Axis Strategic Bond Fund is one of the top ranked medium duration funds (please see our research tool, Top Ranking Mutual Funds - Debt: Medium Duration). We identify top ranking funds based on rolling returns performance consistency because consistency is one of the most important attributes of mutual funds, especially debt mutual fund schemes where investors prefer performance stability.

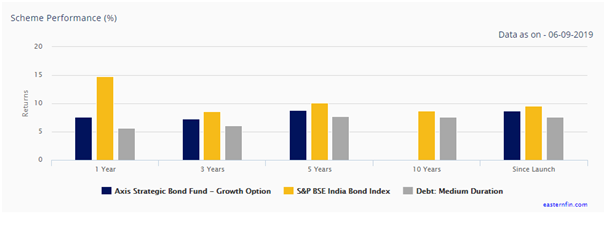

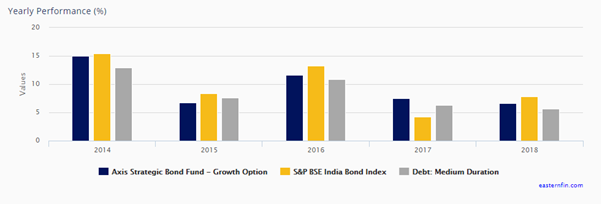

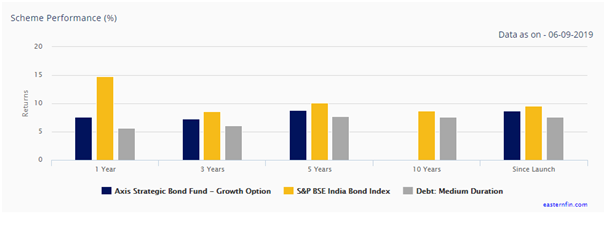

Axis Strategic Bond Fund has given 7.6% return in the last 1 year. Over the last 3 and 5 years, the scheme has given 7.3% and 8.9% CAGR returns respectively.

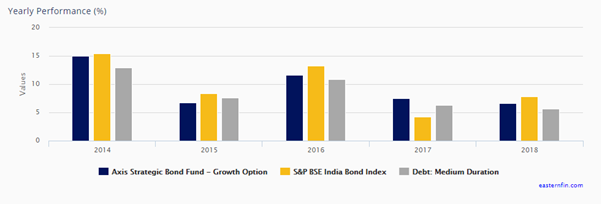

The fund has given more than 7.5% annual returns in 4 out of the last 5 years. The only year in the last 5 years, where return was less than 7% was 2017 when bond yields rose sharply. Please see the chart below.

Axis Strategic Bond Fund is a medium duration fund. As per SEBI’s mandate medium duration funds should have a duration profile of 3 – 4 years. Duration has direct relationship with interest rate risk of a debt fund. Bond prices have an inverse relationship with interest rate movements – bond prices go up when interest rates fall and vice versa. Debt funds which employ duration strategies give higher returns in a declining interest rate environment and lower returns in the rising interest rate environment.

Medium duration funds have moderate interest rate risk. It can give good returns in declining interest rate environment and have limited downside risk in a rising interest rate environment. Volatility or risk is an important consideration for debt fund investors. Though interest rate risk of Axis Strategic Bond Fund is moderate, the scheme may experience volatility in a rising interest environment. Therefore, you should invest according to your risk appetite. Investors should also remember that, interest rate movements are always in cycles. A period of high interest rates is always followed by period of lower rates. In our view, you should always have a sufficiently long term investment horizon (at least 3 years) for Axis Strategic Bond Fund or other medium duration funds.

