Dear Investors,

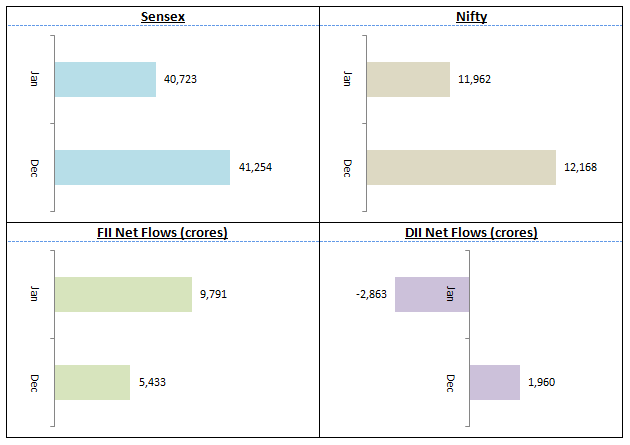

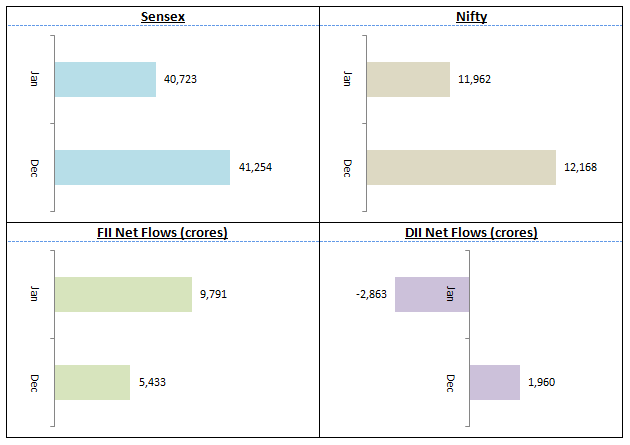

Nifty closed January at 11,962, a tad lower than the level at the beginning of the month. The index made a high of 12,355 riding on the pre-Budget rally but came off the highs closer to the Budget day. Sensex closed the month at 40,723. Expectations from the Union Budget 2020 and the global economic fallout of the Coronavirus in China were the main factors in the stock market in January. We will discuss Union Budget 2020 in a separate post, but in this note we would like to say that the Finance Minister faced a very difficult job in this Budget trying to balance spending to revive economic growth while trying to maintain fiscal deficit within tolerable range.

FIIs continued to be net buyers in the month of January(Rs 9,791 crores net) showing continuing foreign investor interest and confidence in the Indian market. DII were net sellers in January. The market had a lot of expectations from this budget and while some investors may feel disappointed with the Budget, with benefit of hindsight we can say that the sell-off on the Budget day was largely a knee jerk reaction. Over the next 3 trading sessions following the Budget day, the Nifty has recovered all its losses and is now trading above the January close. One of main positives, the market has taken from the Budget, is the Government’s commitment to fiscal discipline and long term structural view of our economy.

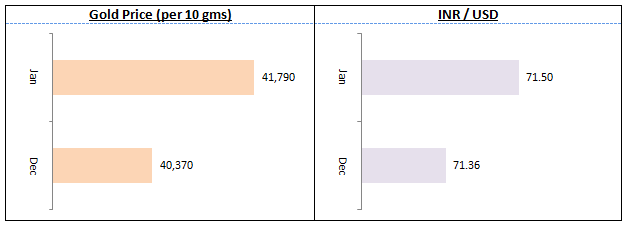

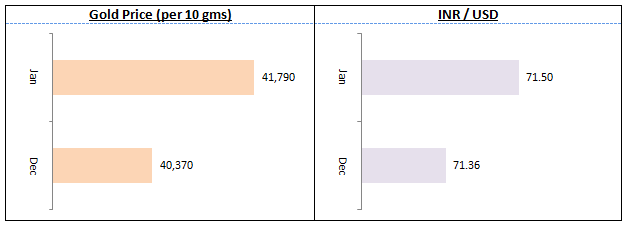

Index of Industrial Production (IIP) figures for December have not been released by the Government, but it is expected to remain subdued. WPI inflation accelerated sharply in December to 2.6% primarily driven by rise in price of food items, particularly vegetable prices. Economic experts believe that the spike in inflation is mostly seasonal in nature and will come down in coming months. The Economic Survey tabled in the Parliament on the last day of January, estimates 5% real GDP growth in FY 2019 – 20. For the next financial year, the Economic Survey predicts a strong rebound to 6 – 6.5% real GDP growth in FY 2020 – 21. Gold, which was the best performing asset class in 2019 (25% return), continued its impressive run in January growing almost 4% to Rs 41,970 / 10 grams. On the currency front, the Rupee depreciated slightly against the dollar in January.

In this month’s blog we will focus on the Union Budget 2020. The Government has announced some major tax reforms in this budget which investors should understand and make investment planning decisions accordingly. We will discuss this in detail in our blog. Needless to say, the tax changes announced by the Government are applicable for the next financial year (FY 2020-21 / AY 2021-22). For this financial year, since we are in the last quarter, tax planning should be most important financial prerogative for investors who have not done so. I will urge all our esteemed customers to contact your Eastern Financier financial advisors in case you have not completed your tax planning for AY 2020-21; our advisors are always on the standby to assist you.

As mentioned in my previous monthly note, with corporate revenue growth outlook remaining weak and Nifty having run up considerably over the past 3 – 4 months, we expect large caps to remain range-bound in the near term till we see strong signs of economic recovery. However, both midcap and small caps seem to have bottomed out and are now consolidating. The deep price corrections in midcaps and small caps over the last 2 years seem to have created attractive investment opportunities. Investor interest is returning to midcaps and small caps, with Nifty Midcap 100 and Nifty Small Cap 100 indices gaining 6 - 7% in January. In our blog this month, we will review a small cap fund (Kotak Small Cap Fund) which has lot of potential in the long term.

As far as fixed income is concerned, the bond market was largely happy with Government’s commitment to fiscal discipline in Budget 2020. In addition the Government has announced some major reforms in the bond market like allowing higher FPI participation in corporate bonds, launching Exchange Traded Fund (ETF) of Government bonds (G-Secs). These developments are positive for the debt funds.

Medium to long duration, long duration and dynamic bond funds were the stand out performers over in 2019. However, investors must also exercise due caution because the Government’s FY 2020-21 fiscal deficit target is predicated largely on a huge disinvestments. In the past, Government has missed disinvestment target and slippage on that front next year may jeopardize the Government’s fiscal deficit target, with consequences for long term debt funds. Due to the domestic and global macro risk factors, we suggest a cautious approach for conservative debt fund investors. Accrual based debt funds like short duration funds, banking and PSU funds, low duration and ultra-short duration funds suitable investment choices for conservative investors with 2 – 3 year investment horizon. Given the continuing stress in many industry sectors e.g. the recent Vodafone event, we urge investors to look for highest credit quality funds. Our financial advisors will help in selecting the right fund for your investment needs.

We look forward to serving your financial needs with our product offerings to suit your specific short term, medium term and long term financial goals. As always, we assure you of our best services. Please provide us your valuable feedback so that we can further improve our services to serve your financial planning needs.

Happy investing,

Ajoy Agarwal,

(Managing Director)