The Indian Economic Scenario

The UN World Economic Situation and Prospects 2024 report said that India, world's fastest growing large economy, is likely to grow by 6.2% in 2024, reinforced by robust domestic demand and ambitious expansions in manufacturing and services. GDP in South Asia is projected to increase by 5.2% in 2024, driven by a robust expansion in India (UN Dept. of Economic & Social Affairs, 2024).

According to Director of the Economic Analysis and Policy Division, Shantanu Mukherjee, the Indian tax collection systems has been recently modified by the incumbent government and to a large extent, these modifications have been instrumental in creating a better stable playing field for businesses and in providing various initiatives to progress. With respect to risks facing the economy, he highlighted that several of the risks are more global in nature. (PTI, 2024). But to ensure sustained gain from the ongoing changes in the economy it is necessary to maintain a continuity – a continuity in terms of implementation, in terms of policy and legislative regime.

Importance of Continuity

While disruption brings in breakthrough changes, maintenance of the present conducive environment is essential to ensure these changes become actually effective. Major or effective changes can never appear overnight. It's a continuous process, and the ultimate results are visible over the long run. In the short, only green shoots will appear. For high economic growth to occur and persist, it is crucial that the government policies are able to provide continue and for that political continuity becomes necessary.

Growth processes are much more stable when backed by policy continuity. Also, continuity offered by government policy has a crucial role to play when aiming because it makes it possible for the general public to plan their future investments with some amount of certainty. Continuity bring about certainty, which is a crucial deciding factor for global investors (Krishnan, 2024).

In India, the budget validates continuity in the government's economic policies, and illustrates prioritization of long-term measures to achieve broader economic goals over the short-term ones. It highlights the progress of the policy measures indicating the possibility of achievement of the set targets over the long term, reaffirming the continuity of prevailing economic stance and announcing plans to launch new booster should the necessity arise. This reinforces the faith in the growth story and boosts the investors sentiments – both Indian and foreign.

A steady and continuous capital flow through investments is absolutely essential if India is to achieve its long-term economic growth target. There may be short term disruptions. But the investors get spooked if they see a change is the overall stability. Uncertainties are always there and will always be there. But a political stability and policy continuity give both the Indian and foreign investors the confidence to remain invested and even increase capital infusion. This in turn is responsible for maintaining government's capital outlay. The increased capital outlay has the potential to further stimulate private sector investments, which is crucial at the times the private sector is taking a pause due to their cautious outlook on the economy.

Political Continuity - The Indian Scenario

The Indian economic scenario, if we see historically, the economic policies and reforms that had been promoted by the central government had remained broadly aligned with the long-term national growth irrespective of the political party coming to power (Maiorano, 2014). This provided economic stability. Even the politicians will vouch for the need for this stability. But generally, investors believe that political continuity is the basic necessity for the stability that ensures continuity of economic policies.

During the first two terms of the NDA government there was mixed implementation of economic reforms in India. Certain positive measures can be highlighted such as the passing of the Goods and Services Tax (GST) and Bankruptcy Code in 2016 which provides for a time bound resolution of insolvency processes. 2017 saw India implementing GST for simplification of taxes, boosting revenue, bettering logistics, improving compliance, and promoting transparency. The GST, a comprehensive indirect tax designed to bring indirect tax under a single umbrella, was introduced with a view to benefit small businesses, facilitate foreign investments, and hasten digitization. GST has a positive impact on the economy irrespective of whether the state is both developed ot less-developed. GST reduces logistics costs through the resolution of discrepancies at check post and through the elimination of border taxes (Goyal, 2023).

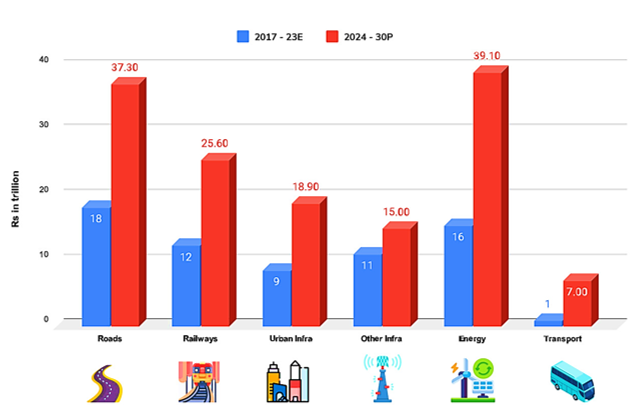

Our governments have always invested in infrastructure – an essential step towards boosting GDP growth. Higher spend on infrastructure is a key tool that propels economic growth and is believed to be extremely useful in macroeconomic stabilization. Over the last decade, specifically, the government has scaled up public infrastructure investment significantly, propelling India on the trajectory to becoming the 3rd largest economy in the world. India has emerged as one of the fastest-growing major economies having a real GDP growth rate of 8.2% in FY24 (Fitch Ratings, 2024). The incumbent government that had adopted policies for economic growth remained in power for two straight terms (and now re-elected for the third time) had provided the essential political stability that can ensure policy continuity and economic stability and hence growth. The government's commitment towards economic growth remains evident as it has allocated 3.3% of GDP to the infrastructure sector in the fiscal year 2024. India launched the National Infrastructure Pipeline (NIP), in 2020 which envisages an investment of INR 111 Lakh Cr over 2020 to 2025 i.e., an annual average investment of almost INR 22 Lakh Cr.

