Your investment journey does not only consist of the investments that you make in the different options. You might also have to dip into your accumulated wealth in order to fund your financial goals like a child's higher education or wedding, making a house, buying a new car etc. All these withdrawals are also a part of your investment journey, as a proper plan of using the funds that you have accumulated over so many years may help you protect your funds from unscrupulous diminishing.

An SWP is a good option to withdraw your money as a regular income to fund your financial goals like a steady income during retirement, or maybe EMI for your home loan.

What is SWP?

A Systematic Withdrawal Plan, also abbreviated as SWP is a predetermined plan of withdrawal from a mutual fund. The withdrawal amount and frequency of withdrawal is predetermined by you at the time of applying for the SWP. In effect an SWP is just the opposite of an SIP. In an SIP, a fixed sum of money is used to buy units of a mutual fund on fixed dates as per the frequency of investment. In SWP, units of the mutual funds are redeemed at the existing NAV on the dates that have been fixed for the withdrawal. So when the NAV is low, more units are redeemed to provide the SWP amount and vice versa. The remaining amount in the SWP fund continues earning returns.

Why should you opt for an SWP?

The natural question here would be why is it better to opt for an SWP instead of redeeming your funds whenever you require it?

First of all, redeeming your funds for goals that require regular income is quite cumbersome. Moreover, choosing to redeem units from an accumulated corpus is a tricky proposition because even though you may have painstakingly spent years to build up the corpus, withdrawal at a wrong time may heavily impact the value of the funds. It is a difficult task to keep an eye on the market for the redemption of your funds since,

a. The immediacy of requirement may push you to redeem at low market levels and

b. You may not have the time to track market highs and lows.

For example, let us take an investor who started an SIP into a mutual fund in 2009, and built up a large corpus in 10 years till 2019. The investor’s plan was to use the funds for his daughter’s college admission in April 2020. Come 2020, COVID struck and markets crashed in March 2020 reducing the value of his corpus substantially. Therefore, you can see how the market lows can have an effect on your investments however long you have stayed invested. The time of withdrawal is crucial.

The second consideration for choosing an SWP instead of any other mode of withdrawal options for your regular income needs is the tax efficiency offered by SWP. An SWP is the most tax efficient option of receiving regular payments for your recurring expenses. Let us look at the tax implications of a few modes of regular income available to you.

How can we say that SWP is tax efficient?

To understand how SWP can be called the most tax efficient option of receiving regular income from your investments, let us first take a look at the various other options apart from an SWP available for receiving regular payment.

a) IDCW: Mutual Funds have two options for withdrawing the returns. One is the growth option where the profit earned on the investment is reinvested into the scheme. The next is the dividend option where the profits earned are distributed to the investors as dividend at intervals as decided by the fund house. The dividend option is the Income Distribution cum Capital Withdrawal option offered on mutual fund schemes.

b) FD Interest: This is the interest that you earn on your fixed deposit plan. While applying for the FD you may specify at what intervals you would like to receive the interest on your amount in the fixed deposit.

c) Pension Annuity: An annuity is a contractual agreement between an insurance company and the investor in the annuity where the insurer promises to pay regularly a fixed sum of money to the investor. The regular income as well as the frequency of payment is fixed at the time of buying the annuity.

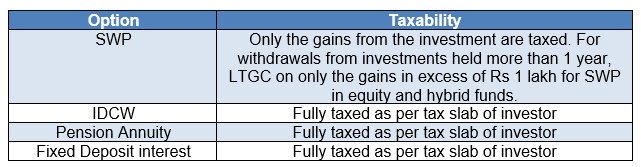

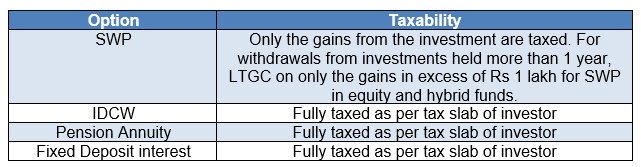

For all the above options except the SWP, the interest is fully taxable in the hands of the receiver. See the table below to see how each of the above options is taxed.

To understand this, let us take an example of an investor Akhil who buys 2000 units in a fund with NAV Rs 100. Now, let us say, in the next month Akhil withdraws Rs 5,000/ when the prevailing NAV was Rs 105. For this, withdrawal (5000 / 105) = 47.62 units were redeemed. The purchase cost of these units is Rs 47.62 X 100= Rs 4,762/-. The rest of the amount in the withdrawn amount that is Rs 5,000 - Rs 4,762= Rs 238. Akhil will be taxed only for this Rs 238. Moreover, if the SWP is from an equity-oriented fund, then gains up to Rs 1 Lakh in a financial year are exempted from tax. In the case of interest from fixed deposit and Annuity, the entire interest amount or the entire dividend amount in case of IDCW is taxed at the tax slab of the receiver of such income.

Things to be kept in mind while starting an SWP

While an SWP is a tax efficient option that can align to your regular income needs it is important to keep few things in mind before choosing this option.

1. Before starting to withdraw from your mutual fund scheme, allow a period of capital growth. Start withdrawing only after the funds in your mutual fund scheme has grown to a sizable corpus.

2. The rate of SWP withdrawal should be less than the rate of returns on your investment. This is important to ensure that your regular income through the withdrawals from the plan does not eat into your Principal amount.

3. Choose funds that are less volatile for your SWP plans, like the hybrid funds that can give you stability along with equity growth. Equity funds may give you superior growth, but during volatile markets these funds could deplete your capital with the SWP.

4. At times when the markets show signs of crashing, you may choose to pause the SWP from your hybrid funds and continue withdrawing from your debt mutual funds.

5. Instead of choosing a fixed amount for your SWP, you may choose to withdraw a percentage of your gains. This option may help protect your capital during market lows. The problem with this option though is that you may not receive any payout when the gains are low.

In any case, an SWP is still a tax efficient way to receive regular withdrawals from your accumulated corpus. Talk to your Eastern Financiers Relationship Manager to help you choose a SWP for your regular income needs.