Interest rates have been continuously coming down in India over the past few years. A large number of investors, who put most of their savings in traditional fixed income investments like bank fixed deposits, post office small savings schemes etc have seen their returns reduce substantially. The severe economic shock caused by the COVID-19 pandemic has forced the Reserve Bank of India to maintain an accommodative monetary policy stance, despite rising inflation. The Government's debt burden has also increased after it allowed fiscal deficit to grow to kick start economic growth; higher interest rate will increase Government expenditure. As a result of these factors, we expect interest rates to remain low or go down even further in near term. At the same time, equity market is at its all time high and investors may be concerned about valuations.

For investors who are ready to take slightly higher risks to get better post tax returns than traditional fixed income investments, equity savings funds may be good investment solutions.

Equity Saving Funds

Equity saving funds are hybrid mutual fund schemes which invest in equity, debt and arbitrage (using derivatives). As per SEBI, overall equity allocation (including hedged and un-hedged exposures) should be minimum 65%. SEBI also requires minimum 10% asset allocation to debt and money market instruments. One of the biggest advantages of equity savings funds is that it enjoys equity taxation.

How equity savings funds work?

- Arbitrage: Arbitrage by definition is defined as risk free profit, by exploiting price differences of the same underlying asset in different market segment e.g. cash and F&O. In arbitrage strategy you will take long (buy) and short (sell) position of the same stock in cash and F&O market respectively. If the price of the stock in F&O market is higher than the price in cash market, you will be able to lock in risk-free profits. Capital safety, returns and liquidity are important considerations in arbitrage strategy.

- Debt: Debt exposure of Equity Savings funds can range from 10 to 35%. The debt allocations of these schemes generate income, reduce overall volatility and provide stability to the scheme. The debt allocation depends on prevailing bond yields and also arbitrage opportunities in the equity market. In bear markets, when the futures premium follow, arbitrage opportunities narrow and equity savings funds may invest up to 35% in debt.

- Active Equity: This is for capital appreciation. Equity savings funds take active (un-hedged) net equity exposure within specified allocation ranges. When fund manager are bullish on equities they increase active (un-hedged) equity exposure to the upper end of the range. The fund manager, however, has the flexibility to reduce the equity allocations and increase exposures to arbitrage or debt if volatility increases in the stock market.

History of Equity Savings Funds

Though many hybrid funds employed arbitrage strategies, the equity savings funds category came into being primarily as a solution to a tax change made by the Government. In 2014, just after the NDA Government came to power, the Government changed debt fund capital gains taxation. Prior to this change in taxation, the holding period of long term capital gains taxation for debt funds was 12 months. In the interim NDA budget of 2014, the long term capital gains period was increased to 36 months. The AMCs came up with a product which can have net equity allocation of less than 65% but will nevertheless enjoy equity taxation.

Risk profiles of Equity Savings Funds

In the early days of this product category, it was often pitched as an alternative to conservative hybrid funds with taxation advantage. However, the category has evolved over the last 7 years or so. It will be wrong to compare equity savings funds with conservative hybrid funds, because equity savings funds can have much higher active (net long) equity allocations compared to conservative hybrid funds, where equity allocation is capped at 25%. So the risk profiles of equity savings and conservative hybrid funds are very different. At the same, the average active (net long) equity allocation of equity savings funds are usually lower than aggressive hybrid and balanced advantage funds. So equity savings are usually much less volatile and more stable than aggressive hybrid and balanced advantage funds.

Taxation of equity savings funds

Short term capital gains (investment holding period of less than 12 months) in equity savings funds are taxed at 15% plus applicable surcharge and cess. Long term capital gains (investment holding period of more than 12 months) are tax free up to Rs 1 lakh and taxed at 10% plus applicable surcharge and cess thereafter.

Performance of equity savings funds

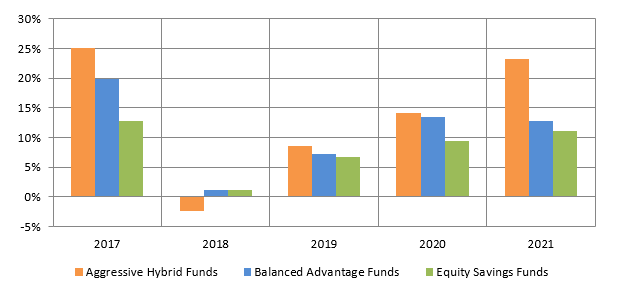

The chart below shows the annual returns of equity savings funds versus other equity oriented hybrid funds categories over the last 5 years. You can see that equity savings funds are much less volatile.

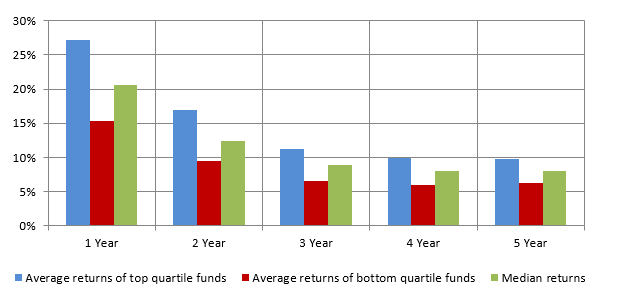

The chart below shows the average performances of top quartile (top 25%) and bottom quartile (bottom 25%) funds versus median performance of all equity savings funds over various periods (ending 7th September 2021). You can see that there is considerable difference in the performance of top quartile (best performing) and bottom quartile (worst performing) funds even over long investment tenures. It is not possible to predict which fund will perform the best in the future, but Eastern Financiers' financial advisors can help you select schemes with strong long term track record based on our strong in-house analytical research capabilities.

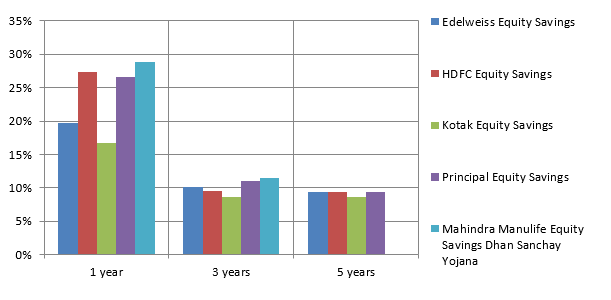

Performance of select top performing funds

Who should invest?

- Investors who are looking for higher returns compared to traditional fixed income investments with relatively lower volatility compared to equity or equity oriented funds

- Investors who want limited downside risks in volatile markets

- Investors in higher tax brackets, who prefer equity taxation

- Investors with moderate to moderately high risk appetites

- Investors with minimum 3 – 5 year investment horizons

Investors should consult with their Eastern Financiers' financial advisors, if equity savings funds are suitable for their investment needs.