In this year’s Union Budget, the Finance Minister made some changes to the New Tax Regime. As a result of the changes, if your income is Rs 7 lakhs or less, you will not have to pay income tax in the New Tax Regime. This change sparked a lot of debate in the online and digital media, with several experts claiming that the debate between new and old tax regimes has now been conclusively settled in favour of new tax regimes because tax rates for different income slabs from Rs 5 to 15 lakhs is lower in the new tax regime.

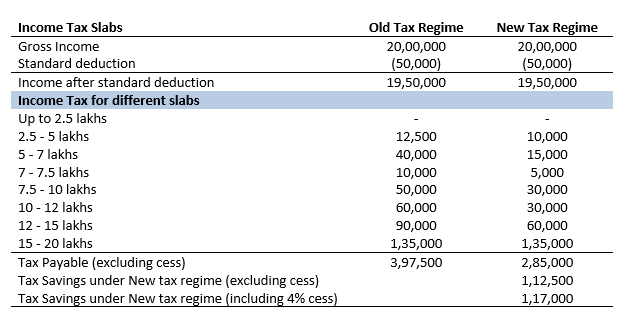

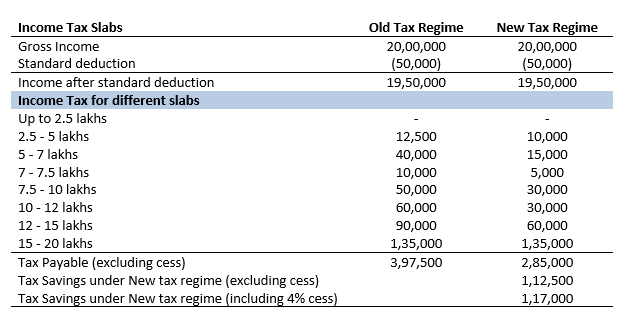

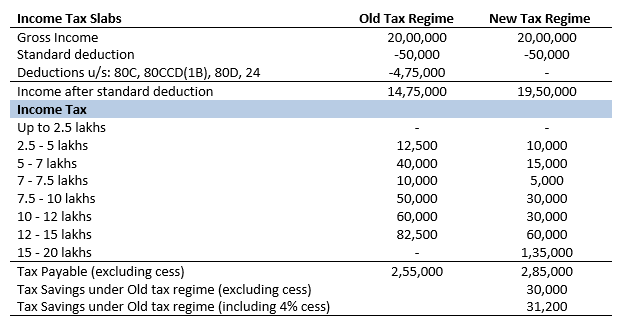

New versus Old Tax Regime (assuming annual income of Rs 20 lakhs, only standard deduction allowed)

Is New Tax Regime better than Old Tax Regime?

The answer is neither yes nor no. Whether you want to opt for new or old tax regime depends on the deductions you can claim. Apart from the standard deduction of Rs 50,000 which is now available to both tax regimes, there are several deductions available in the old tax regime, which tax payers cannot avail in the new tax regime. Some the common deductions claimed by tax payers in the old tax regime are:-

- Section 80C (PPF, ELSS, Life insurance etc): Rs 1.5 lakhs

- Section 80 CCD (1B) (National Pension Scheme): Rs 50,000

- Section 80D (Mediclaim): Rs 25,000 (for self) + Rs 50,000 (for senior citizen parents)= Rs 75,000

- HRA (House rent allowance): Lesser of (a) Actual rent paid or (b) 50% of basic salary + DA (for metro cities) or 40% of basic salary + DA (for metro cities)

- LTA (Leave travel allowance): Will depend on the maximum LTA provided by your employer and your actual cost of travel by air (economy class only), train (up to First AC fare) or bus.

- Section 24 (home loan interest): Rs 2 lakhs

If you are unable to claim any deduction, then the New Tax Regime is clearly more efficient than Old Tax Regime. Next we will show several scenarios of deductions that can be claimed under old tax regime, taxes payable thereof and how it compares with taxes payable in new tax regime. In all the examples, we will assume that your annual income is Rs 20 lakhs.

