Small cap funds invest in companies which are smaller than the 250th company by market capitalization. Due to their smaller size, the earnings growth potential of small cap companies tends to be higher than large cap and midcap companies. Small cap companies also tend to be cheaper than large and midcap companies. While small cap funds tend to be more volatile than large and midcap funds in the short term, higher earnings growth and valuation re-rating can have tremendous wealth creation potential in the long term.

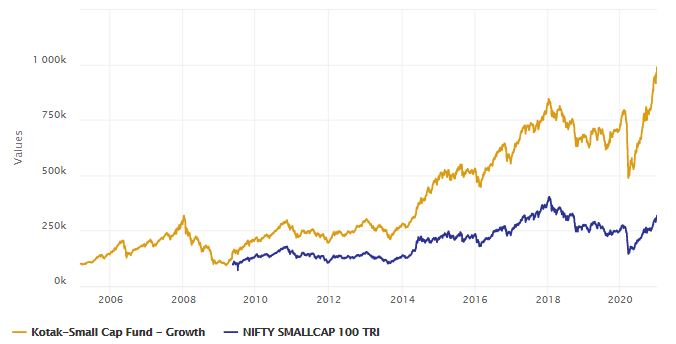

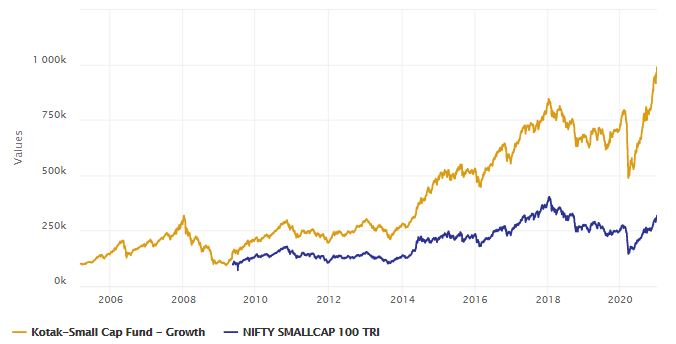

The chart below shows the growth of Rs 1 lakh investment in Kotak Small Cap Fund at its inception (NFO) about 15 years back. You can see that your money would have multiplied nearly 10 times and grown to over Rs 10 lakhs.

Why should you invest in small caps now?

Small cap funds tend to outperform other equity categories in bull markets and underperform in bear markets.

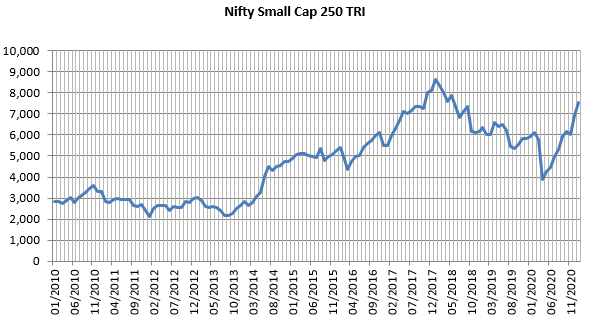

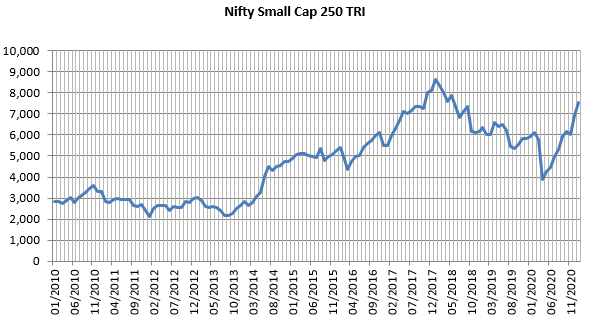

The chart below shows the growth of Nifty Small Cap 250 TRI over the last 10 years. You can see that small caps after outperforming from 2014 to 2017 went through a very deep correction in 2018 to 2020. This prolonged bear market for small caps brought prices to fairly attractive levels. That is why we saw investor interest in small caps when the market recovered after the COVID-19 crash in March 2020.

Even though small caps have rebounded strongly in line with the rest of the market, you can see that current price of Nifty Small Cap 250 index is still below its all time high, even though the Nifty and Sensex crossed their all time highs nearly 3 months back. Therefore, we believe that from the current levels, small caps are likely to outperform Sensex and Nifty in the medium to long term. We also think that the Government’s Atmanirbhar Bharat vision, favourable policies and the post COVID global supply chain redistribution will favour small cap companies in India. We expect to see robust earnings growth for these companies in the medium to long term as the economic recovery gathers steam.

About Kotak Small Cap Fund

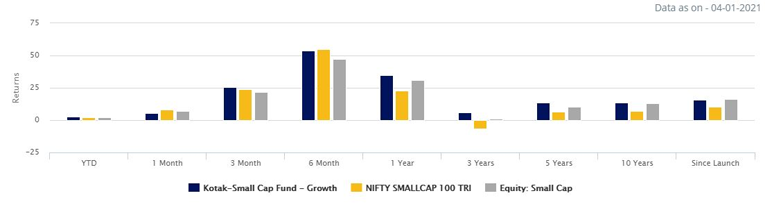

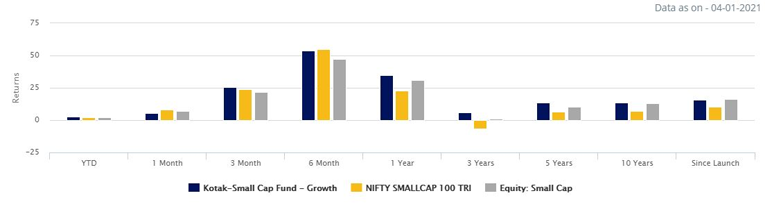

This fund was launched in 2005 and has Rs 2,154 Crores of assets under management (AUM). The expense ratio of the fund is 2.14%. The chart below shows the performance of Kotak Small Cap Fund versus its benchmark and the small cap fund category over different time scales. You can see that the fund has consistently outperformed its benchmark and category over different periods.

Wealth Creation

The chart below shows the growth of Rs 10,000 monthly SIP in the scheme since inception. You can see that with a cumulative investment of around Rs 18 lakhs, you could have accumulated a corpus of over Rs 62 lakhs in the last 15 years or so. The wealth creation by this fund is indeed commendable.

Who should invest in Kotak Small Cap Fund?

- Investors who want to create wealth for their long term financial goals

- Investors who have high risk appetites. The fund can be volatile in the short term

- Investors who can remain invested for at least 5 to 7 years or longer

Should you invest in lump sum or SIP?

SIP is the ideal investment mode for volatile funds like small cap funds. However, from time to time, investors can take advantage of market conditions (deep corrections, mean reversion in investment cycles etc.) to tactically invest in lump sum. We think that investors can take advantage of the current market conditions including price levels to tactically allocate a portion of their portfolio to small cap funds by investing in lump sum, provided you have long investment horizon. If you have lump sum funds but are concerned about volatility, you can also invest through 3 – 6 months STP.

Conclusion

Kotak Small Cap Fund is going to complete 15 years next month. The fund has a strong track record of wealth creation. We discussed in this article that the current market conditions provides attractive investment opportunity in this fund either through SIP or lump sum. If you want to know more about this fund or how to invest in this fund, please contact your Eastern Financier’s financial advisor or call / email us at service@easternfin.com