Dear Investors,

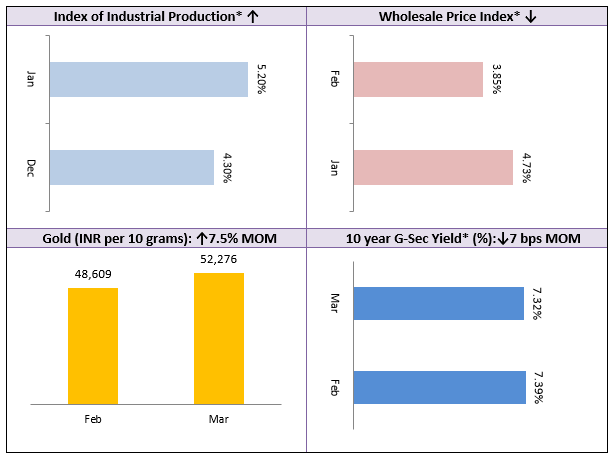

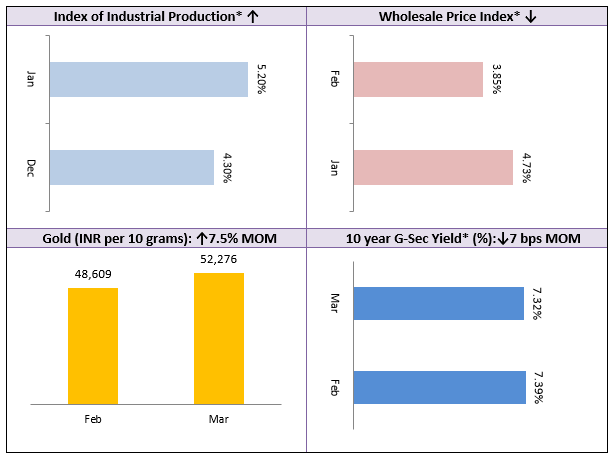

Indian equity market was an underperformer in March 2023 compared to developed markets like the US. Adani stocks continued to be an overhang on the market in the first couple of weeks in March. The collapse of Silicon Valley and Signature Banks in the US, along with Credit Suisse crisis caused markets to turn volatile in the middle of March. However, the market recovered most of its losses by end of the month.

The market seems to have discounted the near term risk factors in prices and looks to consolidate from current levels. However, medium term risk factors like possible recession in the US later this year or early next year may not be fully priced in. The S&P 500 PE ratio is around 21 – 22 versus historical average of 17 – 18. This means the market has priced in a mild recession or no recession. Therefore, further corrections are not ruled out if the economic outlook worsens, but long term investors can take advantage of these corrections to accumulate units at lower prices. Small caps underperformed in 2022 and we expect them to outperform over medium to long term investment horizon. You can invest in small caps through SIP / STP.

As far as debt funds are concerned, the 10 year bond yield has eased a bit and the yield curve has flattened considerably. Flattening yield curve indicates mean reversion in the future. Long term investors can invest in dynamic bond funds with minimum 3 years investment horizon. Over shorter tenures, accrual based money market fund, low duration, short duration and corporate bond funds can be suitable investment options.

In the last week of March, the Government has proposed to remove long term capital gains tax benefit for debt funds effective from 1st April 2023. This has come as rude shock to the mutual fund industry and many investors. We want to clarify to our investors that the change in long term capital gains taxation will be applicable only to investments made on or after 1st April 2023; you will continue to enjoy long term capital gains tax benefit of your debt fund investments made before 1st April 2023. We also think that despite the parity in taxation, debt funds continue to be attractive investment options compared to traditional fixed income investment options.

As we begin a new financial year, we wish health and prosperity for all our investors.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!