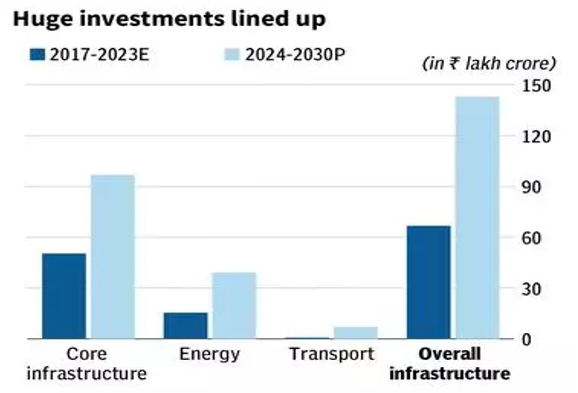

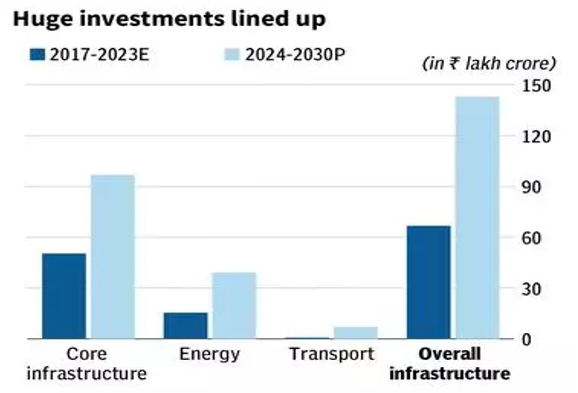

Figure 1: Infrastructure Spending in India

Source: The Hindu BusinessLine (BALABHADRUNI, 2023).

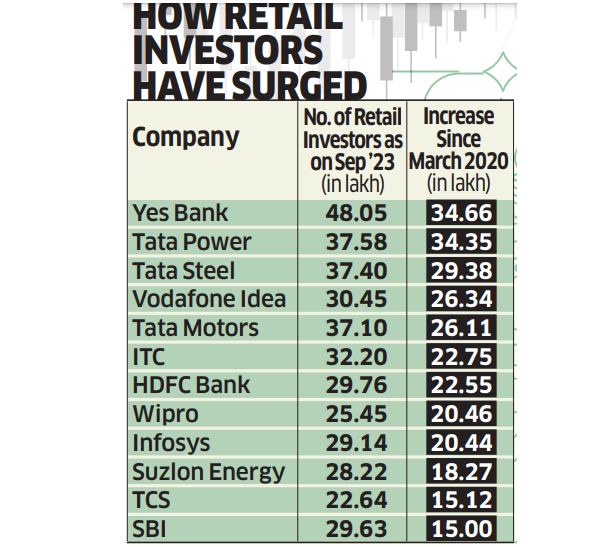

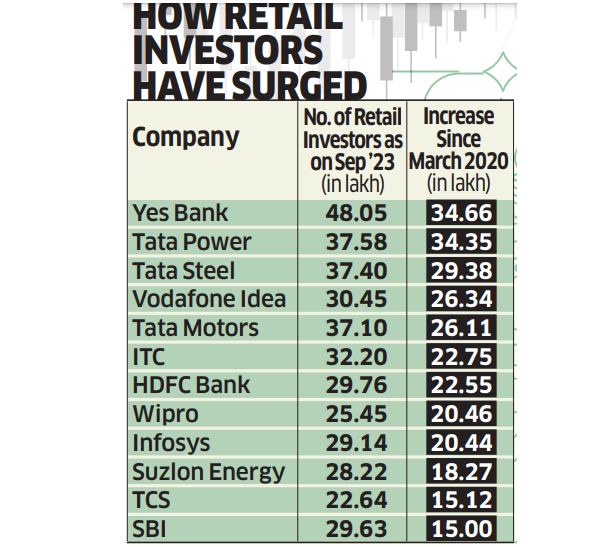

Such robust spend on infrastructure in a stable economy supported by policy continuity also brings in retail and small investors to the investment arena, urging them to pump money into the economy. The investment options start to look good to not only the resident investors but also to non-residents across the world who start gaining confidence in the economy and scout for attractive investment options. Something like this has happened in India – retail participation has surged and the following figure is a small demonstration.

Figure 3: Investment by Retail Investors

Picture Courtesy: Economic Times

India's top Nifty50 companies have witnessed a steady rise in the ownership by retail investors, increasing from 6.16% in September 2019 to a record 6.98% in September 2023 (Mascarenhas, 2023).

