A very popular term in the market that investors come across every now and then is CAPEX and how it is affecting the market. Many wonder what it is. Many are aware that it is the acronym for capital expenditure but only a handful knows what it actually means or what it its significance.

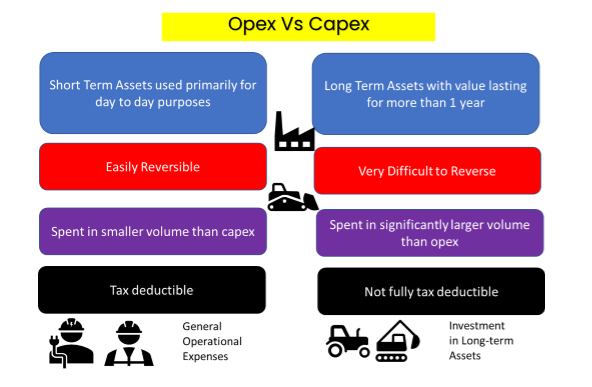

Capital expenditure or capital expense (abbreviated capex, CAPEX, or CapEx) refers to the money spent by an organization or a corporate entity for purchasing, maintaining, or improving the fixed assets they have, including buildings, vehicles, equipment, or land. In other words, capex funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. Two things are stressed here - one is the acquisition of the asset and the other is its maintenance. When an asset is newly purchased or when money is used towards extending the useful life of an existing asset, such as repairing the roof, such an expense is considered to be a capital expenditure. Unlike operating expenses or opex, capex is essentially long term in nature.

Figure 1: Differences between Opex & Capex (Source: EFL Research)

Normally capital expenditures take either of these 2 forms -

- Maintenance capex - refers to expenses incurred for maintaining a company's present levels of operations or

- Growth capex - refers to expenses incurred for enabling or enhancing future growth [1].

And it comes from both the government sector and the private sector. The capex done by the government directly or through agencies such as Public Sector Undertakings (PSUs) forms a part of public expenditure. Both figures have significance when we calculate India's GDP. While Private capex is funded by individuals, groups, or business entities, funding for Public capex comes from the government or other state-run bodies.

How does Capex affect the Indian economy?

Public capex is made towards building infrastructure and developing human capital which in turn helps the development of private businesses. In simple terms, government spending on infrastructure development will boost industry which is essential for general economic development. Both private capex and public capex will also boost the country's GDP.

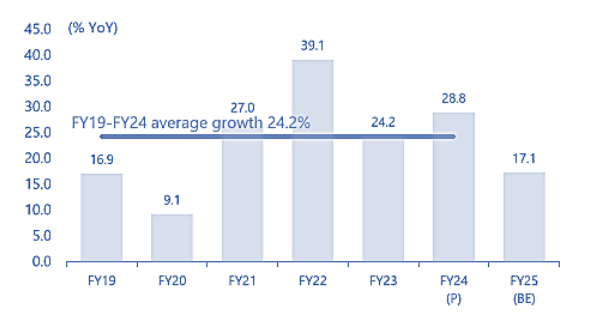

Figure 2: Growth (%) in GoI Capex (yoy) [2]

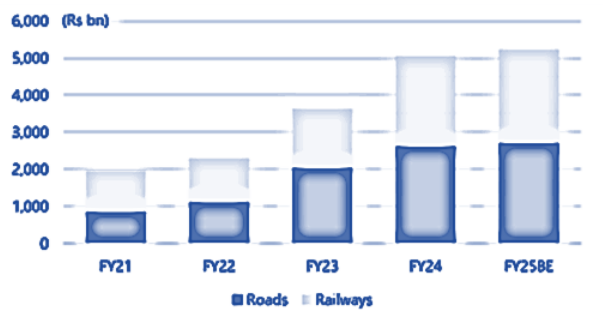

Figure 3: GoI Capex - Railways & Roads [2]

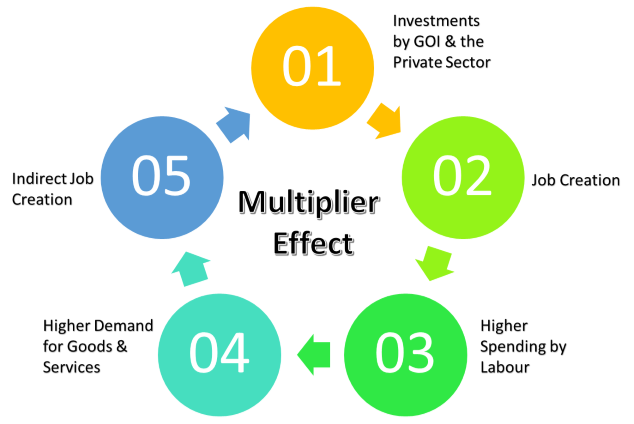

Think about it like this, if we have better transports, better connectivity, undisrupted and adequate power supply, more and better skilled labour we will be able to produce better quality of goods and services within a shorter span of time. We will need lesser time to produce and deliver the same volume of goods and the time we save can be effectively used in productive endeavours such as research and development, training and mentoring, etc. That's where the importance of capex lies - it provides better opportunities, easier movement of goods and the people, superior connectivity and better skill development. It also expands the scope for investors. Wouldn't you work better if you had better roads and public transport to commute? If you had better connectivity that would make your work faster and easier? Or if you had access to some of the best contemporary information and communication technologies available? In short, Capex has a multiplier effect.

