Expenses… a good part of our income… goes into buying various stuff for ourselves; some essential - like food grains, spices, cooking media, milk, bread, eggs etc. and some non-essential such as an expensive mobile phone, costly wrist watch, designer garments, costume jewellery, high-end television sets, luxurious holidays, movie at multiplex, etc.

Spending on essentials is considered as non-discretionary expenditure – you just have to bear it, no matter what. Even if you are not earning you would have to buy food, at least for yourself and clothing to cover yourself and would need a roof over your head – "ROTI, KAPDA and MAKAAN".

Here in comes the concept of debt. When you are not earning enough or not earning at all, you will need to borrow to meet your daily needs. For some the source of credit may be relatives, friends or other private money lenders, for some it's credit cards and for others it could be loans from banks and nbfcs. Some don't have to repay, some repay, some don't want to repay. Jokes apart, wherever and whenever expenses outrun income there will be debt.

It makes sense to borrow, if it is for essentials and then try to bring the earnings up to a level where you can repay. What is left over and above this is your saving. How you utilize it will go a long way to determine your future financial well-being.

For an individual whatever is left of his / her disposable (after-tax) income after meeting expenses on essentials – daily, monthly, yearly, etc. are the savings. From this left over, the individual might decide to spend additionally – on practically anything, for instance eating out, watching movies, going to exotic locations for a holiday, buying an extra pair of shoes that you don't really need but always wanted to have or a new mobile phone or going out with friends or anything at all, that depends simply on your discretion, is what is termed as discretionary spending. Generally, this is considered to be spending on luxury, never on necessities.

What does it mean for businesses?

In simple terms – it means more income. When individuals and households make higher discretionary spending, on goods and services, vacations, luxury items, and other nonessential items, money flows towards businesses which cater for those goods and services. Businesses, hence, receive a boost. As these are non-essential products they are generally expensive and sometimes super-expensive. The producers or entrepreneurs earn good margins, strong margins. But they have to be very careful so as to maintain their brand recognition and reputation if they are to command that kind of a pricing power. Else, someone else will take away its market share – the competition is always cut-throat and survival difficult. Entrepreneurs must maintain their competitive edges and keep their consumers happy and try to gain market share through unique offers.

The Big Picture

India's consumer spending has been growing steadily.

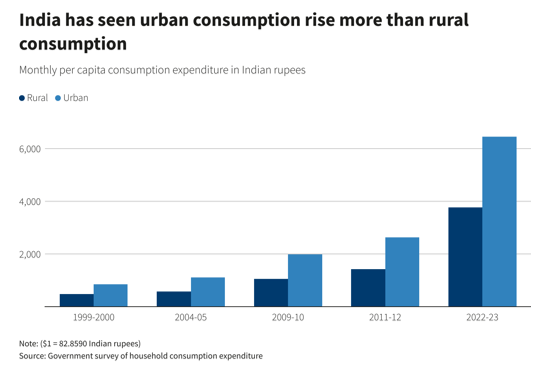

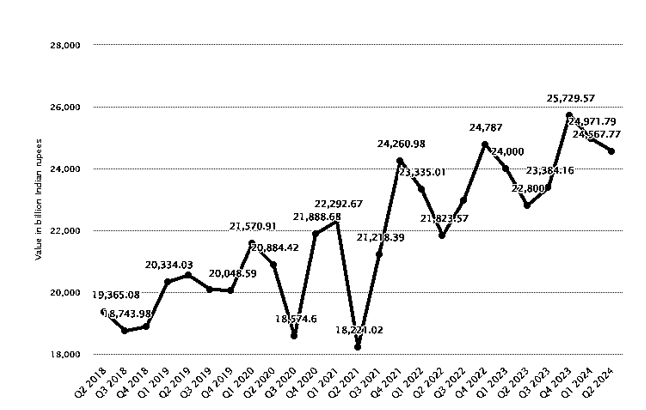

Figure 1: Rising consumer expenses in India [1]

It echoes a positive business outlook buoyed by the renewed consumer confidence in the post-COVID times. India's consumer market is anticipated to grow into one of the world's largest as the number of households in the middle-income to high-income categories continue to rise with the growth and expansion in their disposable incomes.