Cut To …. 2024 Elections

The Indian markets went through the roofs on 3rd June, the day before the counting began, on the anticipation that Modi-led BJP will continue for a 3rd term. PSU and Infra stocks were on fire. Why? Because the anticipation of continuity kept the investors elated.

When the same political party continues to be in power for longer period usually the policy regime stays stable. Revolutionary changes may come in … and they generally do … you can't say no to evolution and transformation if you have to survive in the modern world … and today's world it a lot more volatile than it was a couple of decades ago. But while the incumbent government brings in transformation, the underlying vision and future goals remain the same.

That's exactly what the investors were expecting from this year's election – a grand majority for the incumbent ruling party. But on the day of the counting all euphoria dissipated when the number of seats secured by the ruling party was less than expected. Fear set in and there was huge selloff in the overall market with a very negligible number of stocks making a northward journey. The doubt about whether the incumbent government will be re-elected for a third term surfaced and stirred in a whole lot of uncertainty amongst investors raising the doubts about continuity of the prevalent policy regime.

The institutional investors, especially the foreign ones started shying away. They took a cautious stance and decided to refrain from injecting money in a falling market. Their major concern was uncertainty that could arise if the preceding government isn't re-elected. To the FIIs, this kind of setback (the ruling party securing less than expected seats but still likely to form government through coalition) increased the level of perceived uncertainty. The performance of the opposition was particularly daunting – it made them feel that the results could tip towards either side. Such an election outcome posed near-term uncertainty, from the FII perspective, although unlikely to alter the economy's trajectory.

What happens next

Pre-election optimism has dissipated, as a coalition government has its own inherent challenges and constraints. Coalition partners are unlikely to offer the government the same degree of autonomy it had enjoyed during its previous two terms. Now the government's policies will need to be approved by the allies as well.

As has been highlighted above, during the past decade India's economic and market growths were primarily driven by extensive spending undertaken by government and a conducive policy regime that benefitted domestic industries. So the question arose on THE DAY, whether the government will be able to maintain the same stance now that the allies will play a bigger and more decisive role in the government. That is what spooked the investors – both Indian and foreign. Retail investors still remained bullish and pumped money in the equity market and into mutual funds. The ability of the new government (NDA 3.0) to address such issues as the high fiscal deficits and the need to cut down debt will be crucial considerations for the country's rating in the next few years. Steady reduction in deficit, especially when reinforced by reforms that ensure robust and lasting rise in revenue, would work towards keeping India's sovereign rating fundamentals robust over the medium term (Fitch Ratings, 2024).

We trust that the key reforms pertaining to land and labour laws would continue to feature on the new government's agenda since it continues to pursue the enhancement of the domestic manufacturing sector. Nevertheless, some amount of concern remains as these areas have remained a topic for argument since long and the ruling party's weaker mandate may complicate their passage further. This has the potential of bringing down the potential upside to the country's medium-term growth prospects. However, we are of the opinion that the overall direction will remain more or less the same with the government remaining largely focussed on the “India Shining” story. This means that manufacturing growth, electrification and urbanization will remain some of the key focus areas. Hence, the reforms will continue to advance across the country (though the pace of execution may not be uniform).

There also lies scope and hope for certain amount of judicial reforms that are likely to focus on lower costs and hassles pertaining to court cases along with their speedy resolution. This is also a key factor that determines the ace of doing business in India.

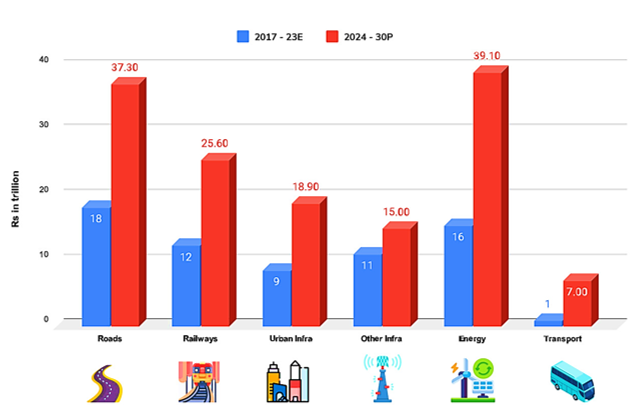

Figure 2: Infrastructure Spending: Sectoral View

Source: CRISIL

Photo Courtesy: LinkedIn (2023)

With India aiming to reach the $5 trillion GDP target sooner or later, India's economic growth in the coming years will be significantly driven by major investment in key sectors such as infrastructure development and investments in upgrading the physical infrastructure remains crucial for the development of other sectors and growth of overall economic activity.

Why Should One Invest in India

This year election has also created a huge opportunity for NRIs to invest in India. All investors, including NRIs have a wide array of investment opportunities at their disposal in India. These include equities, mutual funds (MFs), and real estate, which let the investors diversify their portfolios – much like not putting all eggs in one basket. Over the last few years a strong investment landscape has been created. A stable policy regime with undeniable growth opportunity provides significant wealth creation opportunities.