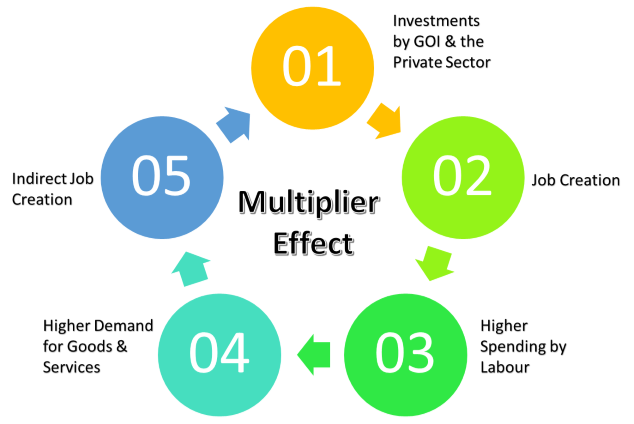

The Capex Multiplier

Capex acts as a multiplier in the sense that every money spent by the Indian Government on capex, increases the national income by a certain multiple. It is basically the change in rupee value of output (GDP) with respect to a change in rupee value of expenditure on capital formation. The multiplier effect operates through the expansion of secondary industries and services which is also responsible for job creation. In case of the Indian economy, capex (as a component of GDP) has the maximum multiplier effect.

A study conducted by the economists at the National Institute of Public Finance and Policy has revealed that in India, Capital Expenditure has a multiplier effect of 2.45 in the short term and 4.8 in the long term [3, 4, 5]. In simple terms, it means that every ₹1 spent on Capital Expenditure will increase India's GDP by ₹2.45 in short term and ₹4.8 in long term. It is not hard to comprehend that capital expenditure multiplier's value of 2.45 translates to a robust push on economic activity coming from public investment [3]. Hence for an economy that is walking the path towards becoming the world's 3rd largest economy, Government capex has a significant bearing in deciding the country's economic growth and progress.

Figure 4: Multiplier Effect of Capex

For the private sector, capital expenditure increases productivity and hence revenue potential. Companies use funds for acquisition, upgradation and maintenance of physical assets including property, plants, equipment, buildings as well as technology. Capital Expenditure becomes instrumental in adding to the value of any business as it is aimed at either maintaining or growing the business. Often undertaken for improvement of the operational efficiency, increasing revenue in the long term, or for upgradation or enhancements of the existing assets, Capital Expenditure is usually able to reduce long-term costs.

Disadvantages of CapEx for Private Sector

Capex is always heavy on the pockets. Buying assets upfront is always costlier. For the private sector the upfront cost is significant and can sometimes be prohibitive for very small enterprises. Some may need to incur debts, some look to other kind of fund raisings such as IPOs.

Another disadvantage is that it's not a one time spent. Capex doesn't stop with the purchase of an asset. Rather it is the beginning of a series of drain on the coffers. Businesses will always have to keep up with repairs and maintenance of the lumpy assets to keep them in running condition and maintain their efficiencies so that production remains unabated and also to protect the value of the upfront investment while it's hard to project long-term value of the capex [6]

How does Capex affect the investors?

Not just analysts but investors too pay close attention to a firm's capex, since, at first, these do not appear on the firm's income statement but have the potential to majorly impact the company's cash flow. Generally, Capex has significant bearing on both the short-term and long-term financial position of a company [7]. CAPEX helps both investors and analysts assess the investment activities of an organization and their magnitude in general. The effect of capex is typically discernible over the longer term. As a matter of fact, the scale of production is primarily determined by the concentration of CAPEX undertaken by the firm in the past.

It is, therefore, essential that the company makes its capex decisions wisely as it is crucial for determining the financial wellbeing of the company. A large number of companies would typically try to preserve the levels of capex that they achieved historically. This is to demonstrate to the investors that these companies are persistently investing in the growth of their business and are serious about keeping their selves fit to suit the changing business scenarios and the business remains viable and sustainable [7].

What is the Present Situation?

