Dear Investors,

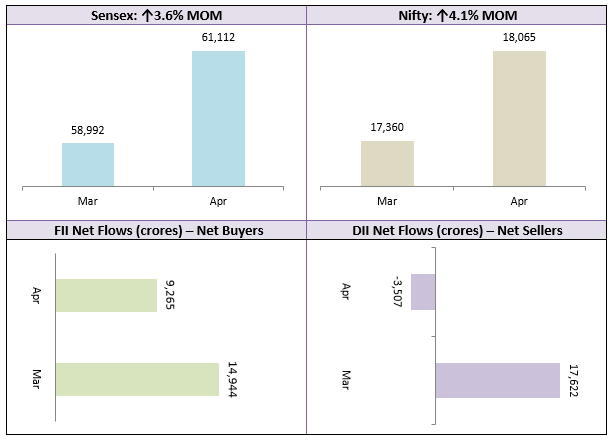

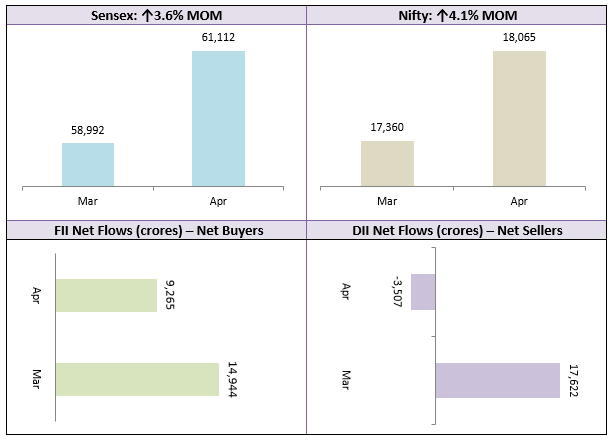

April 2023 was a good month for equities globally despite lingering concerns about weakness in the banking system. The Nifty gained 4%, closing the month above the important psychological level of 18,000. Upward momentum was seen in the broader market as well, with the Nifty 500 gaining 4.5%. FIIs inflows continued in April, with FIIs making net purchase of nearly Rs 10,000 crores in April. The mechanical indicators like VIX, Put Call Ratios etc are signalling that the market will remain strong in May 2023.

The US market was also surprisingly bullish in April, despite lingering concerns about the stability of regional banks. The Dow Jones closed the month 2.5% higher, while the S&P 500 gained 1.5%. The US market is expecting that the current interest rates are nearing the Fed terminal rate. Markets look to be in consolidation mood and near-term risk factors seem to have been discounted in prices. The market expects soft landing or at worst, a mild recession in the US later this year or early next year. But investors should be prepared for volatility if the US experiences a deep recession. You should invest with long investment horizons and focus on asset allocation. As I have mentioned several times in my letters to you, investing through SIPs in quality mid and small caps is always a sound strategy for long term wealth creation.

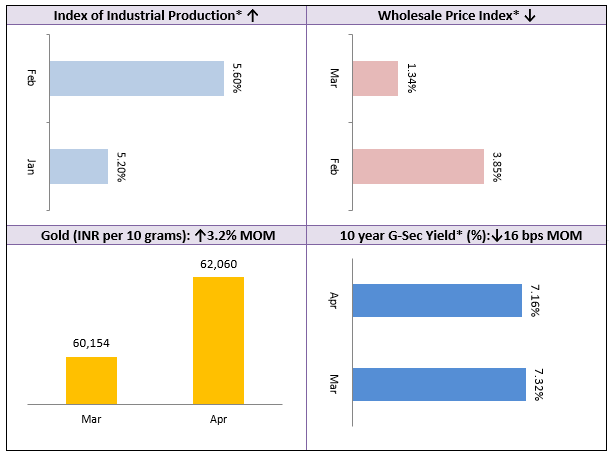

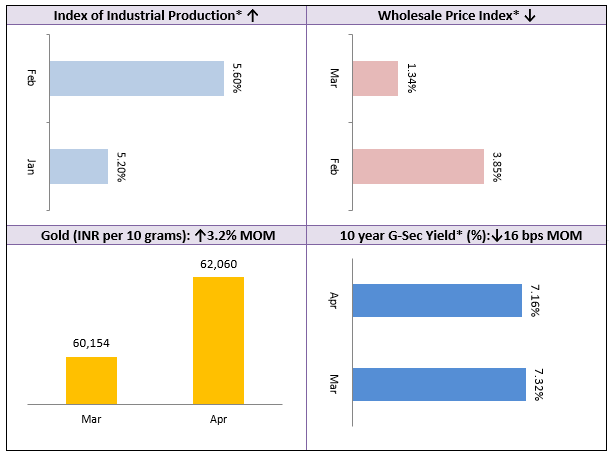

In the commodity markets, Gold is continuing to rally due to continuing inflation and concerns of economic slowdown. Gold has already gained 11% in the first four months of CY 2023 and we expect it to gain further strength as we reach the end of the interest rate cycle. You may consider rebalancing your asset allocation to increase your asset allocation to Gold.

As far as the debt market is concerned, the 10-year bond yield has eased further, with the RBI putting a pause to rate hikes for the time being. As we approach the end of this interest rate cycle duration strategies may yield higher returns for long term debt investors. Long term investors can invest in dynamic bond funds with minimum 3 year investment horizon. While long term yields have softened, the 91 day T-Bill yield hardened by 4 bps. Short term investors (1 year or less) can take advantage of these yields by investing in ultra-short duration or money market funds. Medium term investors (2 – 3 years) can invest in corporate bond and Banking & PSU debt funds. Flattening yield curve indicates mean reversion (lower interest rates) in the future and you can benefit from higher yield as well as capital appreciation over 2 – 3 years investment horizon.

For some parents, this is an important time of the year as the Board results will be declared in a few days. We wish parents and children, best of luck and success in academic careers. I on behalf of my team, assure you of best service for all your investment needs.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!