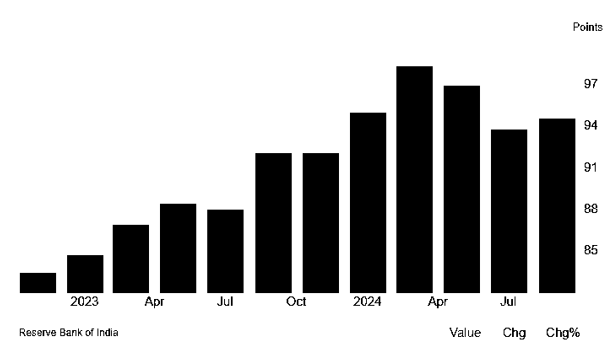

Figure 2: Consumer Confidence Index in India [2]

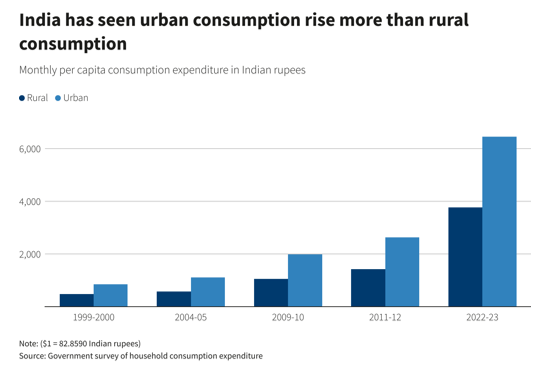

A key factor driving this increased consumer spending in India is believed to be its young demographic [1]. The Household Consumption Expenditure Survey, released by MOSPI, estimates average rural consumer spending to be ₹ 3,773 ($45.54 approx) per person, per month, for the 1-year period through July, rising up from ₹ 1,430 reported in the previous survey that was conducted in 2011-2012. Urban spending increased from ₹2,630 to ₹6,459 ($77.95) during the same time span [3].

Figure 3: Urban consumption rising faster than rural in India [3].

As seen in the report that was published by the Ministry of Statistics, household spending in India has risen by over double within a time span that is a little more than a decade. The discretionary items have been able to curve out a larger share from the expenditure pie. The government report provides clues for businesses, both national and international, that are constantly scouting for ideas to tap the markets in the world's most populated country.

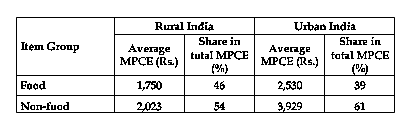

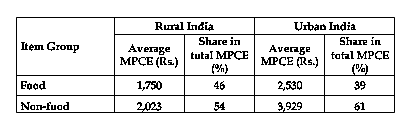

The report depicts a clear picture of expenditure on food items taking a back seat with respect to household spending while expenditure on discretionary items including clothes, television sets and entertainment had been on the rise [4]. The report also revealed that consumer electronics, for instance hand held electronic devices and mobile communication devices including smartphones and laptops, as well as gaming consoles were some of the items at the top of the spending list of the Indian holiday shoppers in 2023 [1].

Figure 4: Average Monthly Per Capita Consumption Expenditure (MPCE) during 2022-23 [5].