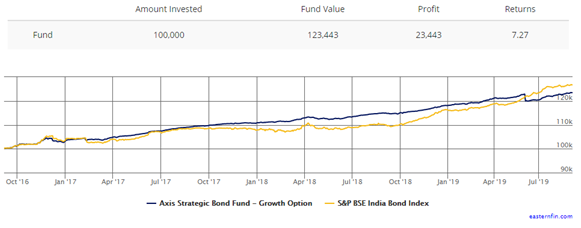

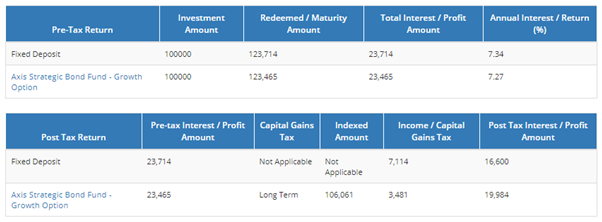

Growth of Rs 1 Lakh lump sum investment – Pre Tax and Post Tax

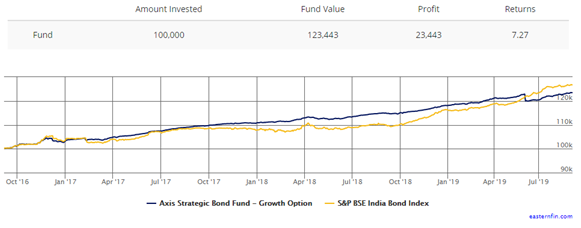

The chart below shows the growth of Rs 1 lakh lump sum investment in Axis Strategic Bond Fund over the last 3 years. You can see that the scheme returns over the last 3 years was comparable to bank FDs on a pre-tax basis.

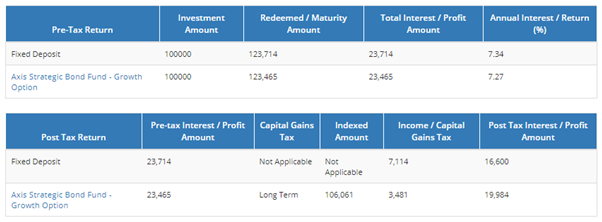

The tables below show the pre-tax and post tax returns of the Axis Strategic Bond Fund versus Bank FD (we have used SBI term deposit rates for our analysis) for an investor in the 30% tax bracket. You can see that the pre-tax returns are almost the same, but on a post tax basis Axis Strategic Bond Fund gave much higher returns compared to Bank FD. While FD interest is taxed as per the income tax slab of the investor, debt fund capital gains for investments held for more than 3 years are taxed at 20% after allowing for indexation benefits. Indexation benefits reduce the tax obligations for investors considerably. You can use our Debt Funds vs Fixed Deposits tool to check the difference between post tax debt fund and FD returns over different investment periods.

Why should you invest in Axis Strategic Bond Fund?

- We are in a favourable interest rate regime over the past 12 months or so and longer duration funds like medium duration, medium to long duration, long duration and dynamic bond funds have given good returns. Axis Strategic Bond Fund has also given good returns in the last 1 year

- The RBI has reduced interest rates multiple times this year and the RBI Governor has unequivocally reiterated that he will follow an accommodative monetary policy by reducing interest rates going forward as well to spur economic growth in India. As such, Axis Strategic Bond Fund has the potential to give good returns in the near to medium term as well

- Credit risk has been a major concern for debt fund investors over the past year or so. The credit quality of the papers (NCDs, CPs etc) in Axis Strategic Bond Fund’s portfolio is quite good. Nearly 87% of the scheme portfolio is rated AA and higher – low credit risk.

- You should have a 3 year plus investment horizon for this scheme. Sufficiently long (at least 3 years) investment tenure will not only ensure good returns despite interim volatility but also enable you to avail long term capital gains taxation benefits in debt funds.

- Axis Strategic Bond Fund is one of the top ranked and most consistent debt mutual fund schemes.

- The risk profile of Axis Strategic Bond Fund is moderate. You should invest according to your risk appetite. You should consult with your Eastern Financier financial advisor or Relationship Manager to know more about this fund.

Suggested reading: In which debt mutual fund schemes should you invest