Dear Investors,

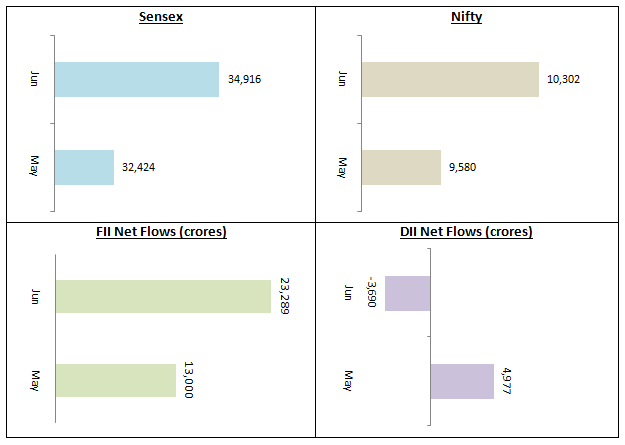

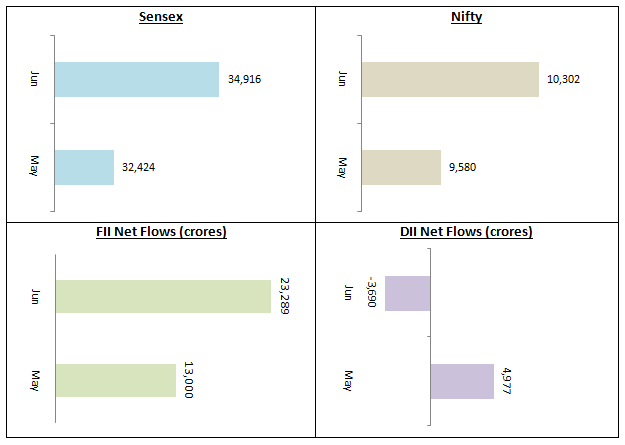

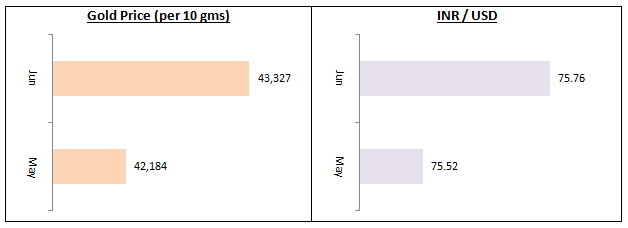

After remaining range-bound in May’20, the stock market saw gains in June. Nifty gained nearly 750 points to closing the month well above the important 10,000 psychological level. Sensex closed the month at touching distance of the 35,000 mark. FIIs were bullish in the month of June with net purchases of Rs 23,289 crores. Domestic Institutional Investors were net sellers to the tune of Rs 3,690 crores.

The gradual reopening of the economy after the lockdown is slowly bringing back confidence among investors. At the same time, rising COVID-19 cases especially in the biggercities etc. is a cause of concern. However, the possibility of a vaccine which has already received the nod for clinical trials is a big positive for the economy. July is an important month for the stock market as the Q1 results of different companies will start getting reported over the next few weeks. A significant drop in earnings due to the lockdown in April – May seems to be discounted in prices. Analysts and fund managers will be pay much more importance to companie’s revenue and earnings outlook for the balance of the year and going forward.

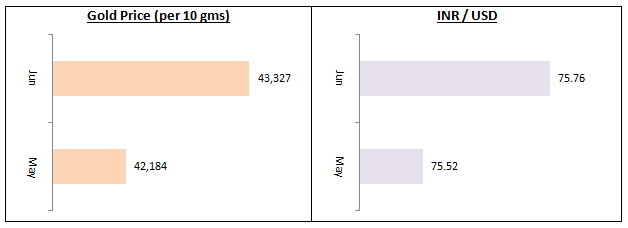

I mentioned in my last month’s letter that the IIP had witnessed a sharp contraction in May, while WPI eased due to lower crude prices. The Government has decided not to report the IIP and WPI numbers for April because of the lockdown. The IIP and WPI numbers for April would anyways have been irrelevant because there was virtually noeconomic activity in that month due to lockdown. Gold continued its impressive run in June increasing 2.7% month on month, while the Rupee weakened slightly against the US Dollar.

In the broader market both midcap and small caps logged in decent gains in June. These segments had corrected sharply over the past 2 years and now seem to be consolidating. In our view, valuations are attractive in midcap and small cap segments – midcap and small cap funds with strong performance track records can give good returns over sufficiently long investment horizon. Though we usually recommend SIP mode of investment for midcaps and small caps, investors can also tactically invest in lump sum to take advantage of low prices from long term viewpoint. Investors can also look at Quant Funds (a relatively new concept for the Indian markets) Read review of a fund that we have short listed.

The RBI in its May monetary policy meeting cut repo rate by 40 bps to a record low of 4% strengthening its accommodative policy stance. With weakening inflation, the Street expects RBI to cut rates even further to boost economic growth prospects. With interest rates on a downward trajectory, Gilt funds, medium to long duration funds and dynamic bond funds can continue their good performance in the near to medium term.

If investors have sufficiently long investment tenures (at least 3 years) and appetite for volatility they can invest in longer duration funds like Dynamic Bond Funds, Banking and PSU funds, Gilt funds etc. which have given good returns in the last 1 year and may continue to do so in the future.

If you have shorter investment tenures and do not have appetite for volatility then accrual based debt funds like ultra-short duration funds, low duration funds, short duration funds and corporate bond funds are suitable investment options. One of the points that I have reiterated in my letters to you over the last many months is the importance of high credit quality when you invest in debt funds. With the COVID-19 pandemic likely to cause sharp GDP contraction cash-flows of companies will come under stress.

Companies which do not have strong balance sheets may face ratings downgrades as we go through the year. Therefore, we recommend investing only in highest credit quality funds even if the yields are slightly lower. Our view is that high credit quality funds even with slightly lower YTMs can give good returns since the interest rate scenario is likely to be favourable this year. Our financial advisors can help you select the right debt funds for your investment needs and risk appetite.

COVID-19 has brought forth before us the importance of adequate life and health insurance. We urge our valued customers to review their life and health insurance policies and buy additional cover if required during this moment of crisis. Our insurance advisors can help you select the right plan suitable for the specific needs of your families. Our financial advisors have strived to provide you the best services in these challenging times. However, if there are any suggestions to improve our services further, we welcome you valuable feedback.

We sincerely hope you and your family stay safe and healthy.

Best Regards,

Ajoy Agarwal,

(Managing Director)