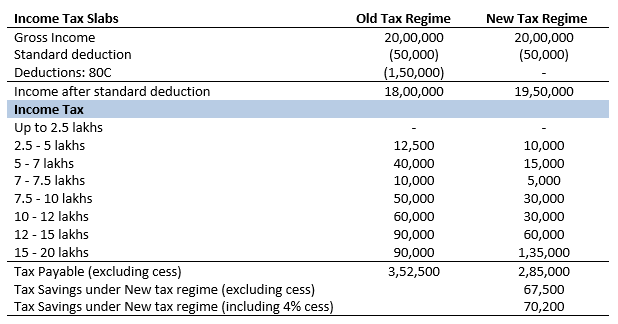

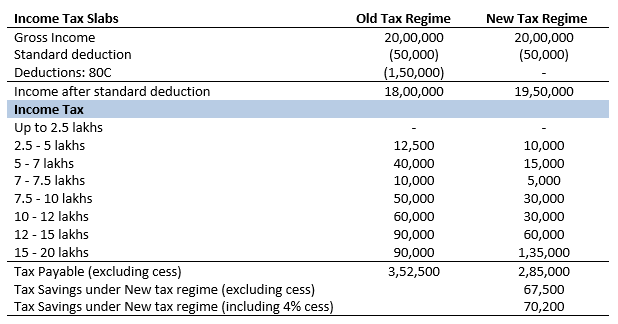

Scenario 1 - You claim deductions for Section 80C

Let us now assume that you are able to claim Rs 150,000 deduction for investments made in 80C schemes like ELSS, PPF or life insurance policies. The net taxable income including standard deduction and 80C deduction will now be Rs 18 lakhs in Old Tax Regime. Let us see what will be your tax payable in the two regimes. You will still be better off in the new tax regime.

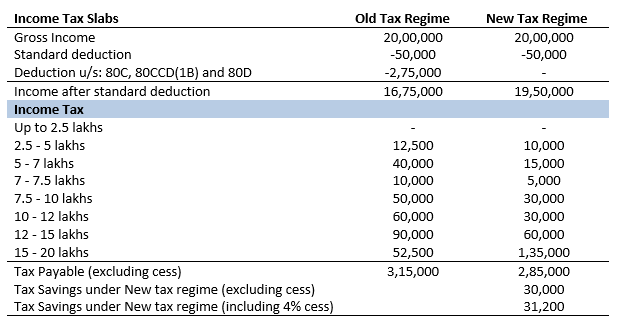

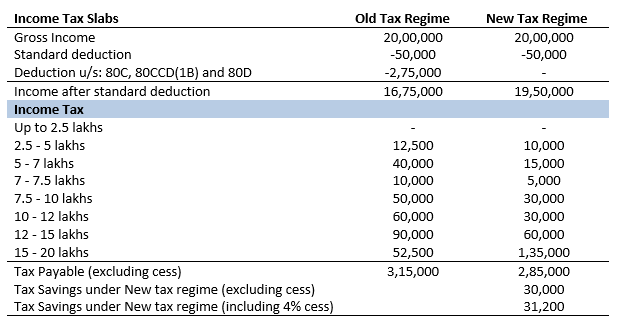

Scenario 2 - You claim deductions for Section 80C, 80 CCD (1B) and 80D (self / family and parents)

Let us now assume that you are able to claim Rs 150,000 deduction for investments made in 80C (e.g. ELSS, PPF or life insurance policies etc), Rs 50,000 for NPS and Rs 75,000 for Mediclaim purchase for self / family and senior citizen parents. Your taxable income reduces by Rs 3.25 lakhs. Your taxable income after deductions is Rs 16.75 lakhs in Old Tax Regime. Let us see what will be your tax payable in the two regimes. You are still better off in the New Tax Regime.

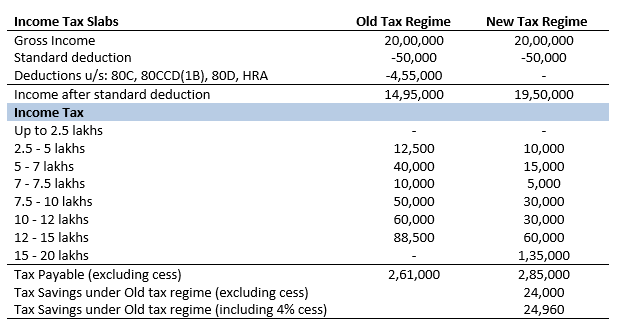

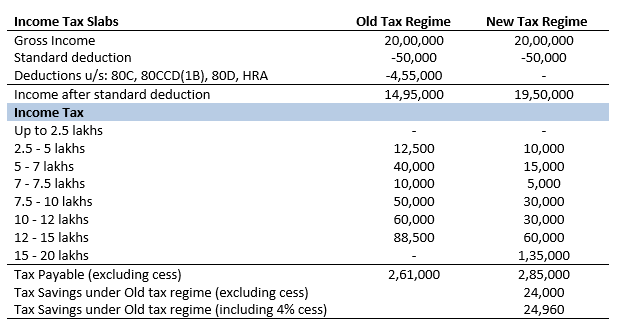

Scenario 3 - You claim deductions for Section 80C, 80 CCD (1B), 80D and HRA

Let us now assume that you live in a rented house paying monthly rent of Rs 15,000. You are eligible to claim HRA of Rs 180,000 in addition to the other deductions you were claiming in Scenario 2. Your taxable income after deductions is Rs 14.95 lakhs in Old Tax Regime. Let us see what will be your tax payable in the two regimes. Now, the Old Tax Regime is better for you.

