Dear Investors,

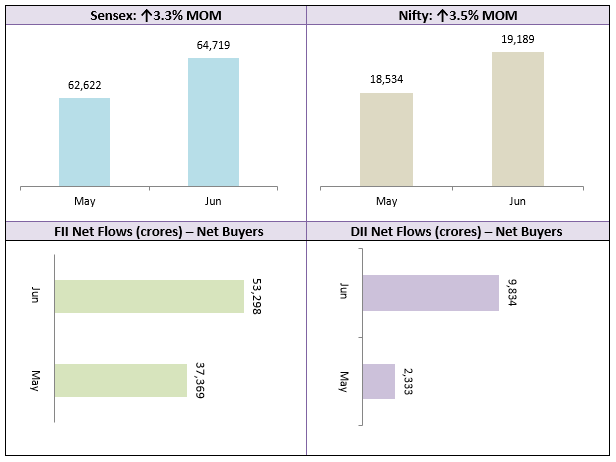

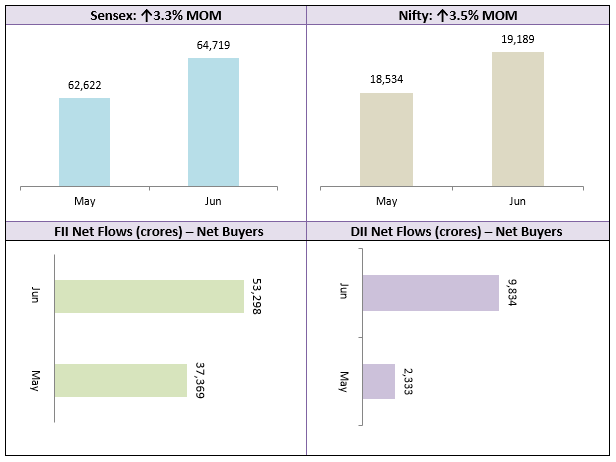

Indian equities continued to gain further strength in June. The Sensex and Nifty gained around 2.5% to close around all time highs of 64,700 and 19,200 levels respectively. FIIs ploughed in more than Rs 50,000 crores, as India continued to be an outperformer the emerging markets pack in the month of June. MSCI India Index gave 7% return in dollar terms, while MSCI EM Index gave 4% return in June. The broader market continued its strong rally, with mid and small caps outperforming large caps in June. In our view the market is in a momentum phase and mid / small caps will continue to outperform in the coming months.

As far as industry sectors concerned, all sectors were in green in the month of June. Capital goods, healthcare, realty, metals and telecom were the top performers in June; these sectors clocked more than 5% gains during the month. Sectors like automobiles, consumer durables, oil and gas and infra also outperformed the Nifty in June clocking 3.5 – 5% gains in June.

We expect the market to trend higher supported by the US market. The market is expecting a rate hike by the Fed in July. The market is discounting 2 more rate hikes in 2023 in stock prices. Global investor sentiments are at this point of time “risk on”. Overall we continue to bullish on Indian equities. Investors should continue to invest in midcaps and small caps through SIPs. You can also take advantage of large corrections by investing in lump sum on dips.

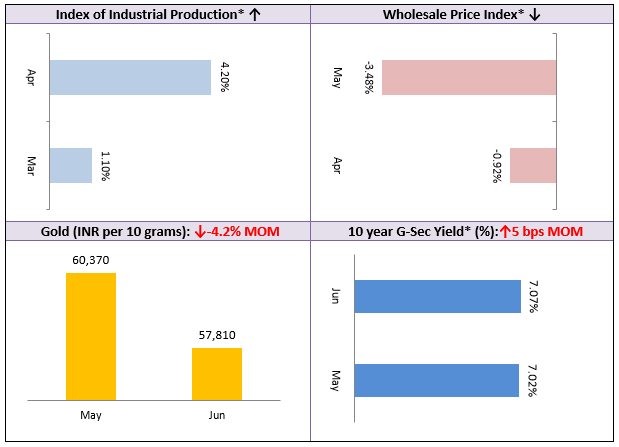

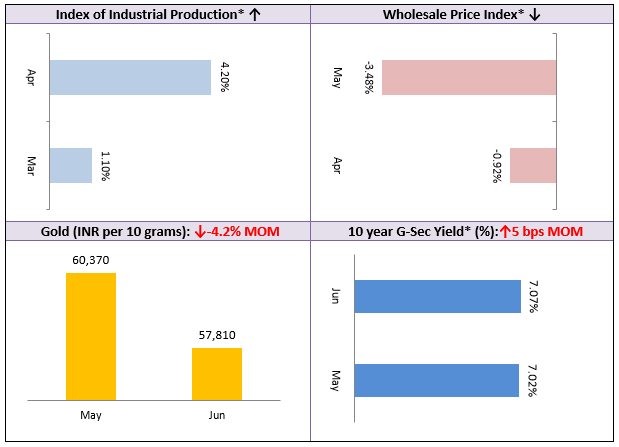

In the commodity markets, precious metals i.e. gold, silver slipped due to prospects of hawkish Fed policy; high interest rates or bond yields make precious metals less attractive for investors. You should avoid investing in gold in these market conditions unless you have very long investment horizons; in the near term equities are likely to outperform gold. However, investors with gold in their portfolio are advised to hold their investments because gold may bounce back in coming months depending on the economic data from the US.

As far as the debt market is concerned, the 10 year bond yield remained range bound between 7 – 7.1%, while the 91 day T-Bill yield eased by 10 bps. As we approach the end of this interest rate cycle duration strategies may be yield higher returns for long term debt investors. Short term investors (1 year or less) can invest in ultra-short duration or money market funds. Medium term investors (2 – 3 years) can invest in corporate bond and Banking & PSU debt funds.

I on behalf of my team, assure you of best service for all your investment needs.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!