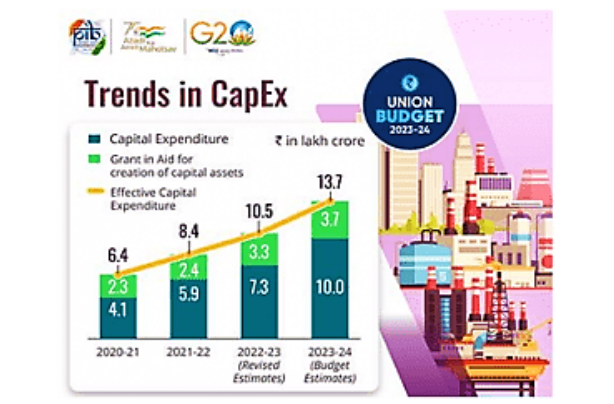

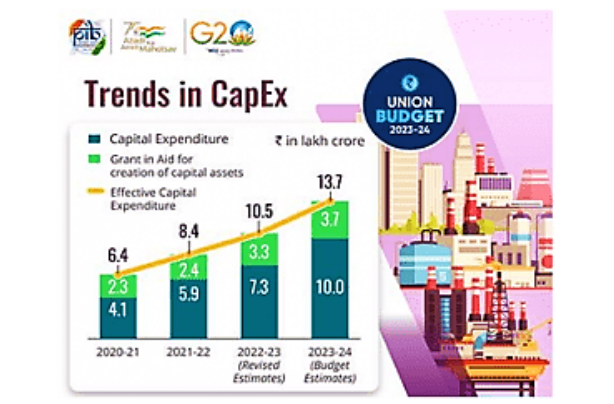

In FY24 the Central Govt utilised ₹9,48,506cr as part of its capital expenditure compared with its revised estimate (RE) of ₹ 9,49,555 crore, which is nearly 99.9% of the RE government data [8].

Figure 5: Trends in Capital Expenditure: FY21-FY24

India increased capex by 42% in FY22 and 24% in FY23, which was cut down to 11.1% for FY25 in the interim budget for FY25 from the budgeted capex in FY24, up 35.9% year-on-year, in line with the government's fiscal consolidation glide path. Despite the Centre's intention to bring down its fiscal deficit from 5.8% in FY24 (RE) to 5.1% in FY25, there has been a significant increase in India's capex target for FY25 from the previous year's revised estimate of Rs 9.5 lakh crore. For FY25 the capex allocated in the Union Budget was ₹11,11,111cr, which is 3.4% of the country's GDP. The government contemplates maintaining robust and sturdy fiscal support for infrastructure over the next 5 years. The government also earmarked ₹2,62,200 cr for railway capital expenditure for FY25.

Conclusion

We are on road to become one of the top 3 economies in the world by 2050. The Government continues to focus on treading the growth trajectory which necessitates a conducive environment that can act as an enabler. Infrastructure development is the best way to do that and for that we need capex. While bringing down fiscal deficit is necessary, infrastructure building will be revenue accreditive in the long run. Capex might look like a painful drain on the pockets now but over the long term it will bring back more than it has expended … Like the saying goes … ‘Today's Pain is Tomorrow's gain'.

References

T. Vipond, "Capital Expenditure (CapEx): Corporate Finance Institute," 2023. [Online]. Available: https://corporatefinanceinstitute.com/resources/accounting/capital-expenditure-capex/ [Accessed 09 Sep 2024].

Jeffries, "India | Equity Strategy," Jeffries, 2024.

S. BOSE, "Fiscal Multipliers for India," National Institute of Public Finance & Policy, New Delhi, 2014.

K. Khureja, "Yojana March 2022 Summary: Harnessing Multiplier Effect - Explained, pointwise| Forum IAS," 11 March 2022. [Online]. Available: https://forumias.com/blog/yojana-march-summary-harnessing-multiplier-effect/ [Accessed 19 Sep 2024]

E. Swaroop, "Estimation of Expenditure Multiplier for India," 2021. [Online]. Available: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/ https://www.ies.gov.in/pdfs/Seminar_Paper_EshaSwaroop.pdf [Accessed 19 Sep 2024]

IndiaFilings, "CAPEX Examples," 2024. [Online]. Available: IndiaFilings, "CAPEX Examples," 2024. [Online]. Available: https://www.indiafilings.com/learn/importance-of-capital-expenditures-in-business [Accessed 15 Sep 2024]

T. Vipond, "Capital Expenditure (CapEx)," 2024. [Online]. Available: https://corporatefinanceinstitute.com/resources/accounting/capital-expenditure-capex/ [Accessed 19 Sep 2024]

ET, "India utilised 99.9% of its capex target in FY24: The Economic Times," 31 May 2024. [Online]. Available: https://economictimes.indiatimes.com/news/economy/indicators/india-utilised-99-9-of-its-capex-target-in-fy24/articleshow/110598557.cms?from=mdr [Accessed 20 Sep 2024]