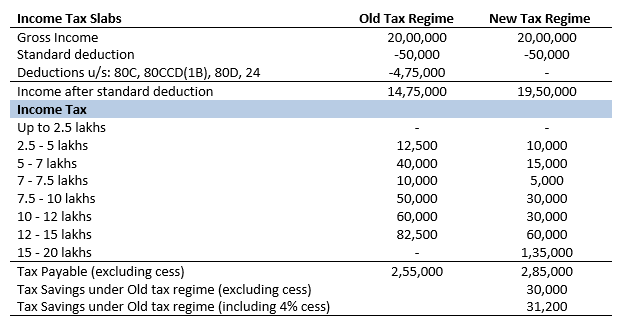

Scenario 4 - You claim deductions for Section 80C, 80 CCD (1B), 80D and Section 24

Let us now assume that you live in your own house which you bought with a home loan. The annual interest payment in your home loan EMIs is Rs 2 lakhs or more. You are eligible to claim Section 24 deduction of Rs 200,000 in addition to the other deductions you were claiming in Scenario 2. Your taxable income after deductions is Rs 14.75 lakhs in Old Tax Regime. Let us see what will be your tax payable in the two regimes. Now, the Old Tax Regime is even better for you.

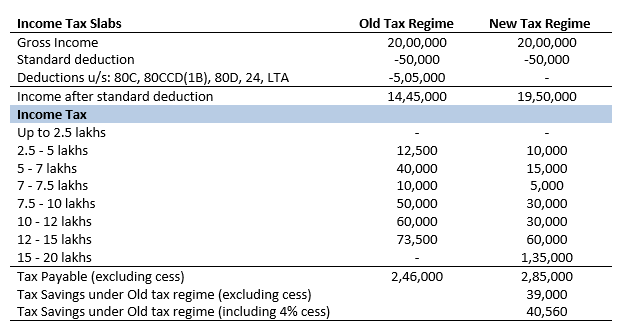

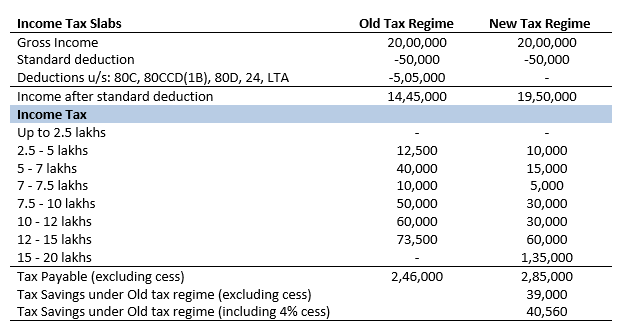

Scenario 5 - You claim deductions for Section 80C, 80 CCD (1B), 80D, Section 24 and LTA

Extending Scenario 4, where you are paying home loan EMIs, let us also assume that you are eligible to claim Leave Travel Allowance of Rs 30,000 (as per your company’s policy). Your taxable income after deductions is Rs 14.45 lakhs in Old Tax Regime. Let us see what will be your tax payable in the two regimes. The Old Tax Regime will give even higher tax savings.

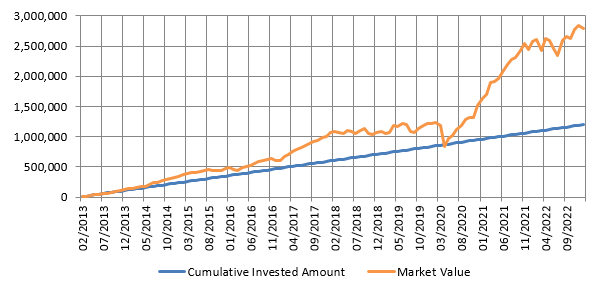

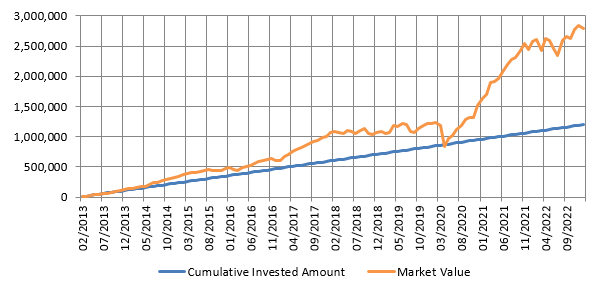

Discipline of savings - Wealth Creation through ELSS

One of the biggest benefits of the Old tax Regime was that, it provided tax incentives to promote a culture of savings. The wealth creation through savings and investments in the Old Tax Regime was much more than tax savings itself. The chart below shows the wealth creation by Rs 10,000 monthly SIP in IDFC Tax Advantage Fund (ELSS) over the last 10 years. With a cumulative investment of Rs 12 lakhs in last 10 years, you could have accumulated a corpus of over Rs 27 lakhs (Returns as on Feb 20, 2023.

Conclusion

In this article, we have shown that there are scenarios where old tax regime is more beneficial than the new tax regime and vice versa. You should consider your financial circumstances and opt for the tax regime that is suited for your specific financial / tax situation. Your Eastern Financier’s Relationship Manager are at your service, if you need any help in making financial and investment decisions.