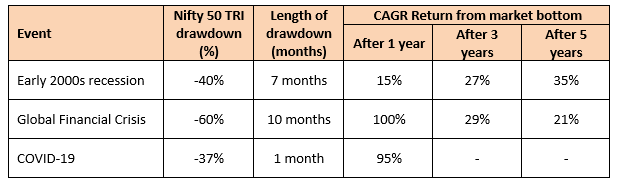

How Nifty bounced back from corrections?

We will now look at how the Nifty bounced back from corrections caused by US recessions over the last 20 years or so. You can see that length of drawdown in Nifty has not only been fairly short (maximum 10 months in the last 20 years) the market bounced back very strongly from all recessions. The bounce back in Nifty has often been much stronger than the bounce back in the US markets – all the more reason for investors to remain disciplined during market corrections. Historical data shows that highest wealth creation is made from investments in bear markets.

Why equities look good for the next few years?

- While global risk factors and sentiments play a big role in market movements, long term returns on equity investments are based on fundamentals.

- Our economy is clearly on the recovery path after the COVID-19 slowdown. As per National Statistical Office, India’s GDP grew by 13.5% in Q1 of FY 2023. The IMF has forecasted India’s GDP will reach to $5 Trillion by FY 2026-27.

- Corporate earnings are at a decade high and growing strongly since the COVID-19 pandemic and are growing at a higher rate than before. Nifty EPS growth in Q1 of FY 2023 was 23% and is expected to grow by 14% on a full year, YOY basis in FY 2023.

- Private Capex spending which has been sluggish for several years is on the cusp of revival and we are seeing early signs. Government infrastructure spending, Production Linked Incentive Schemes and Atmanirbhar Bharat scheme is likely to incentivize capex revival.

- Global supply chain realignments due to geo-political risks, particularly in reference to China, can be an opportunity for Indian manufacturing industry.

- The growing middle income segment of our population (rising per capita income) and their aspirations is reshaping private consumption expenditure, which further strengthens the growth outlook of Indian equities.

- Valuations look reasonable from a forward PE ratio perspective. This is a good time to invest in equities. Volatility in equity markets will provide investors with the opportunity to invest at attractive prices and get higher long term returns

What should investors do?

- You should be disciplined in your investing and always have long investment horizons. Minimum 5 years investment tenures are recommended for equity investors.

- You should continue to invest through SIP. SIPs will keep you disciplined and you can take advantage of market volatility through Rupee Cost Averaging. You can also read what should you do with your mutual fund SIPs

- You should diversify across market cap segments. While large caps provide stability in volatile markets, allocations to midcaps and small caps in deep corrections can significantly improve your portfolio returns.

- Systematic Transfer Plans (STP) is great route for investing in equities in volatile markets since you can take advantage of price corrections through Rupee Cost Averaging.

- More is not always good; you must focus on quality in any market phase. It becomes even more important in volatile market conditions. Your Eastern Financiers financial advisor can help you make the right investment decisions.

- Discuss your investment plans with your Eastern Financiers financial advisors or contact us at and we will get in touch with you for your investment needs.