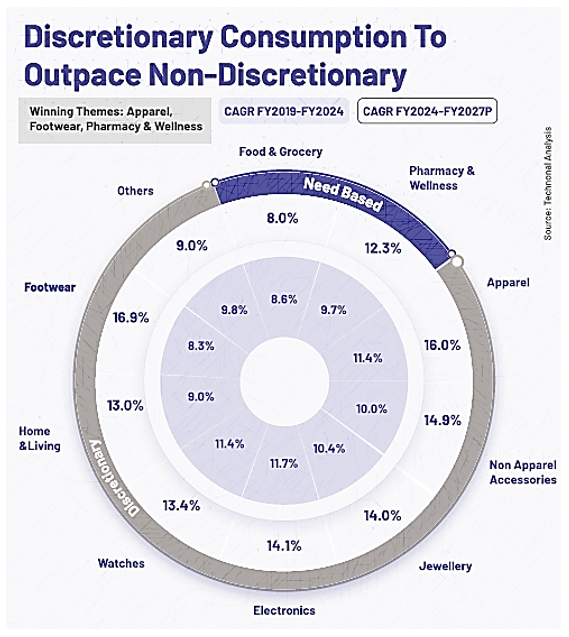

Probable Future

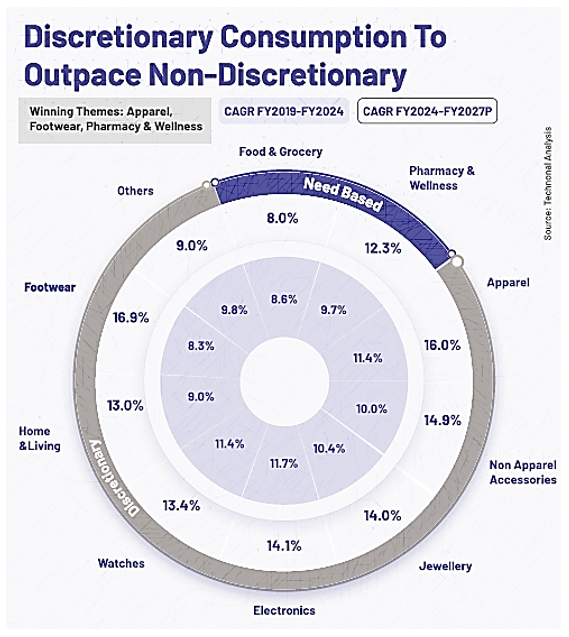

Discretionary spend will most likely continue to outpace the expenses incurred on staples. With the rise in per capita income, increased globalization, expanding urbanization and greater and faster access to credit through wider user of such instruments as credit cards, easier access to the internet and proliferation of e-commerce business that offer convenience of shopping from the comfort of your home; and other structural drivers have come into play. They will further accelerate the shift of consumer spending in favour of discretionary spending.

Figure 5: Future of Consumer Spending [6]

The amount spent on non-discretionary articles, on an average, is set to rise significantly leaving considerable scope for various businesses to take advantage of the changing nature of the consumer spending and spread their wings. It can also be profitable for them to launch new products or upgraded version of the old ones. These are more likely to be readily accepted as the consumers' inclination is towards spending on luxuries and not necessities, which will push up what we call "premiumization".

References

[1] M. Rathore, "Consumer spending in India from 2nd quarter of 2018 to 2nd quarter of 2024(in billion Indian rupees) | Statista," 21 Oct 2024. [Online]. Available: https://www.statista.com/statistics/233108/india-consumer-spending/. [Accessed 20 Nov 2024].

[2] Trading Economics, "India Consumer Confidence - Current Situation Index," 2024. [Online]. Available: https://tradingeconomics.com/india/consumer-confidence. [Accessed 20 Nov 2024].

[3] Reuters, "Indians spending less on food, more on discretionary items, government survey shows," 25 Feb 2024. [Online]. Available: https://www.reuters.com/world/india/indians-spending-less-food-more-discretionary-items-government-survey-2024-02-25/. [Accessed 20 Nov 2024].

[4] K. P. Bhavsar and Bloomberg, "India spends less on food, more on clothes, entertainment: What govt data tells about country's household spending," 24 Feb 2024. [Online]. Available: https://www.livemint.com/news/trends/india-spends-less-on-food-more-on-clothes-entertainment-what-govt-data-tells-about-countrys-household-spending-11708837548436.html. [Accessed 25 Nov 2024].

[5] MOSPI, GOI, "Factsheet of Household Consumption Expenditure Survey (HCES)2022-23," 2024. [Online]. Available: https://www.mospi.gov.in/sites/default/files/publication_reports/Factsheet_HCES_2022-23.pdf?download=1. [Accessed 20 Nov 2024].

[6] A. Wealth, "India: Decoding Demographic Dividend," AngelOne Wealth, 2024.