The last 2 years have been difficult for midcap segment. The Nifty Midcap 100 index fell nearly 17% over the last 2 years. In 2018, the midcap index fell 17% and in first 9 months of 2019, the index fell by another 13%. Over the last 3 – 4 months, midcaps seem to have bottomed out a recovered some ground. In the last 3 months, the Nifty Midcap 100 index gained 10 – 11%, with the substantial part of the gains coming in the last 1 month (6.4%). Midcap funds were very popular with investors in the past 4 years preceding the crash in 2018.

You may see the historical returns of Midcap Equity Mutual Funds here.

From 2014 to 2018, midcap funds on average gave 2.8 times returns (CAGR of nearly 30%). Over the same period equity mutual fund industry AUM grew at a CAGR of 44% (as per AMFI data), a substantial portion of the flows going to midcap funds. Naturally midcap funds comprised a significant portion of many investment portfolios and a deep fall in prices must have been distressful for investors. However, at this point of time we fell that the correction has created attractive investment opportunities in the midcap funds category.

Risk / return characteristics of midcap funds

It is important for investors to understand the risk / return characteristics of the assets so that they can make right investment decisions. Equity as an asset class is intrinsically volatile and within equity as an asset class, midcap as a market segment is more volatile than large caps. SEBI defines midcap stocks as 101st to 250th companies in term of market cap. These companies are smaller than large cap but larger than small caps.

While their smaller size in terms of market share and balance sheets makes midcap companies more vulnerable during economic downturns, the appeal of midcap companies is in their growth potential relative to mature large cap companies. Historically, quality midcap stocks were able to grow earnings (EPS) much faster than large cap stocks over sufficiently long periods. Another attractive aspect of midcap stocks is that they are relatively undervalued compared to large cap due to the lower institutional ownership relative to large caps. Over a period of time, the valuation of such stocks get re-rated giving considerable returns to investors. Many large cap companies today were midcap companies in the past and investors created substantial wealth in these stocks.

These features make midcaps very attractive for investors who are looking for high returns and midcap funds have historically outperformed large cap funds in bull markets. We have seen a number of times in the past (e.g. 2004 to 2008, 2014 to 2018 etc), investors flocking to these funds in bull markets. When a lot of money flows into a stock, its price rises beyond its fair price and the stock gets overpriced. This effect (overpricing) tends to get exaggerated in India because of the ownership pattern of midcap stocks in our country.

In India, the promoter and promoter’s family owns a very large percentage of shares outstanding in the companies; as a result the volume of free floating shares for midcap scrips are low. When a large amount of money chases a relatively small number of shares in bull market, the share price tends to become very expensive. The opposite effect is seen, when investors pull out money (bear market) – the share price crashes. Midcap investors should always be prepared for high volatility and have a long investment horizon. Investors get the best returns in midcap stocks over several market cycles (covering both bull market and bear market) to give these stocks the time to recover from deep corrections and achieve the growth and intrinsic value potential. Ideally, one should be prepared to remain invested for 7 years or longer in midcap funds.

What led to the correction of midcap stocks in 2018 - 19?

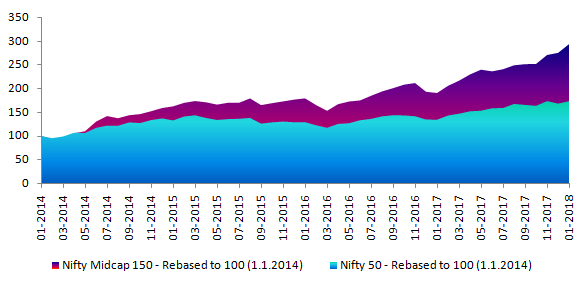

In the previous section, we explained the risk / return characteristics of midcap stocks. As mentioned earlier, midcap stocks usually trade at a discount to large cap stocks (undervalued). Midcap stocks underwent a fairly deep correction in 2013 and were trading at much lower P/E ratios compared to large cap. The trigger for midcap rally was the “Modi wave” preceding the 2014 Lok Sabha elections. Reforms instituted by the BJP led NDA Government e.g. Make in India, Infrastructure, Insolvency and Bankruptcy Code (IBC), Goods and Services Tax (GST) etc were expected to favour midcap companies the most. As a result a lot of money flowed into midcap stocks causing their share price to shoot up. The chart below shows the growth in Nifty 150 TRI versus Nifty 50 TRI from 1st January 2014 to 1st January 2018.

