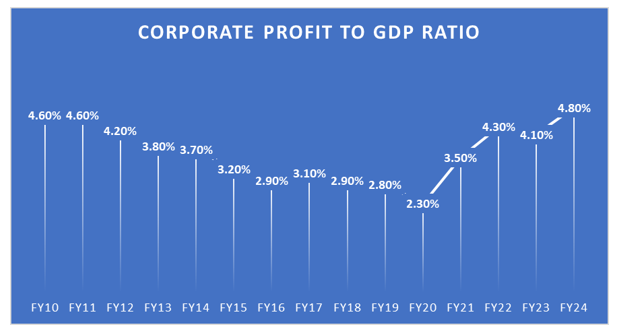

The corporate profit to GDP ratio in India has reached the highest in last 15 years in India in March 2024. This is pertaining to the Nifty 500 universe (accounting for 91% of total market cap) and it stood at 4.8% (5.2% achieved in FY08). For the entire listed India Inc. universe, this ratio stood at 5.2%. The improvement in profit was led by the banking, financial services and insurance or the BFSI sector, oil and gas, and automobile sectors, which contributed 95% of the total improvement, whereas sectors such as metals, technology and chemicals contributed adversely.

Figure 1: Corporate Profit Growth to GDP Ratio over the Years

This is basic mathematics. The size of the Indian economy is used as the denominator for calculating the ratio and the sum of corporate profits as the numerator. Corporate profits growth rate declined significantly in FY23, but at a faster rate than the decline in GDP growth rate which brought down the ratio and in FY24, the growth rate in corporate profit has been much higher than the estimated GDP growth rate, thus pushing up the ratio to a 15-year high.

Sectors such as technology and chemicals are picking up. The recent consumer data suggest improvement in rural demand – a key component that have been acting as a drag on the demand side of the economy. All these factors, assuming the geopolitical situation does not deteriorate from here (we are more or less relaxed about domestic certainty as far as political stability and policy continuity at home is concerned), have the potential to push the ratio further up towards the level achieved in FY08 and may be beyond.

But just in case the domestic GDP growth falters (seems unlikely at this point), if the aggregate corporate profit holds at the current level, then also we can see further improvement in the ratio. Or the economic growth remains steady at the current level but the corporate profits rise due to, say, margin improvement, then also a better ratio is possible. We believe that the government’s higher focus on reduction of dependence on imports, robust capex trajectory alongside operational efficiencies augurs well for the overall economy including the oil and gas sector, while growth in sectors such as capital goods, FMCG and power are likely to further boost overall corporate profitability. In simple terms, we could see this ratio rise further.

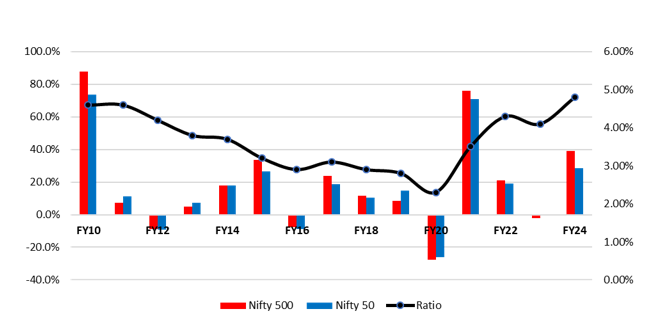

All that being said, what does it mean for equity investors??? … The rising ratio augurs well for the equity market. It will justify the India’s premium valuations compared to other emerging markets. But it is also true that the earnings will also rise sharply. Reducing losses in sectors like Telecom, Industrials, Financial Services, PSU Banks, Private Banks, Metals & Metal Products, increased urbanization and formalization, digitization and digitalization are some of factors driving earnings growth. This gives a positive thrust to the share market.

Figure 2: Correlation Between the Ratio & the Market

As the government continues implementing reformative policies we will see robust earning growth, going forward. That is definitely good news for long term sustainability of Indian bull market.