We have stated multiple times in our blog that asset allocation is one of the most important determinants of portfolio returns in the long term. There are two types of asset allocation strategies:-

- Static or fixed allocation whereby you always aim to maintain a particular equity to debt allocation in your portfolio. The target equity or debt allocation depends on your investment goals (long term, short term etc.) and risk appetite.

- Dynamic asset allocation where you invest in different asset classes based on market conditions. Dynamic asset allocation aims to reduce portfolio risk and generate superior risk adjusted returns in the long term.

Almost all investors face situations when they are unable to decide where to invest e.g. whether to invest in equity funds or debt funds. When markets are volatile investors may be hesitant of investing in equity fearing losses and at the same time, they may be tempted by lower prices. Similarly when market is high, investors may want to invest in debt but also not lose the opportunity of profiting from momentum in equity markets. This confusion can lead to either indecision or wrong decisions.

Dynamic Asset Allocation Funds

There is no denying that emotions play a big role in our investment decisions. However, fear or greed or confusion (leading to indecision) can be harmful to your financial interests in the long term. Dynamic Asset Allocation Funds take emotions out of investing and apply sound investment principles in making investment decisions. These funds use mathematical models which dynamically change the asset allocation based on market conditions.

Valuation based dynamic asset allocation

Valuation based dynamic asset allocation models use the age old investing principle of buying low and selling high. These funds sell equity and buy debt when markets are high; they buy equity and sell debt when markets are low. The biggest advantage of valuation based dynamic asset allocation funds is that they aim to reduce risk (bring stability) and produce superior risk adjusted returns in the long term (by buying high and selling low).

IDFC Dynamic Equity Fund

IDFC Dynamic Equity Fund is an asset allocation fund which uses P/E ratio to dynamically manage asset allocation between equity and debt. They shift asset allocation from equity to debt when P/E ratios are high (high prices) and vice versa when P/E ratios are low (low prices). Asset allocation is managed in a systematic step-wise manner depending on the trajectory of valuations (P/E ratio). The fund manages your investment dynamically investing in large, midcap and small cap stocks, as well as long term and short term bonds depending on market conditions. It uses a quantitative approach which takes emotions out of investing.

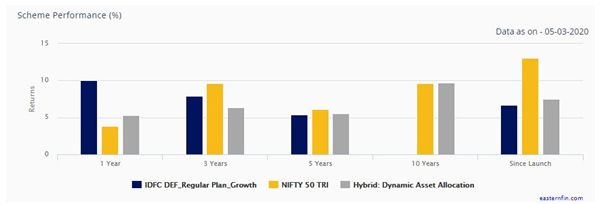

IDFC Dynamic Equity Fund is one of the best performing dynamic asset allocation funds over the last 3 years or so. The chart below shows the trailing returns of the fund across different time-scales. You can see that the scheme outperformed its category over the last 1 to 3 years. You can also see that the scheme outperformed Nifty in the last 1 year, generating nearly double digit return for investors when Nifty gave less than 5% return.

The chart below shows the growth of Rs 1 lakh lump sum investment in IDFC Dynamic Equity Fund over the last 3 years. You can see that the scheme gave almost similar returns as Nifty despite being much less volatile (upward and downward spikes). This makes the fund excellent investment for investors who do not have high risk appetite or very long investment tenures.

You can also invest in the scheme through systematic investment plan depending on your investment needs. The chart below shows the returns of Rs 10,000 monthly SIP in the scheme over the last 3 years. You can see that SIP in the scheme would have outperformed SIP in Nifty.

Why invest in IDFC Dynamic Equity Fund?

The last 2 years have been difficult for Indian stock market, especially the broader market. Though the Government has taken several steps to revive the economy and we saw some positive reaction from the stock market, the spread of Coronavirus has hit the stock market very hard over the past month or so. Nifty has fallen nearly 10% on a year to date basis and the market outlook is very uncertain. Though the price correction over the last 2 years has created attractive investment opportunities in the long term, the global risk factors (due to Coronavirus) and domestic risk factors (due to economic slowdown) will weight heavy on the market in the near term. In such uncertain conditions, it is difficult to make investment decisions including asset allocation.

As such, we think that dynamic asset allocation will be a good strategy keeping a long investment horizon in mind. IDFC Dynamic Equity Fund has outperformed Nifty in difficult market conditions over the last 1 year. Since the economic outlook is uncertain and volatility likely to persist, we think that the fund will continue to outperform in the near term.

Who should invest in IDFC Dynamic Equity Fund?

- Investors who want to limit downside risk and benefit from superior risk adjusted returns in the long term

- Investors who do not have high risk appetites - investors with moderately high risk appetite

- Investors who can remain invested for 5 years or longer to get the best results

- Investors in high tax brackets, who want to benefit from long term capital gains taxation in equity oriented funds.

Conclusion

In Eastern Financiers, we continuously work to curate a bouquet of products depending on your financial needs and prevailing market conditions. In this article, we have discussed how IDFC Dynamic Equity Fund can be a good investment option in the current market conditions for long term investors who do not have high risk appetites. If you want to know more about this investment or other investments which may be suitable for your investment needs, please contact your Eastern Financier’s financial advisor or call us at 033 - 40006800.