Dear Investors,

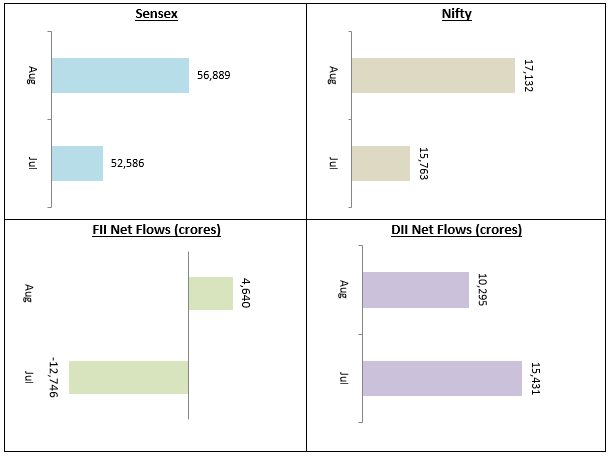

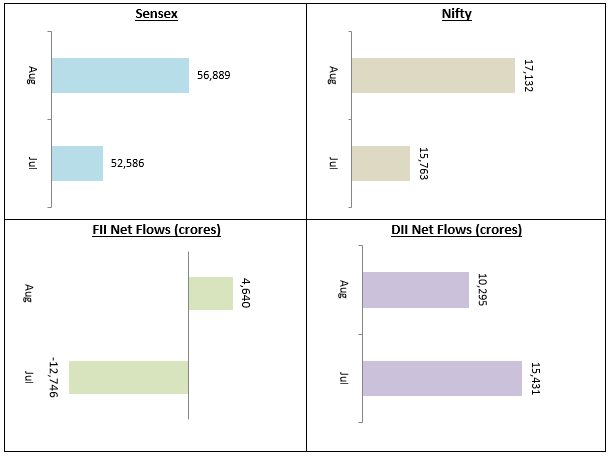

After trading sideways in July, the Sensex and Nifty resumed its bull run in August. Both the Nifty and the Sensex rose by 8 - 9% in August 2021, ending the month above 17,000 and 56,000 levels respectively. FIIs turned into net buyers in August, but the market was driven mainly by the bullish domestic sentiments with DIIs making net purchases of more than Rs 10,000 crores in August. Overall, the sentiment in the market is bullish and we expect the leading indices to go higher in the near term.

While large caps enjoyed bullish sentiments in August, the same cannot be said for the broader market unfortunately. The midcap performance in August was a mixed bag, with some stocks seeing corrections, while some others outperformed. Overall, the Nifty Midcap 150 Index remained range-bound in August. Sentiments in the small cap segment turned bearish in August, though the Nifty Small Cap 250 Index bounced back somewhat from the lows of mid August by the end of the month. Overall, we expect bullish sentiments to continue over the next few months with a bias towards large caps, but midcaps and small caps may experience volatility.

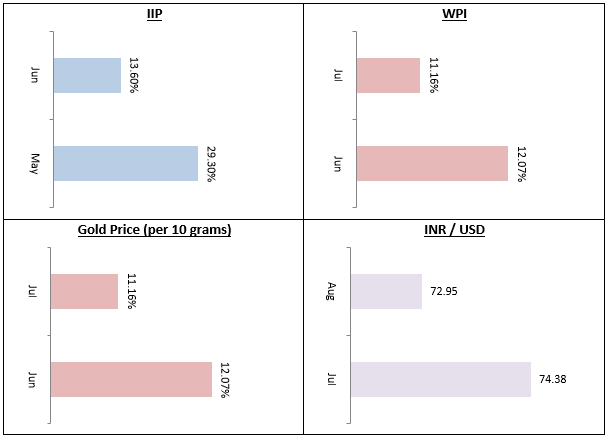

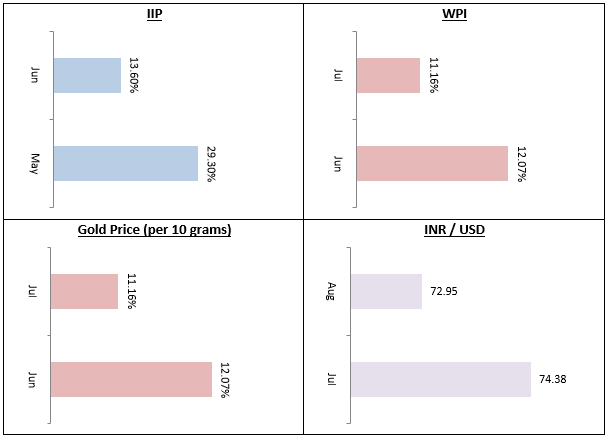

The Index of Industrial Production (IIP) rose by 13.6% in June, but like the IIP figures of last few months, this again is primarily due to low base effect. With COVID restrictions relaxed in many parts of the country, pent up demand in customers and the festive season approaching we expect industrial output to grow faster in the coming months. WPI inflation eased further to 11.16% in July, but inflation will continue to remain high on the radar of the Reserve Bank of India and be a cause of concern for investors, particularly debt fund investors.

Gold prices eased by nearly 2% in August showing that investors are still bullish about equities. However, we reiterate our outlook on gold and advise investors to have 5-10% of their total investments in gold from the asset allocation perspective.

There was good news on the foreign exchange front in August, as the INR gained nearly 2% versus the US Dollar. We expect the three major risk factors mentioned in my last letter i.e. impact of COVID third wave (delta variant), trajectory of international crude oil prices and the Fed's monetary policy in the US will continue to remain important. There are indications from the Fed that, it is likely to continue its accommodative monetary policy this year. So we expect equities, especially large caps, to trend higher based on global liquidity situation. However, as and when the Fed changes its monetary policy and begins tapering, we may see pullback in equities. Investors must be prepared for this risk and focus on asset allocation, especially now when the market is at its all time high.

As the Indian economy recovers from the impact of COVID-19, the long term prospects of equity as an asset class is promising. In the near term however, we expect large caps to outperform mid and small caps. Mid and small caps had a great rally over the past 15 - 18 months or so. While the rally in the broader market may not have entirely run out of steam, given current valuations, we expect it to be stock specific.

You can continue to invest in midcaps and small caps through the SIP route over long investment tenures (at least 5 - 7 years) because we expect mid and small caps to outperform in the long term. By investing through SIPs, you can also take advantage of market volatility through Rupee Cost Averaging. For investors who do not have high risk appetite, large cap funds or hybrid funds may be more suitable for lump sum investments.

As far as debt funds are concerned, there is still considerable uncertainty about global commodity prices and inflation. We think it is prudent to invest in higher credit quality shorter duration accrual funds in these conditions to minimize interest and credit risks. The Reserve Bank of India has injected massive amount of liquidity in the financial system which has kept the yields of very short duration funds like overnight, liquid and ultra short duration funds low. For higher yields, you may invest in money market and low duration funds. However, you should have investment tenure of at least 6-12 months from these funds. For investors with minimum 3 year investment tenures, high credit quality funds of short to medium duration profiles like corporate bond funds, Banking and PSU debt funds etc will be good investment choices.

Conclusion

Overall, our investment outlook on financial markets for 2021 is favourable, but we should be prepared for the risks that may lie ahead. I have discussed the importance of asset allocation several times in my monthly letter to our esteemed investors. Please read our latest blog on this topic. Our financial advisors can help you with all investment and other financial needs. I reiterate my commitment for the highest standards of service. On behalf of Eastern Financiers’ team I extend my heartiest greetings and best wishes for the upcoming festive season.

Best Wishes,

Ajoy Agarwal,

(Managing Director)