Arbitrage mutual funds are hybrid mutual fund schemes who aim to generate risk free profits by exploiting price differences of the same underlying asset in different capital markets. In language of investments and finance the term arbitrage denotes risk-free profits. These mutual fund schemes have a very little or no risk because they take opposite positions (long / buy and short / sell) in the same underlying security. They generate returns by exploiting price difference of the same underlying security in different market segments. These funds usually give returns that match overnight fund returns or even liquid fund returns, but they enjoy a tax advantage because they are treated as equity or equity oriented funds from a taxation standpoint.

How do they work?

The most common arbitrage mutual fund strategy is to exploit the price difference of an underlying security (or index) in the cash and derivative segments of the stock market. Let us assume that a stock is trading at Rs 100 in the cash market and for Rs 102 in the F&O (derivatives) market. You can lock in risk free profits by simultaneously buying shares of the stock in cash market and selling same number of futures in the F&O market.

Investors should understand that arbitrage profits do not depend on the price movement after the trade is executed because on expiry of the futures contract the futures and cash price converge. Let us assume on expiry of your futures, the settlement price is Rs 105. You will make a profit of Rs 5 / share in the cash market and a loss of Rs 3 / share in the F&O market – your profit will be Rs 2 / share. If the settlement price is Rs 98, then you will make a loss of Rs 2 / share in cash market and a profit of Rs 4 / share in F&O market – your profit will again be Rs 2 / share. Hence arbitrage is market neutral and therefore, virtually risk free.

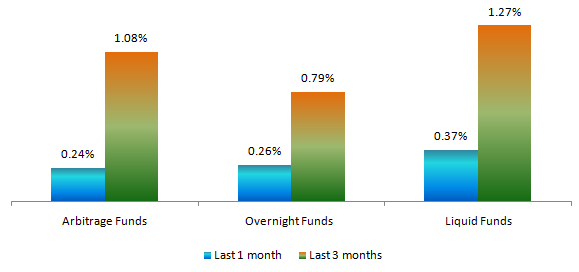

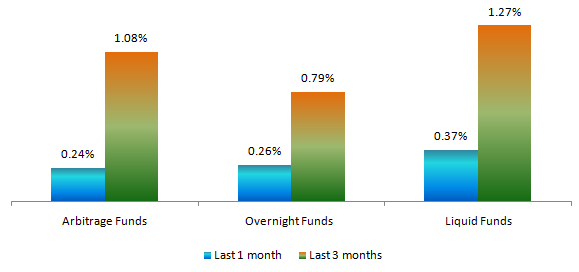

Arbitrage versus liquid and overnight fund returns

Source: Eastern Financier’s Research, as on 2nd June 2020

You may check the trailing returns of all Arbitrage Funds

Tax Advantage

Arbitrage funds are meant for very short term investment - usually a few months. Over such short investment tenures arbitrage funds enjoy a huge tax advantage over both traditional fixed income investments e.g. bank deposits and debt funds. Interest paid by bank deposits is taxed as per the income tax slab rate of the investor. Similarly short term capital gains in debt funds (investment tenure of less than 3 years) are taxed as per the income tax slab rate of the investor. Short term capital gains in arbitrage funds held for less than 12 months are taxed at 15%. If you hold your arbitrage funds for more than 12 months, the profits (long term capital gains) of up to Rs 1 lakh is tax free. Long term capital gains in excess of Rs 1 lakh is taxed at 10%.

Tata Arbitrage Mutual Fund

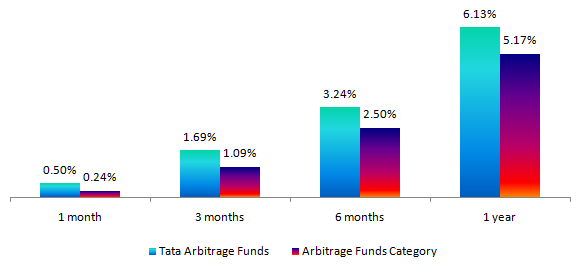

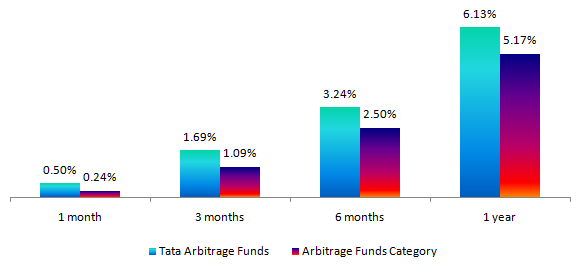

Tata Arbitrage Fund was launched in December 2018 and has Rs 951 Crores of assets under management (AUM). The expense ratio of the scheme is just 1.12%. The scheme has consistently outperformed the arbitrage funds category average over various trailing periods ranging from 1 month to a few months to a year. Since its launch, the scheme has delivered 6.5% annualized returns.

Source: Eastern Financier’s Research, as on 2nd June 2020

Summary

Arbitrage Mutual Funds are one of the safest and most tax efficient investment options over very short investment tenures ranging from a few months to 12 months or longer, if you want to avail long term capital gains tax advantage. We are recommending Tata Arbitrage Fund to our clients as it has demonstrated a consistent track record of good performance.

Investors should note that currently there are no arbitrage opportunities in the very near term. You should be prepared to remain invested for at least 3 to 6 months or more. If your investment horizon is shorter than 3 months, then we recommend overnight or liquid funds.

Please contact your Eastern Financier’s financial advisor, if you want to know more about Arbitrage Mutual Funds or are looking for short term investment solutions. You can also call us 033-40006800 or email to us at service@easternfin.com.