Gold occupies an important position in Indian households because of its significance in auspicious occasions. Cultural significance aside, Gold is also an important asset class for several reasons:-

- Gold diversifies portfolio risks

- Gold is a long term hedge against inflation

- Gold is a hedge against equity risks in volatile markets

Gold for risk diversification

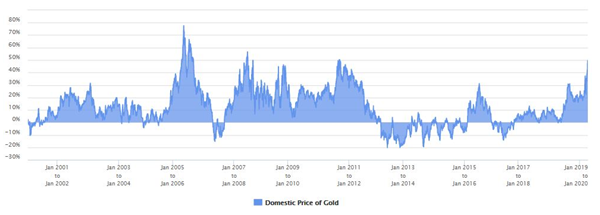

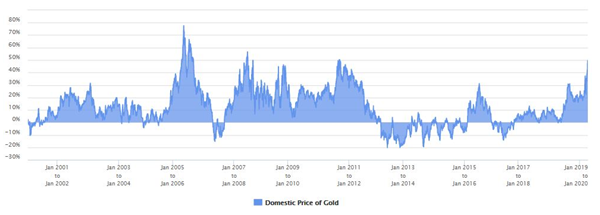

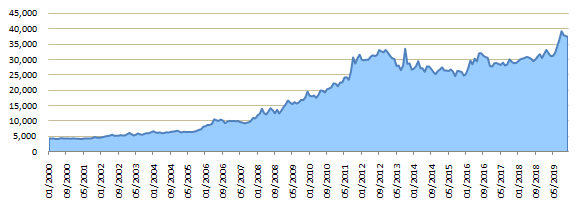

The chart below shows the 1 year rolling returns of Gold over the last 20 years. You can see that for most periods (nearly 80% of the times) Gold gave positive 1 year returns. Gold gave more than 8% annualized returns (average returns expectations from fixed income) 57% of the times and more than 12% annualized returns 46% of the times.

Therefore, we can conclude that risk return trade-off in Gold is quite favourable, making it an ideal asset for portfolio risk diversification.

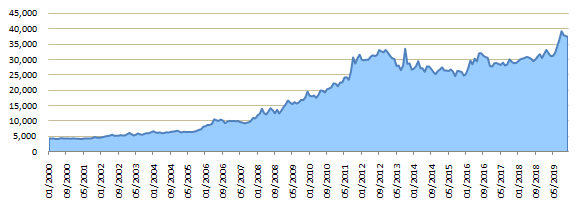

Gold as hedge against inflation

Historical data shows that, Gold price appreciation is a hedge against inflation. Over the last 20 years Gold price appreciated at a compounded annual growth rate (CAGR) of 11.33% beating inflation and creating wealth for investors. Investors must have a long investment horizon for Gold.

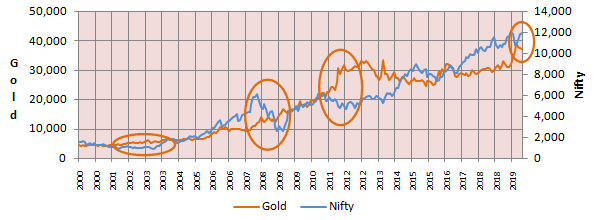

Gold hedge against equity

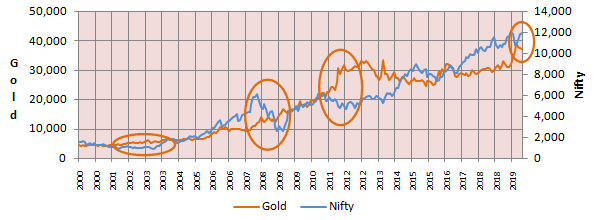

Gold price movement has a negative correlation against equity. You can see in the chart below that in the past, Gold performed well when the equity was weak (see the regions of the chart circled in orange). In the last 1 year, Gold has given 46% returns, while Nifty has given -20% returns.

Therefore, adding Gold to your asset allocation not only reduces portfolio volatility but can significantly boost portfolio returns in volatile markets.

Is this a good time to invest in Gold?

Historical data shows that Gold performs exceptionally well in market crashes (see the chart above). The spread of COVID-19 pandemic has sent stock markets around the world in a meltdown. Gold price has surged 11% in the last 45 days. Though markets have recovered from the lows, further volatility is likely since the economic outlook is uncertain. In such an environment, gold is expected to do well even though Gold prices have run up significantly over the last 1 year or so.

Financial crises in the past have shown that liquidity created by central banks in response to crises often go into Gold which is seen as a safe haven by risk-averse investors. Further, the RBI is likely to resort to aggressive interest rate cuts in the coming months as hinted by the RBI Governor. Interest rate reduction will lead to INR depreciation which would cause Gold price appreciation in INR. However, you should not look at Gold as a speculative investment but as a means of asset allocation & diversification.

How to invest in Gold?

The best way to invest in Gold is through Gold Exchange Traded Funds. They are highly cost efficient and liquid assets. You need to have a demat account to invest in Gold ETFs. If you do not have demat account, you can invest in Gold Index Funds which are also cost efficient investments. Gold investments are also highly tax efficient over 3 years plus investment tenure.

Capital gains in Gold ETFs and Index Funds held for more than 3 years are taxed at 20% after allowing for indexation benefits. Indexation benefits will reduce your tax obligations considerably. If you want to know more about Gold investments, please contact your Eastern Financier’s financial advisor or write to us at service@easterfin.comor call us at 033-40006800.