You can see that Nifty Midcap 150 grew at a much faster rate than Nifty; while Nifty grew at a CAGR of 15% during this period (1st January 2014 to 1st January 2018) - Nifty Midcap 150 TRI grew at a CAGR of 31%. In order for earnings to keep pace with share price, midcap EPS growth needed to be 16% higher every year than Nifty EPS growth. In other words, if Nifty EPS growth was average 10% every year, then midcap EPS needed to grow at 26% to justify the valuation.

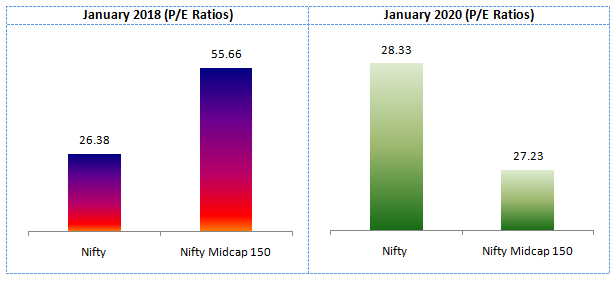

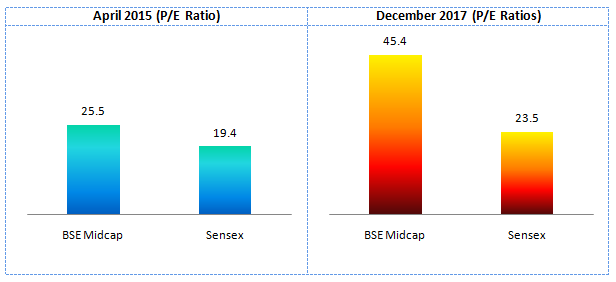

Many of these Government reforms which were expected to benefit midcaps were structural and would show results in bottom-line growth only in the long term. The rally in midcap was a consequence of investment flows and not justified by fundamentals. The chart below shows the P/E ratios of BSE Midcap Index versus Sensex in April 2015 and December 2017. You can see that Midcaps had become more expensive than large caps as early as April 2015 and by December 2017, the valuations were completely unreasonable and correction was inevitable in midcaps.

Deep corrections led to strong bounce-backs

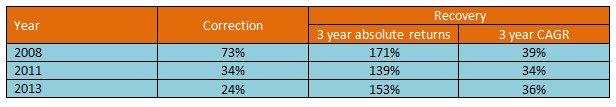

Typically, 20% or more correction in price is classified as deep correction or in stock market lingo, bear market. We have witnessed bear market in midcaps over the last 2 years, but the good news for investors is that bounce-back from bear markets in the past have been very strong. Over the past 15 years (2005 to 2020), we saw four bear market period in midcap segment of the market viz. 2008, 2011, 2013, and 2018 – 19; every period saw midcaps falling by more than 20%. On the last 3 occasions i.e. 2008, 2011 and 2013, midcaps bounced back strongly after the corrections giving strong returns over the next 3 years. The table below shows the deep corrections in Nifty Midcap 150 TRI and the absolute as well as CAGR returns over the next 3 years following the corrections.

Why is this a good time for investing in midcap funds?

There is an old saying and it has often been true in stock markets that, history repeats itself. The midcap correction of 2018 - 19has been in the range of the corrections seen in 2011 and 2013 - from January 2018 to September 2019, midcaps corrected by 30%. Though midcap index has recovered by 10% over the last 3 months, there is considerable upside potential in the long term if history were to repeat itself.

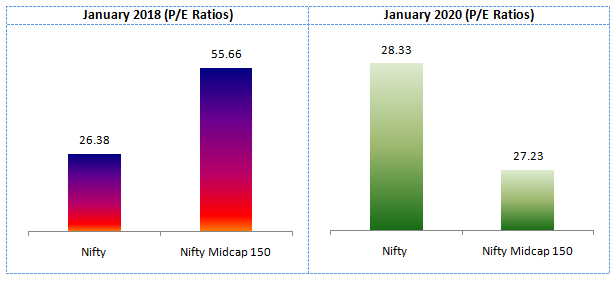

Further, midcaps are once again attractive from a valuation viewpoint. Midcaps which were trading at a considerable valuation premium to large caps in 2015 - 17, are once again trading at a discount to large caps (please see the chart below).

Wealth creation potential of Midcaps in the long term

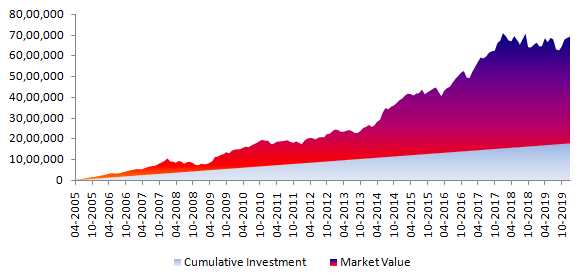

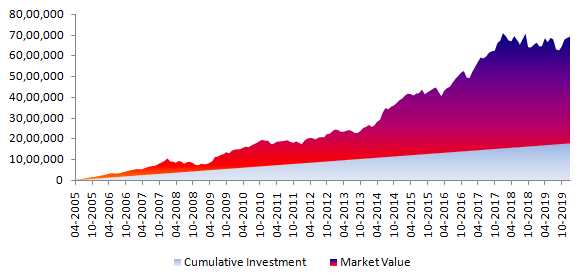

The chart below shows the returns of Rs 10,000 monthly SIP in Nifty Midcap 150 TRI from April 2005 (inception of the index) till date. With a cumulative investment of Rs 17.8 lakhs you could have accumulated a corpus of Rs 53.7 lakhs.

Wealth creation potential of top performing midcap funds is greater

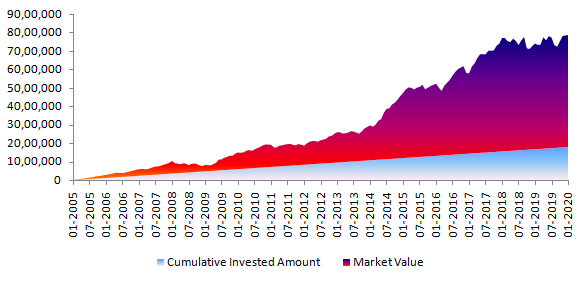

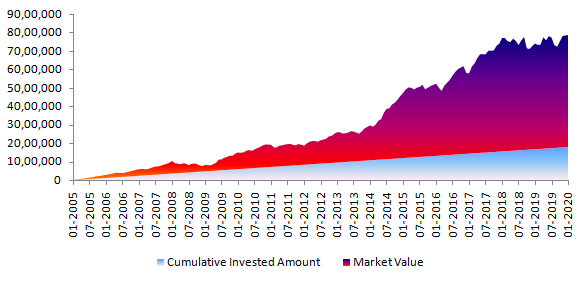

The chart below shows the returns of Rs 10,000 monthly SIP in Franklin India Prima Fund from January 2005 till date. With a cumulative investment of Rs 18.1 lakhs you could have accumulated corpus of corpus of Rs 63 lakhs. High quality mutual fund schemes are able to create alphas for investors through active stock selection, research and portfolio management. Our financial advisors can help you select the best performing schemes which have high potential of future growth.

Conclusion

The path to recovery in midcap will not be short and may involve a bumpy ride. The Indian economy is in the grip of a slowdown, but the long term prospects of India Growth Story remain intact. Historical data shows that current price levels and relative valuations present attractive investment opportunities over long investment horizons. Midcaps have created tremendous wealth for investors in the past. Investors with high risk appetites may invest in these funds for getting good returns in the long term. We think SIP is the best approach for investing in midcap funds, but the current price levels also present attractive tactical investment opportunities in lump sum. Please check the SIP returns of Midcap Equity Mutual Funds from our website.

You should consult with your Eastern Financiers financial advisors if midcap funds are suitable for your investment needs.